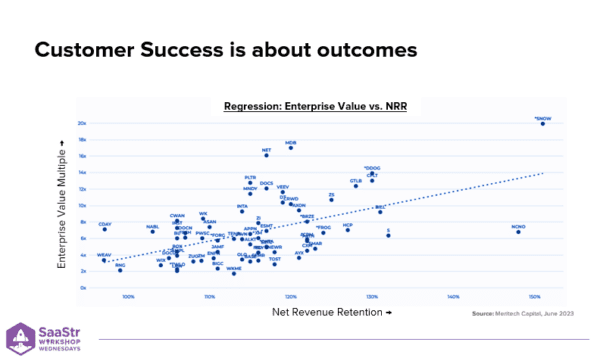

Customer success is all about outcomes. If you’ve raised venture capital, you know net revenue retention is important.

When we look at publicly traded companies, there is a direct correlation between NRR and Enterprise value. That’s the end state we’re going for.

What does NRR have to do with customer success?

Everything!

At last week’s Workshop Wednesday — every Weds at 10 a.m. PST — Former VP of Customer Success and current founder and Managing Partner at Success Venture Partners, John Gleeson, shares his lessons learned scaling customer success from $1M to $300M in ARR.

Anyone looking to grow their customer success team, or rather, drive growth and NRR, will have some valuable takeaways.

What Does NRR Aim To Answer

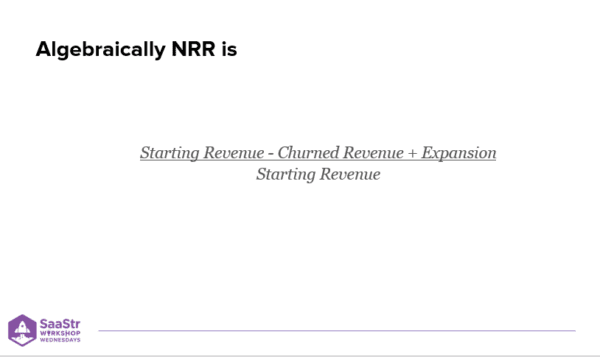

Most people know the formula for NRR. It’s a lagging indicator, so let’s look at the question that formula is aiming to answer.

- Do my customers find value in my product and service? (Will they renew?)

- Are they willing to trust me with more of their business? (Will they expand?)

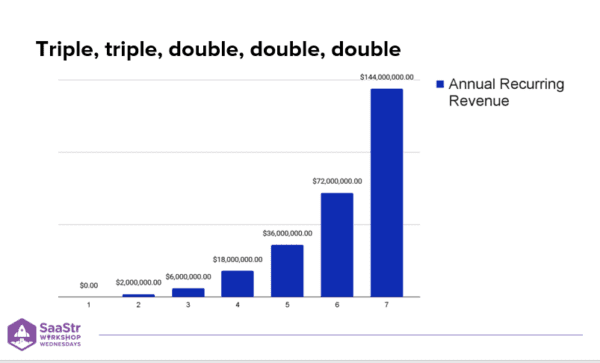

For the sake of explanation, John breaks down the evolution of customer success into the classic triple-triple-double-double-double.

If you don’t know, it’s the hockey stick curve going from $2M to $6M to $18M to $36M and on and on after you’ve found product market fit.

It doesn’t always break out perfectly like that, but we’ll pretend it does for the sake of argument.

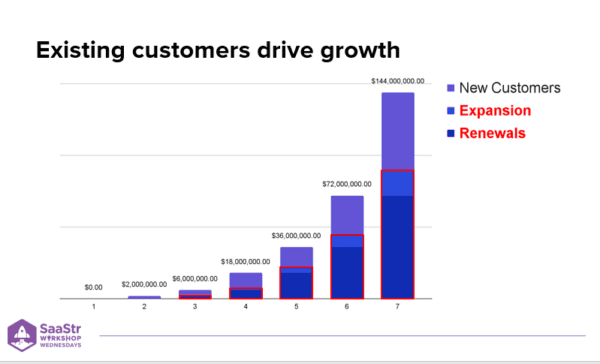

In SaaS, you have three ways to make that curve stand out.

- Get more new customers.

- Sell to more existing customers.

- Do a better job at keeping more existing customers.

We talk a lot about getting new customers, but it’s actually expansion and renewals that make the curve stand out.

Even if you think you’ve passed the stage of product market fit, it’s always worth keeping a lens toward it and understanding the needs of your customers as you evolve from early to later stages.

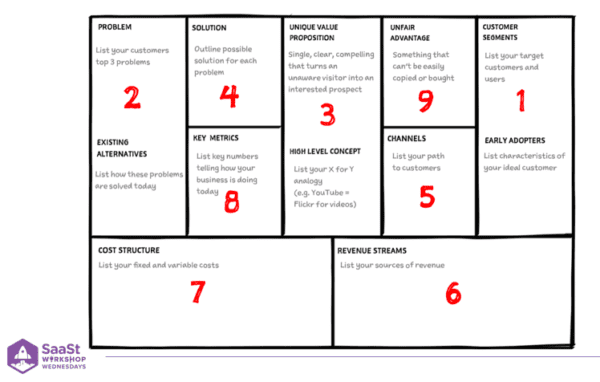

After you close a deal, you learn a lot about your customers. The framework above is a lean canvas to help you understand your customers’ needs post-sale.

If you keep these insights on the customer flowing to the right channels, it becomes a hub in your organization.

What is the highest form of product market fit?

Renewals.

It’s one thing to bring the customer over the line and sell for the first time.

It’s another when a customer says, “You promised me something and delivered. I’m willing to do that all over again.”

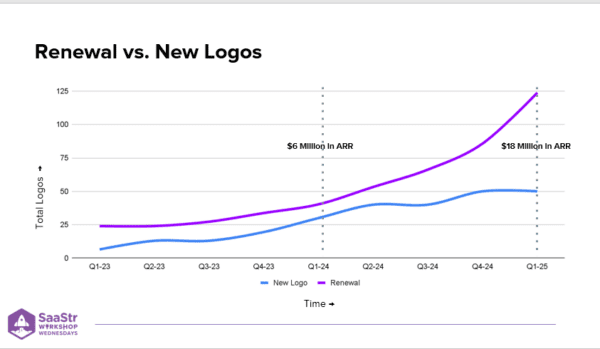

New logos are important, but pay particular attention to the renewal process because that’s where product market fit gets locked in.

This is applicable at every stage of growth.

Now, let’s get into the triple, triple, double, double, double.

The First Triple

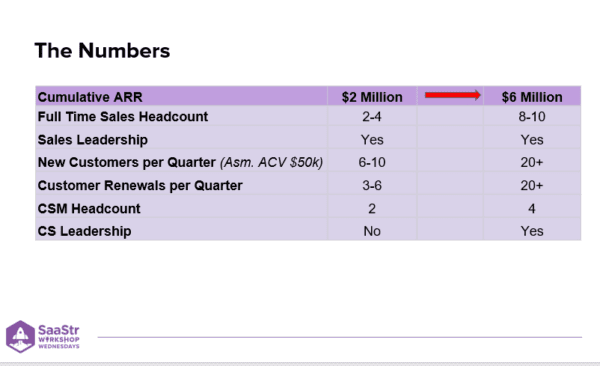

The first triple is one of John’s favorite stages of growth — going from $2M to $6M.

Chances are:

- You’ve hired your first Head of Sales, and you’re probably about to see a lot of growth on the sales side.

- Headcount maybe goes from 2 or 4 to 10.

- You probably don’t need a Head of Customer Success quite yet, but certainly some people supporting customers.

As important as it is to see what numbers are happening, it’s worth thinking about what’s happening organizationally, too.

Everyone is about to go on their own journey to find product market fit.

Your selling team will 3x, and sales will become codified.

During this time, you might also see:

- Mis-hires

- Poor fit customers

- More demanding customers

All those new hires are going on a journey to find their own version of product market fit — learning how to sell this product.

When scaling from founder-led sales to another person selling the product, customers become more demanding.

To combat this, Customer success might try to build in more processes.

Bake Flexibility into the $2M-$6M Stage of Growth

Customer success benefits customers, but it also supports the entire GTM.

Your first Customer Success team is an extension of the founders. This team:

- Confirms PMF.

- Feeds the product vision and roadmap.

- Educates the organization about your customers.

Up to $2M, the founder was supporting all of that. Now, it’s other people.

So, you’ll need to bake in the capacity for early customer success hires to find their own version of PMF.

At this stage, you don’t have an enablement function, so reps are holding onto anyone who can help them understand the insights and intel into your customer base.

When to Hire Your First Head of Customer Success

This is as much an art as it is a science. You have to look to your first Head of Sales to get this right.

Because if you hire your Head of Customer Success too early, you don’t have enough customers to pay for that hire. If you hire too late, you’ve got a whole sales engine running, and when new customers come in, no one’s there to greet them.

Some variables to consider when timing your Head of Customer Success hire are:

- Your Head of Sales is observably ramping well.

- Early sellers are meeting quotas.

The Math:

- Roughly $3M in ARR or about $1M in founder-led renewals

- Two founder-led CSMs with around $1-1.5M per rep, with the capacity to reach $2M each.

If you reasonably believe velocity will pick up, sellers are getting to quota quickly, and the math is right, it might be time to hire a Head of Customer Success.

When you go to make that hire, you can always Google what the job looks like online, but there are a couple of things to add.

Customer Success has changed quite a bit, and a new set of competencies are required.

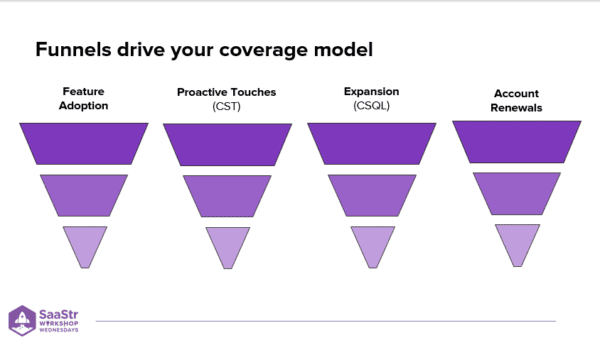

- Mastery of funnels — CS has many funnels like onboarding, usage, case studies, and expansion.

- Being truly cross-functional. At later stages, Customer Success may not own all the resources that support customers, so they have to work cross-functionally.

- Some knowledge about A/B testing and a balanced approach to tech, process, and people.

- An ability to scale through a couple of stages of growth.

There’s real value in having a consistent person who gets to know the customer over time and can keep a team together and grow with the organization.

The Second Triple

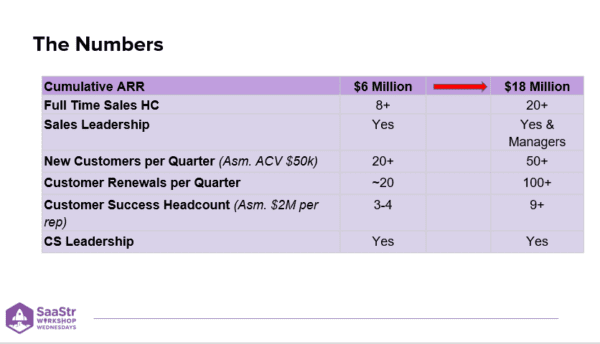

You need flexibility during the first triple, but now, at $6M-$18M, you need to start building out processes.

You’ve hired your Head of Customer Success at this point, and things are getting really big. There are a lot of people in the organization, and it’s time to scale your Customer Success org as well.

You’ve made it to $6M ARR, and accounts are coming up for renewal, but as you cross that line, the compounding nature of SaaS starts to take over.

After $6M, logos start to stack on top of each other if you have a good renewal rate.

That’s where the curve comes from — renewals stacking on renewals stacking on renewals.

The curve is where flexibility starts to break down, too. Too many customers are coming in, and Customer Success teams get lost.

The solution?

Break out onboarding from the Customer Success function.

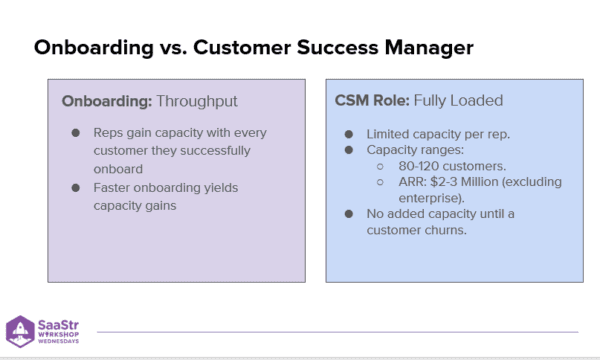

Onboarding vs. Customer Success

You do this to create capacity.

The CSM role looks different than other roles. Once a Customer Success Manager reaches $2M-$3M, they can’t take on any more work. They’re fully saturated unless customers churn.

Onboarding, on the other hand, means you’re always passing a customer through the motion if you’re good at your job.

They sign the contract, onboard, and the motion is done. Capacity comes back.

If you break out onboarding, you can create a ton of scale in that onboarding motion.

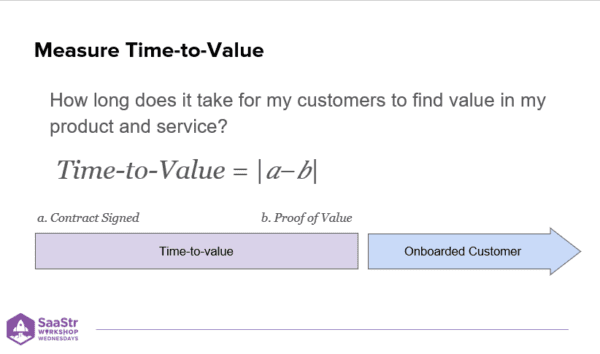

The most underrated metric at this stage is time-to-value.

At Motive, they condensed the time-to-value by breaking out onboarding to pick up more customers. They grew from $1M to over $60M in six months.

This freed up the CSM team to think more strategically in the long term. At this stage, the whole goal is to take limited resources of people and use them most effectively.

Scale starts with great onboarding.

The First Double

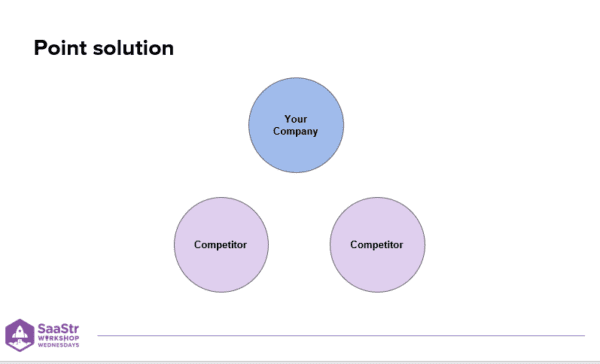

In SaaS, we come to market with point solution. The common wisdom is to do that thing 10x better than competitors.

In the early stages, a lot of founders say they do things differently and don’t have competition. But the reality is that point solution only gets you so far.

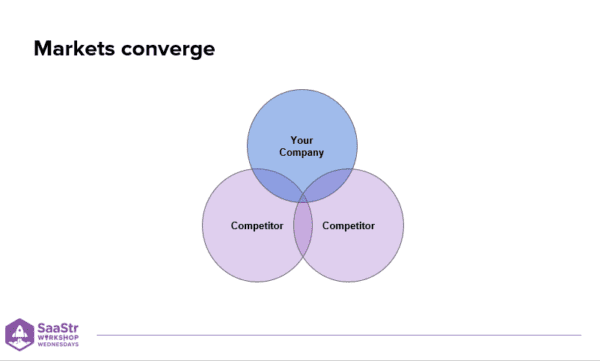

The holy grail of SaaS is to build a platform. So you have to come to market with more features, and you start to converge on competitors.

This is generally where churn starts to pick up because competitors are selling against you.

Customer Success has to be on the offensive at this stage, which is a different selling motion than sales.

You can’t do blanket campaigns. You have to set up different funnels and track customers down these funnels in order to push them toward that renewal or expansion.

The feature adoption book of business for Customer Success is about everyone using the product now.

So, the next step is to give them even more value.

Not inbound, but outbound touches will help them to do more with your products.

After feature adoption and touches, you could open up the aperture and ensure every account had a CSQL against it.

So, if a competitor reached out, there was an insurance policy against it.

The Second Double

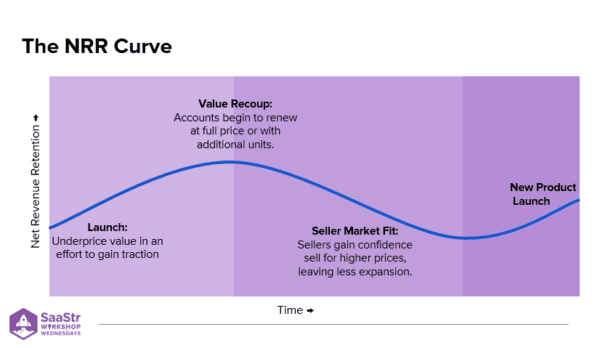

When you launch a new product, you always undersell.

As you get comfortable or you pass it to the CS org, you’ll naturally recoup all of that value.

The customers expand, and NRR starts to climb. You pat yourself on the back because NRR is high.

But what happens when you have a lot of ARR at scale?

NRR can draw down.

At the same time that you recoup value and get comfortable selling your product, there is less land and expand and more selling your product at full price.

New logos come in fully baked, so with more ARR and less to expand or recoup, there isn’t as much going back into that NRR number.

When one person churns, it counts for more.

NRR can draw down even with a great Customer Success motion.

In this dip, the whole motion of Customer Success comes together — figuring out how to pull up NRR through additional offerings.

Customer Success comes full circle. Product market fit never stops.

Five Key Takeaways For Scaling Customer Success

- Product market fit continues at every stage of growth. Customer Success plays a significant role in this, from $0 to $300M+ in ARR.

- Customer Success supports customers and your entire GTM motion.

- Onboarding is where the capacity to scale comes from. As such, time-to-value is the most underrated metric in SaaS.

- Issues can lurk behind impressive metrics. Cohort analysis allows you to proactively address issues before they arise.

- Customer Success proactively sells. The best defense is a great offense.