So over the past decade-and-a-half we’ve come up with a lot of yardsticks, metrics and rules for SaaS companies.

E.g.,:

- CAC of < 12-14 months is Good-to-Great

- Paying sales reps 25%-30% of what they close is Good

- A burn multiple of 1 or less is Good

These metrics do sort of work, if you have some capital to spend (e.g., can invest in marketing that takes a little while to pay off).

But — they break if you aren’t really a traditional, 80%+ Gross Margin, 100%+ NRR SaaS company.

In particular:

- Hybrid SaaS with payments and fintech usually has far, far lower gross margins than pure software. See, e.g. Shopify, whose blended gross margins with payments even at its scale are still less than 50%. Often in the 40%-50% range, instead of 75%-80%. Yet, I see most “Hybrid SaaS” startups ignore this and spend as if they had 80% margins.

- Non-Recurring Revenue Doesn’t Count, At Least Not as Much. If your revenue from any stream can go down in a given month or quarter, it’s not recurring.

- Pass-Through Revenue Simply Doesn’t Count. Is it OK to recognize pass through revenue as “revenue”? It depends. B2C folks take different positions here. But what’s clear is it’s a terrible, terrible idea in B2B and SaaS to include 0%-10% gross margin pass-through revenue when you model your SaaS metrics.

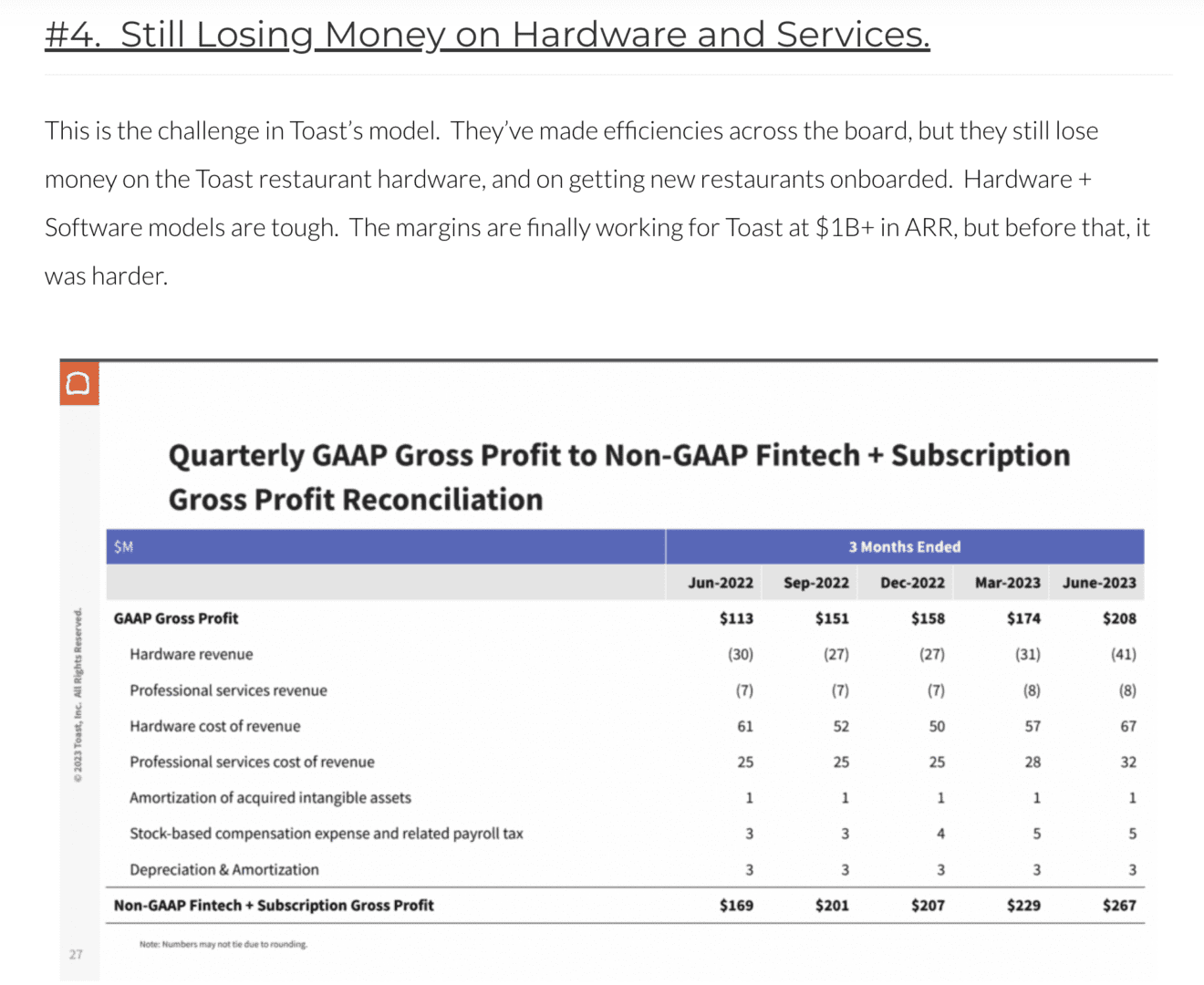

- Loss-making Hardware Revenue Doesn’t Count. Toast loses money on those cool devices you use in restaurants. That’s great, and it enables their software. But you can’t count that as profitable revenue. It isn’t.

- SMB SaaS often has much lower than 100% NRR, especially to start. In fact, Very Small Businesses often see 3% a month churn or higher. You simply cannot spend 12 months of revenue to acquire a customer if they on average … last less than or not much more than a year. Eventually most SaaS SMB leaders get to 100% NRR one way, or another (often by either going multiproduct and/or a bit more upmarket). But until you get there — you can’t spend like you do.

Toast even at a $1B+ run rate is still losing money on hardware and services:

And even today, I’m seeing way way too many venture-backed startups with hybrid, less than 100% recurring, and/or SMB models spending money like … they can use enterprise SaaS metrics.

They can’t.

You can’t spend like you do. Or it ends up all gone, faster than anyone planned. Even though you used and even met those “Standard SaaS” metrics.….

______________________

David Sacks and I hit on this a bit in this deep dive from SaaStr Annual here:

A related post here: