Some SaaS and Cloud leaders have seen big impacts from the post-2020 hangover, but others keep accelerating. MongoDB is one of those that has never stopped.

Instead of looking at those who are struggling, let’s take a look at the epic growth story of MongoDB, a company crushing it in 2023.

MongoDB is at a stunning $1.5B in ARR, 29% overall growth, and is worth $29B. That’s about as good as it gets in SaaS and Cloud!

While many less efficient public SaaS companies are trading at tough multiples of 3-4x ARR, and the average is about 6x ARR, MongoDB is almost 20x ARR.

Let’s look at nine interesting learnings about this leading company.

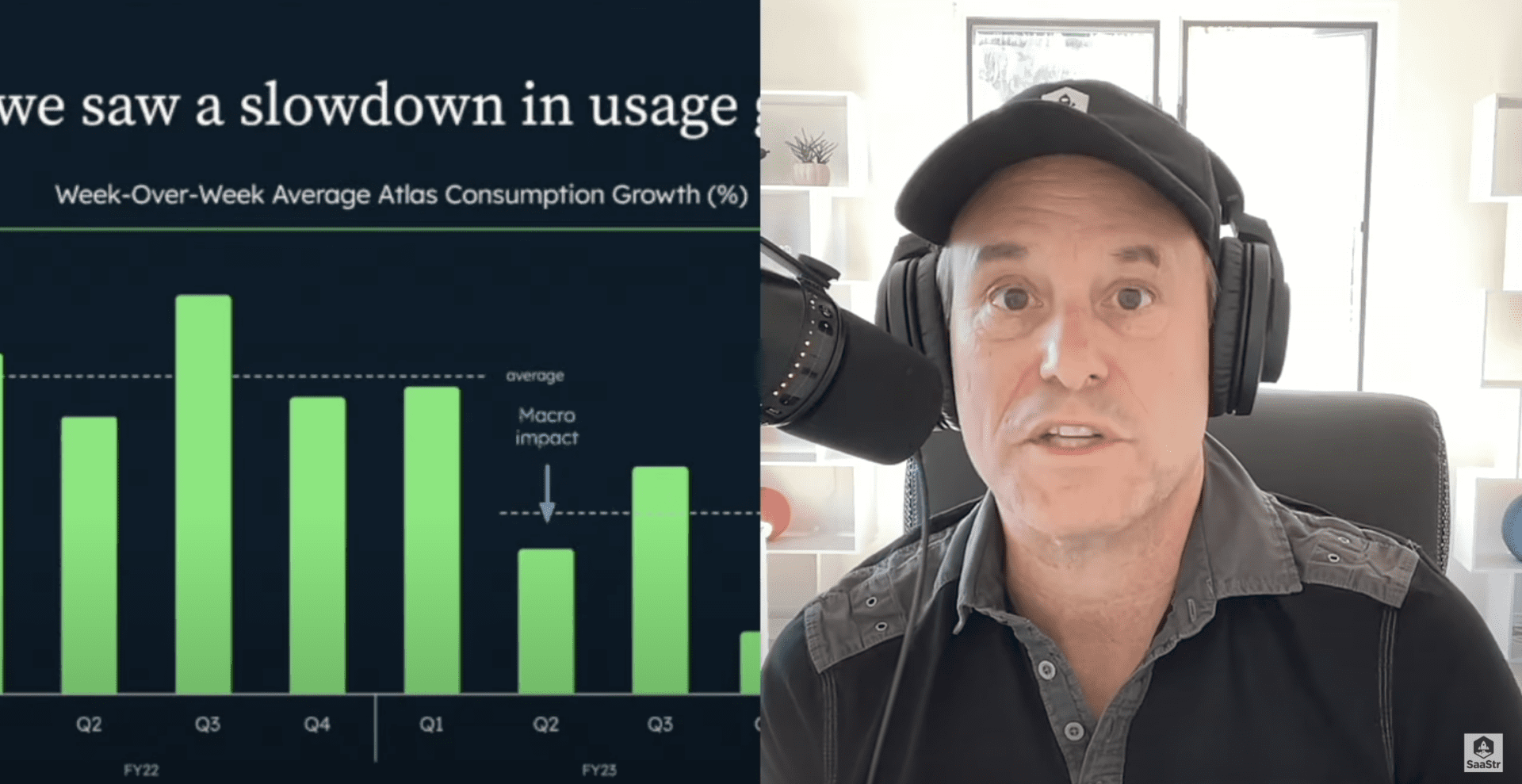

#1 — 2022 Saw A Slowdown In Usage Growth, But 2023 Saw A Potential Bounce Back.

Even with MongoDB’s epic growth, 2022 saw a big slowdown in usage growth. And when you have partial utility-based pricing like MongoDB does, you see the impact fast.

Folks pulled usage down as much as they could to save money, although logo churn remained low.

But last quarter saw a bounce back. Usage was up, although not quite like the days of 24 months ago. So we’re seeing signs of coming off the lows.

Are we near or past the lows in SaaS and Cloud buying patterns? We’ll see.

#2 — New Workloads Are Only A Small Percentage Of Today’s Revenue, But Are The Majority Of Tomorrows.

MongoDB thrives with workloads. You put more workloads in the database, and then you add more over time. That ACV grows and grows gently over time to $1M+ deals.

But new workloads and new use cases of MongoDB are only about 10% of new bookings.

Why?

Because it takes time, and this is the power of NRR and playing the long game. MongoDB isn’t trying to force it, even if they could.

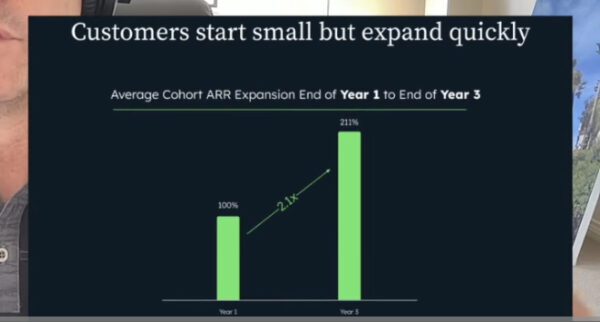

This chart shows the awesome power of high NRR and how you have to invest in customers that scale with you over time.

#3 — New Customer Count Is Up 24%—a Very Good Sign.

MongoDB is growing 29% at $1.4B in ARR, but what a lot of people at scale have trouble with is getting new customers. They milk the base, and the new customer account doesn’t remotely approach the new revenue growth rate.

Upselling your existing base and raising prices to keep top-line growth growing isn’t adding real long-term value. Adding new customers does, and ideally, growing new customers at least half as fast as revenue.

If you’re growing at 30%, it’s good to see at least 15% growth in your new customer base. If you’re growing at 50%, you want to see at least 25% growth. That’s your future, not just your present.

MongoDB is crushing it, adding +24% new customers while growing +29% overall — a bullish sign for the future.

#4 — $1M+ Customers Are Up 30%, Even With Economic Headwinds.

$1M+ and bigger customers fuel MongoDB’s growth. Many people complain that there’s no budget in Enterprise and that it’s impossible to close bigger deals.

Sure, it’s harder to close bigger deals. Budgets are tight, and folks are looking to shrink their number of vendors.

Yet leaders like MongoDB are growing quicker than startups, and it’s usually the opposite.

CIOs and others want to concentrate their budget on vendors they trust, so if you have a strong brand, you can benefit from this trend.

Mongo’s $1M+ customers are up 30%, which is pretty epic.

If your million-dollar customers are growing at that rate and new logos are growing at almost 30%, at the end of the day, you’re probably going to breeze to $10B in ARR.

#5 — The Average Customer Spend More Than Doubles After Two Years.

High NRR is magical, but NRR as a metric isn’t a GAAP metric. It can be gamed a bit and is subject to interpretation.

But you know what isn’t? Revenue growth. That’s what really matters.

Here you can see the magic in MongoDB’s business model.

After 24 months, the average customer has grown 2.1x. And that includes its biggest customers. They still grow 2x in spend over the first 24 months.

What does this mean?

It means you do not have to rip off the customer or get every single dollar upfront. As you build up a great sales team, they’ll get better at getting revenue up front, and that’s great up to a point.

You don’t want to break it. Mongo lets you try its products for free and scale up. They know across thousands and thousands of customers that customer spend will grow 2.1x after two years, so they can lean in and invest in that knowledge.

#6 — Top 100 Customers Are 33% Of Revenue. Enterprise Customers Are 75% Of Revenue.

Why is this important?

MongoDB has become pretty Enterprise, and that’s common for people north of $1B ARR. Slack started as a free tool, and as it crossed $1B, its majority became Enterprise. At that scale, you need $100k and $1M+ deals.

This stat isn’t just a case study of Go To Market. It’s also a case study of PLG.

Mongo doesn’t always describe themselves this way, but they’re very PLG. They have thousands of users using it for very little or free at the long end of the tail.

PLG is great but can take many different paths. It’s not a one-size-fits-all motion.

Some people want to move to a PLG model because they think it’s cheaper than Enterprise sales. And the truth is, it hasn’t been very efficient for Mongo until recently.

There are plenty of companies with great PLG self-serve viral motions that still spend a ton on sales and marketing.

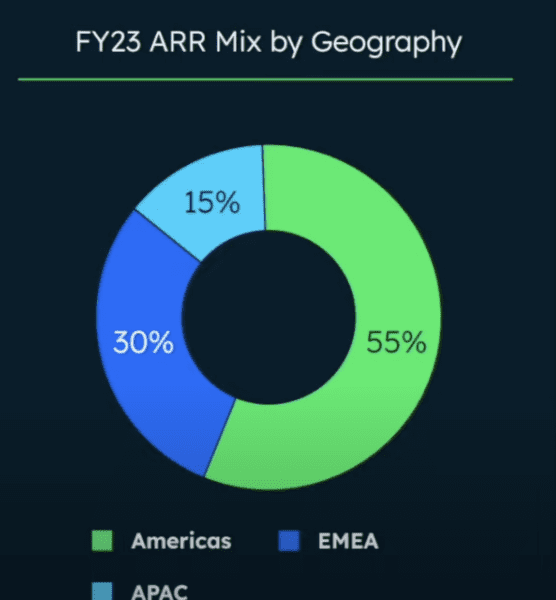

#7 — 45% Of MongoDB’s Revenue Is Outside North America. Go Global If You Can, Folks!

This is a small but important point.

45% of MongoDB’s revenue comes from outside North America. This is true for many leaders like HubSpot, Monday, DataDog, and others.

You need to localize your product and do it early. It’s not a waste. You will go global early.

If you want to scale beyond early adopters and tech-focused folks, you need local offices, ideally when you have $1M ARR and a geography. You won’t close the old-school customers without it.

The point?

If you focus too much on the American market, you may be giving up half of your revenue.

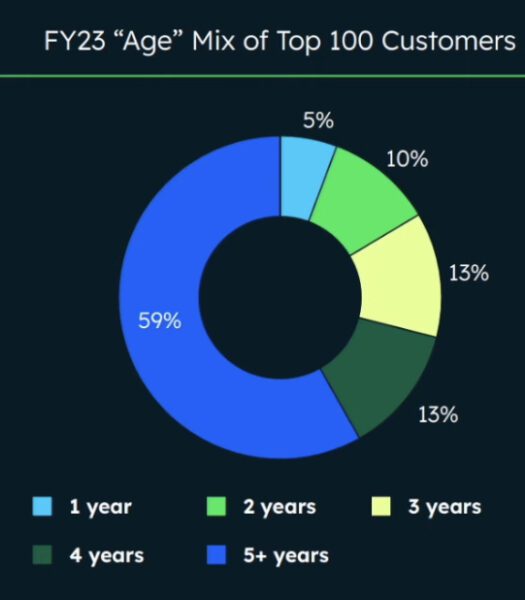

#8 — Most Of MongoDB’s Top 100 Customers Have Been Customers For 5+ Years.

It’s interesting to see the benefits of high NRR in this way. Most of MongoDB’s top hundred customers, which typically represent a third of their revenue and are fairly concentrated, have been customers for 5+ years.

That’s one key to their jaw-dropping numbers — keeping their top customers forever.

Almost three-quarters of their customers have been with them for 4+ years. They treat them well, lock them in, and grow their spend over time.

You don’t always have to close a $1M deal upfront. You can grow into them. MongoDB does and earns it.

#9 — Almost All Cloud Leaders Got Radically More Efficient In One Year.

How efficient should you be, and can you be in SaaS?

In 2019, 2020, 2021, no one really cared if you were efficient, but boy, has that changed.

A year and a half ago, Mongo had very negative margins, and it makes sense because growth was epic.

And for the first time in their recent history, they swung to being operating margin positive or “being profitable.” They went from -40% to +5%.

How did leaders like MongoDB, HubSpot, Monday, and Salesforce go from being pretty inefficient to efficient in a single year?

They kept the headcount kind of flat. Everyone got about 15-20% more efficient, and everyone had to do 15-20% more work. And it worked!

MongoDB has one of the highest public multiples in SaaS and Cloud. Efficiency is a complicated metric, and Mongo isn’t wildly efficient, even at $1.5B in ARR. But they are wildly successful.

So the existential question remains: Are they mortgaging the future and under-hiring during a downturn?

First, this isn’t a downturn—more of a side turn. And for now, we’ll see if they revert to less efficiency if the market continues to bounce back.