How well you retain your customers can make or break your business’s success in the long run. With customer retention rates varying widely across different industries, understanding the average rates can provide valuable insights into how to keep customers coming back.

In this article, you’ll see how your company compares to other businesses in the industry and understand if you have room to improve your rates.

By benchmarking your actual retention rate against industry averages, you can identify areas for improvement and implement effective retention strategies to increase profits and ensure long-term success.

So, let’s get right into it!

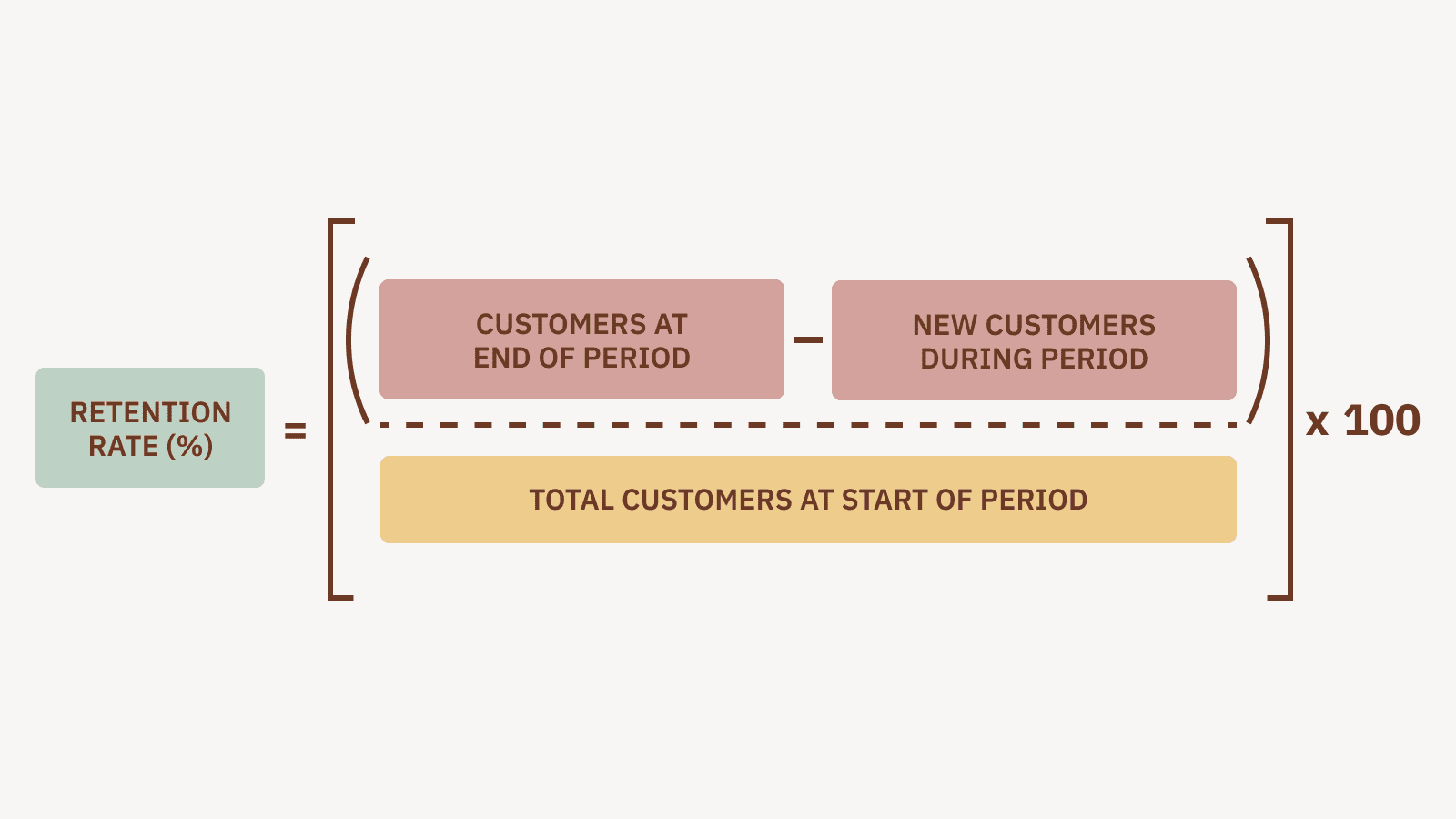

Calculating Customer Retention Rate

Just to ensure that we’re on the same page, here’s a reminder of the data you’ll need to calculate your customer retention rate:

- The time frame you want to study

- The number of existing customers at the start of the time period

- The number of total customers at the end of the time period

- The number of new customers added within the time period

Once you have all the data, you can plug it into the retention rate formula:

[(Customers at the end of the period) – (new customers during the period) ÷ total customers at the start of the period] X 100 = customer retention rate

By using this formula, you can measure the effectiveness of your customer retention efforts and make data-driven decisions to improve your retention rates.

How to Determine a “Good” Retention Rate?

When determining a “good” customer retention rate for your business, there isn’t a one-size-fits-all answer. Retention rates can vary significantly across industries and companies based on factors like your product type, price point, and customer demographics.

One approach to choosing a retention rate benchmark for your business is to look at your historical data and trends to determine what is achievable and realistic. You can also use a bottom-up approach by setting a revenue goal and calculating the retention rate required to achieve that goal.

Another helpful method is comparing your retention rate to your competitors and industry peers. This allows for a better understanding of what’s typical in your industry and where you stand in relation to other businesses.

Regardless of your specific approach, it’s crucial to acknowledge that retention rate is an important KPI for your business. A high retention rate indicates that your customers are satisfied with your product or service and are likelier to continue using it and recommending it to others.

Average Retention Rates by Industry: A Comparison

Customer retention rates are highest in the media and professional services industries worldwide at 84%. The hospitality, travel, and restaurant industry has the lowest customer retention rate, at 55%.

Professional Services – 84%

The professional services industry boasts one of the highest retention rates at 84%. It’s mainly because professional service companies strongly emphasize developing close relationships with their clients, resulting in higher retention rates. They recognize the individual needs and preferences of each customer, making the services they offer an integral part of their success.

These companies successfully integrate their services into their customers’ daily routines through effective personalization.

Banking and Finance – 75%

According to recent studies, the average American tends to stick to the same primary checking account for up to 17 years. While there are a few reasons why consumers switch banks, such as relocation or major life changes, most clients remain loyal to their banks for decades.

Only 4% of consumers switched banks in 2018. This can be attributed to banks’ high level of consumer satisfaction. By focusing on customer satisfaction strategies, banks make the banking experience seamless, contributing to customer success.

Insurance – 83%

Insurance companies have various factors influencing their retention rate. A higher retention rate does not always indicate a company’s success. Losing 17 out of 100 clients for an insurance company can have more significant consequences than for a retailer. To keep their clients, insurance companies strive to increase their market share and make it harder for clients to leave.

Retail – 63%

Retail is a highly competitive industry with customer retention rates that are among the lowest, averaging 63%. This can be attributed to the high level of competition and the ease of leaving for customers.

With plenty of options available to consumers in the retail industry, companies need to put extra effort into retaining customers. Additionally, the retail sector has a high volume of leads, and for some companies, the cost of customer acquisition is similar to retaining existing ones.

IT and Software – 81%

IT, software, and SaaS businesses have an average retention rate of 81%. This industry has the benefit of being able to provide results quickly to its customers. However, not meeting customer expectations can easily lead to high customer churn.

Media – 84%

The media industry has the greatest global consumer retention rate – 84%. Media firms frequently have enormous marketing budgets that enable them to target vast client populations. Despite a lack of personalization, this contributes to a high retention rate.

Telecommunications – 78%

Telecom companies have an average customer retention rate of 78%. The high retention rate can be attributed to long-term contracts and customer loyalty incentives that make it undesirable for current customers to switch providers.

10 Factors That Influence Customer Retention Rates

Customer retention rates are influenced by various factors that can vary significantly across different industries.

In general, the quality of products or services, the level of customer service, pricing, brand loyalty, and overall customer experience are some of the main ones. Some factors, however, are more significant for some industries than others.

For example, factors like product selection, ease of use of the website or app, delivery speed, and customer support can all play a significant role in the e-commerce industry. Meanwhile, in the hospitality industry, factors like the quality of accommodations, staff friendliness, and overall guest experience can impact customer retention rates.

1. Product Quality

Product quality is one of the most critical factors that impact customer retention rates. Customers will likely remain loyal to a business if they consistently receive high-quality products that meet or exceed their expectations. In contrast, if a company offers low-quality products, customers will likely look elsewhere for a better experience.

Product quality can differ significantly across different industries. For example, in the fashion industry, customers may prioritize the quality of the materials and the craftsmanship of the garments. Meanwhile, in the food industry, customers may be more concerned with freshness, taste, and nutritional value.

2. Customer Service

After product quality, customers value excellent customer service. How a company reacts to and manages a customer’s complaint or criticism affects its existing customers.

A good customer service experience contributes to a positive brand image and experience, whereas a negative experience can become a reason customers cancel their subscriptions.

3. Branding

Strong branding can create a positive image of a business in customers’ minds, leading to increased brand loyalty and repeat business. A well-established brand can also help businesses differentiate themselves from competitors and attract new customers.

Brand identity can differ significantly across different industries. For example, in the luxury goods industry, branding may focus on exclusivity, prestige, and high-quality materials. On the other hand, in the fast-food industry, branding may focus on affordability, convenience, and speed.

As a business, you must carefully consider your target audience and industry when developing a branding strategy. Ensure it resonates with your customers and supports your customer retention program.

4. Brand Loyalty

Brand loyalty refers to the extent to which customers remain committed to a particular brand or business over time. Companies that have established strong brand loyalty benefit from customers who are likelier to stay loyal and make repeat purchases, even when they have to change prices or when competition is high.

Brand loyalty can differ significantly across different industries. For example, in the tech industry, customers may be more likely to switch brands or products as technology evolves and improves. While in the automotive industry, brand loyalty may be more robust due to significant investment and emotional attachment associated with owning a vehicle.

5. Trust

Customers return to companies they trust. It’s easier to nurture client loyalty when customers know they can effortlessly return their purchases without paying any hidden costs or being subjected to other unethical company practices.

Customers are likelier to be loyal to a brand if they believe the company will take responsibility if something goes wrong. So, if you consistently act in the best interest of your customers, you can benefit from increased customer loyalty and positive word-of-mouth recommendations.

Trust can differ across different industries. For example, in the financial services industry, customers may prioritize trustworthiness and transparency. In the healthcare industry, trust may be based on the quality of care medical professionals provide.

6. Customer Lifetime Value

Customers who browse an app or an e-commerce store and feel the platform speaks directly to them are more likely to return. Repeat customers have a higher customer lifetime value (CLV), which measures a customer’s total money spent with a business during their relationship.

Customer Lifetime Value Formula:

Customer Lifetime Value = Customer Value x Average Customer Lifespan

Customers who need more specialized services or goods are often more loyal. It’s because such companies can personalize their offerings and make their customers feel valued.

CLV can differ significantly across different industries and businesses. For example, in the telecommunications industry, customers have a high CLV due to the long-term contracts and recurring revenue generated by subscription-based services. In contrast, in the retail sector, customers have a lower CLV due to the frequent and relatively low-value purchases made by individual customers.

7. Company Values

Customer loyalty grows when your company’s values match customers’ beliefs. For example, in the fashion industry, customers may favor businesses prioritizing sustainability and fair labor practices. The tech industry, on the other hand, may attract customers by prioritizing data security and privacy.

8. Price

While low prices may initially attract customers, businesses that consistently offer low prices may need help maintaining customer loyalty if they deliver quality products or services.

Price sensitivity can differ across different industries and businesses. For example, in the fashion industry, customers may be more willing to pay premium prices for high-quality designer products. On the other hand, in the grocery industry, customers may be more price-sensitive and prioritize stores that offer competitive prices and frequent promotions.

9. Perks

Perks and incentives can also impact customer retention rates. Here’s a list of some of the most effective techniques to make existing customers feel valued and retain them for a long time:

- Discounts and deals

- Free membership

- Free samples

- Free resources

- Free shipping

- Loyalty programs

- Referral programs

10. Convenience

Some customers simply prioritize convenience above anything else. For example, they may choose your company over your competitors because you offer a simple checkout process. Or they may decide because you deliver orders faster than your competitors.

How to Improve Customer Retention Rates

Let’s explore various tactics that you can implement in your customer retention strategy to improve your retention rate and build strong relationships with your customers.

Measure Your Current Retention Rate

Improving your retention rate starts with understanding where you stand. Measure your current retention rate by analyzing data like customer purchases, repeat business, and customer feedback. This data can help you identify improvement areas and create a change plan. It’s essential to track your retention rate over time to see if your efforts are effective.

Prioritize a Positive Customer Experience

Providing positive customer service is one of the most effective ways to improve customer retention rates. Customers are likelier to remain loyal to your business if they feel valued and appreciated. This can be achieved by offering fast and personalized customer support, addressing customer complaints promptly, and going above and beyond to resolve issues. When customers feel heard and respected, they’re likelier to continue doing business with you.

Implement Personalized Cancellation Flows

With Chargebee Retention; you can create personalized cancellation flows to prevent customers from canceling their subscriptions or services. It helps you identify the reason for cancellation and offers customized solutions to address these reasons. For example, if customers cancel because your service is too expensive, you can offer them a discount or an alternative plan.

By addressing the customer’s specific needs and concerns, you can increase your chances of retaining them for extended periods.

Collect Customer Feedback

Collecting customer feedback is crucial in improving your retention rate. It can help you understand your customers’ needs and preferences and identify areas of improvement.

Regularly sending out customer retention surveys can gather valuable insights into their satisfaction levels, areas where you can improve, and potential growth opportunities. Consider offering incentives like discounts, free products, or access to encourage participation.

Once you collect the feedback, take action and address any concerns or issues customers raise to improve overall retention rates.

Track Important Retention Metrics

Tracking important retention metrics is essential for improving customer retention rates. These metrics provide valuable insights into the effectiveness of your retention strategies and can help you identify areas for improvement.

Some key retention metrics you should track include:

- Churn rate — measures the percentage of customers who stop using your product or service within a specific time frame.

- Customer lifetime value (CLV) — calculates the total revenue a customer will generate over their relationship with your business.

- Net Promoter Score (NPS) — measures the likelihood of your customers referring your business to others.

- Customer satisfaction score — measures how satisfied your customers are with your product or service.

Ready to Benchmark Your Customer Retention Rate?

Customer retention is an essential aspect of any successful business. Understanding the average customer retention rates within your industry allows you to compare your performance with your competitors and identify areas for improvement. Additionally, analyzing your customer retention rates over time is equally important. By doing so, you can measure the effectiveness of your retention strategies and adjust your approach as needed. Recognizing the factors affecting customer retention and regularly monitoring your rates can help you build a loyal customer base and achieve long-term success.

Maximize long-term business success with Chargebee Retention by enhancing your customer base, streamlining subscriptions, personalizing cancellations, and boosting retention rates.