So there’s a question I’ve had for some time in SaaS: does high NRR really equal higher growth?

Yes, most of the best in SaaS have high NRR, at least once they are public. But there are multiple ways to build a leader, and startup don’t always start off with high NRR even if they end up there.

SaaS Capital asked this question among some other great ones of 1,500 private SaaS companies here.

And what they learned is: Yes.

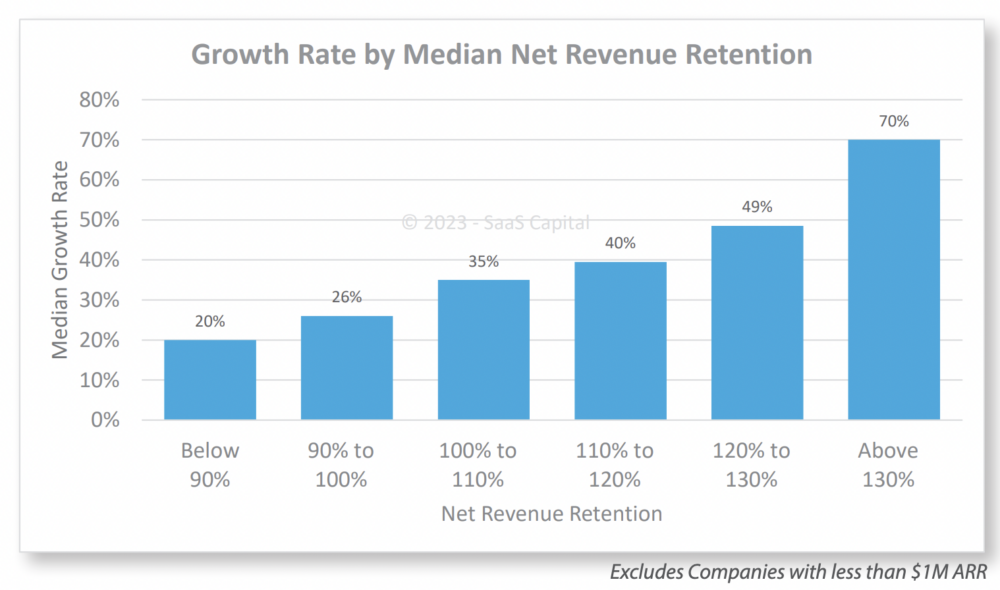

“Higher growth is generally associated with higher retention and vice versa. The higher a company’s retention, the easier it is to grow, as the company doesn’t have to replace as much lost revenue. The impact of retention is also cumulative as it repeats and expands on itself year after year. Figure 5 comes from our 2023 SaaS Retention Benchmarks for Private B2B Companies and highlights the relationship between growth and retention. This relationship is a rare example of increasing returns from investment in upsells and cross-sells. Increasing Net Revenue Retention (NRR) from the 90% to 100% range to the 100% to 110% range improves growth rate by 9 percentage points. Companies with the highest NRR report median growth that is double the population median. This is a rare example of increasing returns from investment in upsells and cross-sells. The relationship between gross revenue retention and growth is not as direct and is more binary. Companies with gross retention below 90% reported growth below the population median of 35%”

Companies with the highest NRR report median growth that is double the population median.

This wasn’t obvious to me. First, SMB SaaS almost always has lower NRR, especially in the earlier years, and that hasn’t stopped HubSpot and Toast many others from getting mighty big. But, the best in SMB SaaS do tend to have higher NRR, especially as they scale. And high NRR sometimes can hide low new logo / customer growth rates. We’ve seen that a lot lately in many public leaders who are leaning more on their installed base lately to grow.

But the data is real. Invest wherever, however you can in increasing NRR. Yes, it does highly correlate to top-tier growth.

“SaaS Capital lends $2 million to $15 million to B2B SaaS companies with at least $3 million of ARR registered and banked in the US, Canada, UK, and Ireland. Please don’t hesitate to reach out if you or a SaaS company you know that fits that description is looking for capital.”