Go-to-market (GTM) design and efficiency are sometimes overlooked, but they’re a critical driver of any SaaS business. Rajeev Dham and Karan Singh, Partners at Sapphire Ventures, and Jane Lee, Vice President at Sapphire walk us through how to double your “Magic Number,” a shorthand for your sales and marketing efficiency.

Magic Number is your growth in ARR over a quarter divided by the sales and marketing spend in the prior quarter. Previously in SaaS, it was widely seen that anything > 1 was healthy if you were venture-backed, and anything > 1.5 is was seen as perhaps too capital-efficient. If you were well-funded, 0.7 was fine.

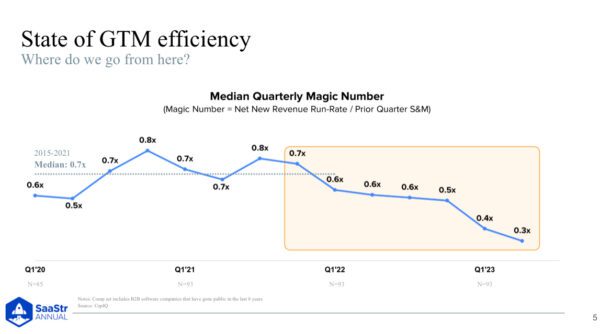

But as Rajeev, Karan, and Jane point out to set the stage for this discussion, Go-to-market efficiency in recent years has suffered a significant drop across both public and private SaaS companies.

To give a sense of the magnitude of this change, you can see the median net magic number for public SaaS companies dropped from .7x to .3x. That means generally spending $3 in sales and marketing to generate $1 in net new ARR.

Why has this decline happened? And how can you double your magic number without reinventing the wheel for better quota attainment or cutting everything? Let’s find out.

From .7x to .3x – Why the Decline in Sales and Marketing Efficiency?

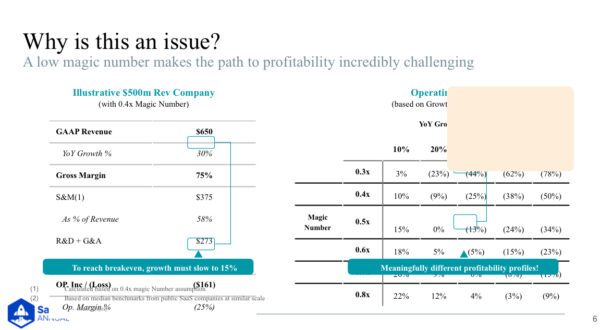

The magic number is a key measure of financial health for any SaaS company, and it has significant implications for your company’s ability to not only drive profits but also its ability to drive growth. For example, say you have a mature B2B SaaS company doing $650M in GAAP revenue, (GAAP stipulates that revenues are recognized when realized and earned, not when received) and you’re growing 30% year-over-year, but you’re operating with a .4x magic number. And say, you back into the sales and marketing expense from Magic Number and assume that the R&D and G&A expenses aren’t around similar levels as public staff comps at a similar scale.

What you actually end up with is quite an unprofitable business operating with -25% operating margin despite having a revenue scale of more than $600M. What does this mean? It means if you want to break even, you’ll have to cut that growth down by half down to 15%, ie if you had a magic number of 0.7 x in this case, you would already be at break even.

This goes to show that efficiency is what gives you the ability to double your growth. A low magic number diminishes your ability to drive profits and growth and makes the path to profitability that much more challenging.

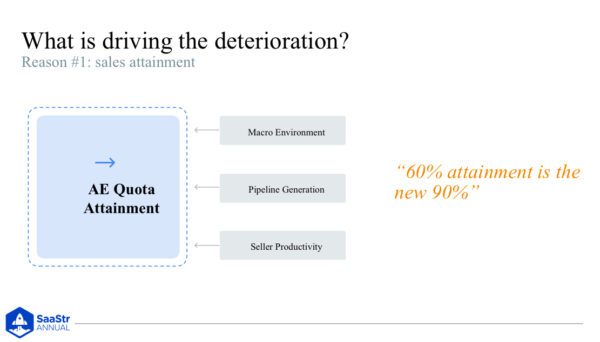

But what’s driving this deterioration in sales and marketing (go-to-market) efficiency? The #1 reason Sapphire sees amongst its portfolio companies is that it’s gotten much harder in the last 18 months to sell software and that’s been reflected in a decline in the core AE sales attainment. In 2023 alone, Sapphire saw AE sales quota attainment drop in H2 to 60% from 90% in H2 2021. That’s a quick one-third decline in AE sales attainment.

We all hope the demand environment will soften up, and boost back up by the latter half of this year, but the point here is that’s just one reason, and there is something still missing from the equation of what’s driving this decline in magic number.

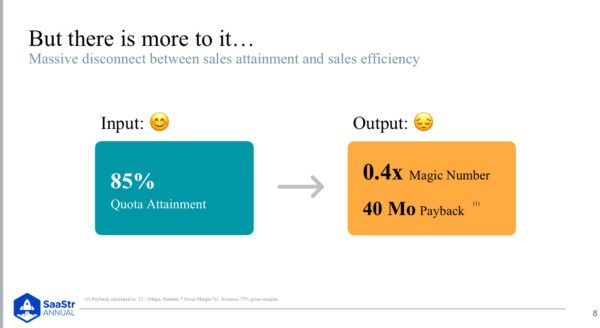

First, while the decline in quota attainment we just walked through is roughly 30%, the decline in sales efficiency has been at a much higher, and whopping 60%. That’s a big gap. Second, when CEOs model their budget for the year, they assume that AE’s will bounce back to 85% quota attainment and drive up their .3x magic number to .4x. That’s good right? … wrong.

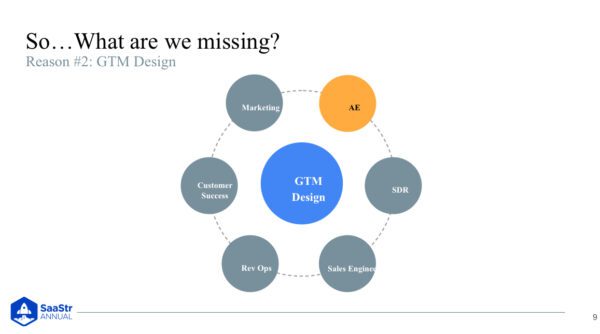

So what are we all missing here in the bigger picture? We’re pointing the figure too often just at sales. You need to look holistically at your go-to-market organization beyond just the AEs and realize that of course, there are so many other folks in a Go-to-market organization and pockets of spend.

Over the past 5-7 years, Sapphire has seen in its data the base composition of GTM teams at best-in-class companies changed dramatically. Let’s look at the data Sapphire pulled from the likes of MuleSoft, New Relic, Procore, Snowflake, and others to get a sense of what’s really happening under the surface.

GTM Composition Can Make or Break Profitability and Growth

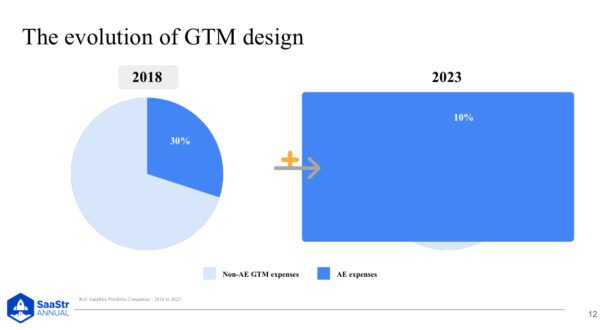

More specifically, Sapphire has seen that the percentage of investment made against quarter-carrying sellers has dropped in the last 6 years. So back in 2018, on average, what we were seeing was around 30% of Go-to-market investment going to quota-carrying sellers. Now that number is actually closer to 10%.

How did this happen? The short oversimplified answer is the macro environment. Macro changes have informed and influenced how company leaders think about investing and deploying their Go-to-market teams. The zero interest rate environment in the past led to an abundance of capital that needed to be deployed. Sapphire believes that this led to the proliferation of SaaS companies and a highly competitive environment amongst one another.

The rise of a competitive environment paired with growth rates not slowing down and the additional capital resulted in behavior trend changes. Back then there were some aggressive sales targets we could all achieve. So knowing these two things together, Sapphire saw some of the behavior trends change across its portfolio.

For starters, they saw lots of companies investing ahead of growth to set themselves up, not just for now, but for one year from now. And certainly, that can be a healthy behavior but what we’ve seen in the data, is that there was an additional incremental investment against “supporting resources” — resources centered around the entire Go-to-market team that drive up seller productivity (think sales engineers, SDRs, CSMs, etc.).

So in theory most founders spent budget against more specialization across the go-to-market team to help sellers focus on closing deals, which should’ve driven up productivity, led to more pipeline generation, and helped hit targets. But in reality, that’s not happening. There’s a drop in seller attainment, and has actually led to a diffusion of responsibility and a lack of ownership. No one is quarterbacking the entire GTM engine.

Companies need to rethink GTM organization design. If you had a blank slate and could determine what good and great look like, what would it be?

What a Good and Great GTM Engine Looks Like

The way operators think about good GTM organization doesn’t reflect what Sapphire sees in board decks and organization design today. The great operators understand a balanced GTM organization and the importance of the efficiency gains you get from that. Let’s look at some examples to give a sense of the impact of the organization design on overall company success.

Scenario 1

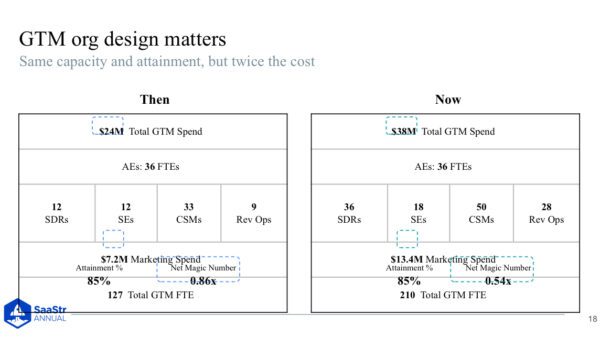

This is an example of how GTM was typically designed 5-10 years ago. Say you have a business with 36 quota-carrying reps, with a million dollar quotas with a bookings goal of $30M for the year. Of these sellers, the various supporting roles look like 3:1 AE to SDR ratio and 3:1 AE to SE ratio. There was a $3M book of business size for CSM and ten to one rev ops ratio.

Under this GTM combo, assume an 85% quota attainment. You’re looking at an aggregate sales and marketing spend of $24M against $20M net new ARR, and it gives you a magic number of .86x, which is pretty healthy based on survey data they’ve published. In fact, it’s pretty close to historical top quartile magic number trends of around 1x. Now, fast forward to today’s scenario.

Scenario 2

For the same 36 sellers, you’re seeing an AE to SDR ratio closer to 1:1, which is a fair attempt to boost pipeline generation and take prospecting responsibility off the sellers. For SEs, it’s a similar AE to SE ratio close to 2:1. Additionally, there’s an increased focus on driving up retention and expansion, with much bigger CSM teams with much smaller book of business sizes.

This similar trend holds true for marketing and rev ops. All in all, this happened as a sincere effort to drive up seller productivity. However, what you end up with is significantly different GTM organizations. One has many more supporting roles and higher expenses for the exact same number of sellers and bookings targets. Not surprisingly, this change in GTM org structure significantly impacts GTM efficiency.

If we went back to the same level and efficiency from scenario one, but under today’s composition, we’d have to increase sales quota attainment to 120% across the board.

Sellers Need to be at the Center of the GTM Engine

GTM organization design matters. When you put the two scenarios beside each other, the challenge is evident — more than double the spend for the same quota attainment.

There needs to be rethinking around GTM design. In particular, sellers need to be right at the center of the GTM engine again. Overspecialization or just specialization can be healthy, but someone needs to quarterback the entire initiative. You can make this shift with the mindset of a more balanced GTM organization to set yourself up for a durable growth company that can withstand the headwinds we’re all facing today.

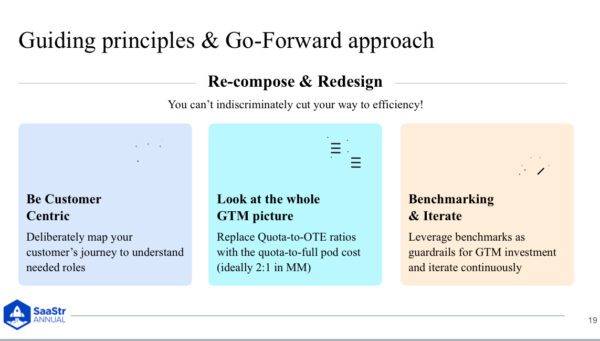

When people see their efficiency metric, the immediate reaction is to cut spend. But really, you want to rethink the spend you have so you can drive up growth while maintaining cost efficiency. How do you do that?

With these three guiding principles:

- #1 Be customer-centric. It’s much harder to have role redundancies and poor handoffs if you start with the customer in mind. Map their journey by phase and stage. You’ll quickly and easily find exactly what you need to invest in from a GTM standpoint.

- #2 Look at the complete GTM picture. You want to look at GTM comprehensively. For example, quota-to-OTE ratios are 4-7x. It’s fair, but what about quota-to-full pod cost? All the resources supporting the revenue generation should be a guardrail.

- Benchmark and iterate. Benchmarks are the starting point, not the endpoint. They give directional cues if you’re out of the swim lanes. Use benchmarks to start conversations internally and leverage the other two guiding principles for why you’re out of benchmark.

GTM organization design isn’t a conceptual exercise. It’s a people-centric exercise. Take the time to tune and iterate until you reach a healthier place. You can build that durable growth with more consistency and help drive success.

Key Takeaways

Today, everyone is doing a little piece. AEs are just a cog in the wheel, which is bad for the customer experience. You want to elevate the AE. Here are the key takeaways for doubling your magic number and driving profitability and growth.

- The magic number has drastically declined by 57% for B2B SaaS companies.

- While declines in AE attainment account for much of this, the evolution of GTM design has been a powerful yet overlooked force at play.

- Total GTM spend has now over-rotated towards non-AE functions.

- GTM teams are nearly twice the cost than before to support the same selling capacity.

- Going forward, there needs to be a reset on GTM design principles.