Founders of 2023 ask themselves, “What does it take to raise money right now in this uncertain market environment?” Peter Specht, Partner at Creandum, shares a data-driven perspective and real-time insights into the market of very recent rounds and current VC expectations.

Unfortunately, raising money isn’t the same as it used to be. Specht walks you through what has happened in the last 12 months and the best practices for today.

Fundraising Market Trends Over The Last 12 Months

Markets in 2021 felt a bit like, “Shut up and take my money!” with rounds happening in 24 hours and term sheets getting thrown at companies. They were fast processes with little due diligence.

2023 is a bit more cautious and awkward.

What does this mean in numbers?

If you look at the year-over-year numbers, total capital raised fell 80% in Q1 this year vs. Q1 of 2022 in the United States.

That’s a considerable drop.

You can see how the market builds up until Q4 of 2021 with almost $63B of cash raised, and then fell to around $43B raised in Q1 of 2022 and $10B in Q1 of 2023.

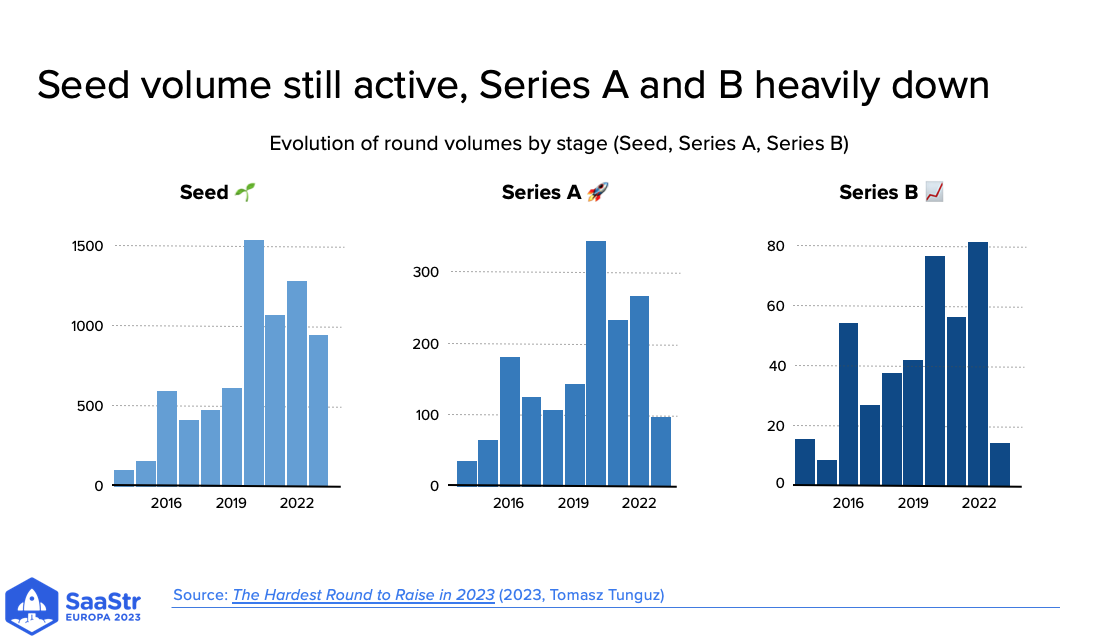

Looking at the volume behind it divided across different stages, you can see some interesting trends.

In Seed, volume is relatively solid and on a high level. It’s relatively healthy for very early stage.

If you look at Series A, there’s a steep drop and much fewer rounds.

Then in 2023, in Series B, it’s the lowest number across the Seed, A, and B rounds, and there are a few reasons for that.

- Investors currently struggle with price finding for these rounds. There’s no new normal or price set yet, and that uncertainty creates a little bit of fear among investors to overpay. “Am I overpaying for this round? Will there be up rounds?” And finding that right clearing price is still a work in progress.

- Many companies raised on very high valuations in 2022 or late 2021, so the bar to grow into these valuations and do a series B is a high one, and many companies still hold back.

- Many companies are holding back to grow into their valuation. They also likely raised a bunch of money in late 2021 and early 2022 and still have runway. So the trend is building out more ARR before going out to Series B.

The State Of The Fundraising Market Today

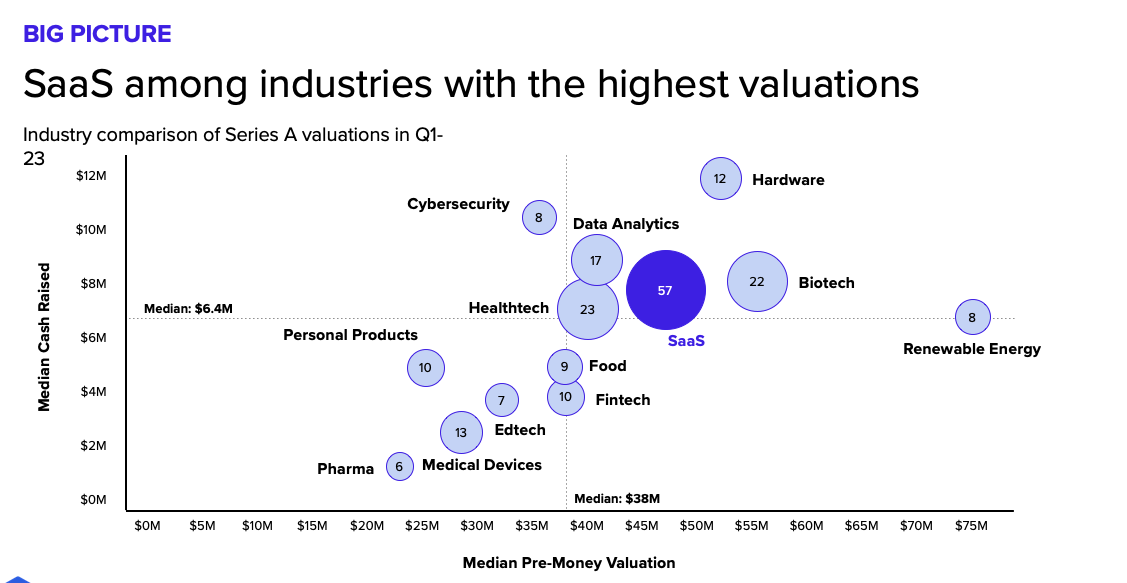

The good news for this audience today is that SaaS is among the industries with the highest valuations.

The reason?

SaaS as a vertical is a relatively attractive business model with high margins and recurring revenue, particularly valued in this market.

If you look at the development of valuations over the past three years, one thing becomes clear. The lines of Seed and Series A have been relatively stable. It dropped a little, but nothing crazy.

And then the Series B lines dropped steeply.

Series B was around $160M median around Q4 of 2021. Now it’s $90M.

The interesting thing is that even though things have “dropped,” they aren’t dropping to unheard-of numbers.

Specht suggests a reframe.

Instead of seeing today’s numbers as something crazy. Instead, we should view 2021 as an anomaly. Why were numbers so high, then?

When you look at things on a longer time horizon, you’ll see that we’re getting back to normal, a level at which it was for many years before the boom of 2021.

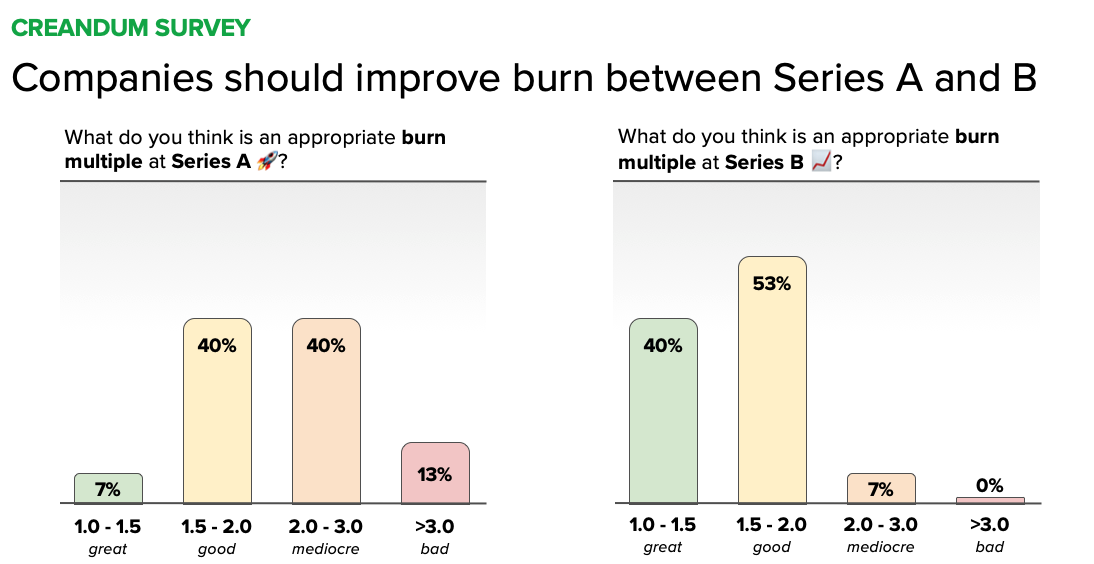

Creandum conducted a survey with the top funds and good investors a few weeks ago to understand the current market better.

Let’s look at some of the most interesting insights.

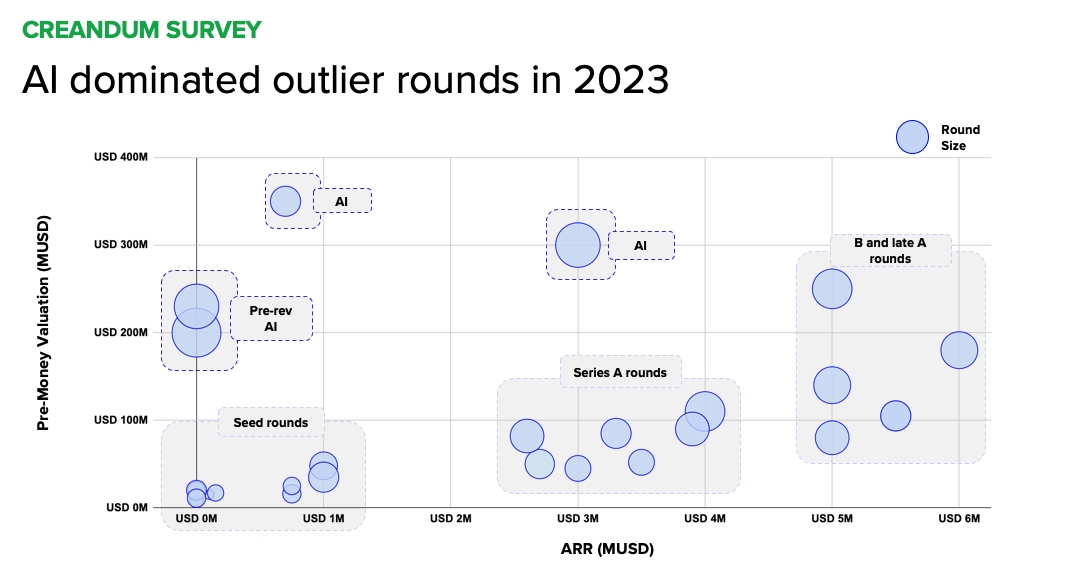

All of the outlier rounds that raised on very high valuations have been AI rounds.

Hypergrowth AI companies are playing in a different sphere and don’t adhere to the laws of gravitas we see in the rest of the market. So some 2021 style rounds are still happening, but they are only outliers and mostly focused on the category of AI.

There’s a gap in Seed where it’s either no revenue or close to $1M in revenue.

Funds and investors are either backing vision or backing Seed rounds with traction.

Investors in Series A rounds favor companies with more to prove and more ARR.

The gold standard for Series A was typically $1M ARR. Now, it’s closer to $2M, with many good funds investing between $2.5M and $4M ARR.

The takeaway from current rounds:

- Most seed rounds are either pre-revenue or late seeds with $0.5-1M revenue.

- A or A-extension rounds are more mature and have >2M ARR.

- B rounds start at $5M ARR. There’s a tendency towards more ARR.

- Selective hyped AI deals with high-growth play on 2021 valuations (100x ARR)

- The bar is high: A or B rounds had high growth >3-5x growth.

What Type Of Revenue Level Do Investors Expect At Seed, Series A, and B in 2023?

For Seed Rounds, many VCs currently expect some revenue. At least half expect more than $250k, and roughly 40% expect $250k-$500k.

For Series A, the majority of investors want to see a minimum of $1M ARR, and the preference is around $2M or more.

And for Series B, most VCs look for $5M ARR.

What about healthy ARR multiples for Series A and B?

Between Series A, it’s roughly between 20-30x. For Series B, people think 15-20x is a healthy multiple for that stage.

What defines if you’re in the lower multiples or higher multiples?

Of course, every founder wants to be in the higher multiples.

In the lower multiple buckets, say 15-25, you’d rather end up at the 15x multiple range if growing at 2-3x. So solid, good growth, not hypergrowth, impacts your multiple.

If you’re growing fast, like 4x or more, and rounds are competitive with multiple term sheets, you have a very good chance of ending up at the high range of the multiples.

There is a caveat, though…

If the base of the ARR is very low and the multiple is higher, a higher number is coming out of it. If your base is below $1.5-$2M ARR, the multiples are very high simply because the denominator is so small.

Growth vs. Burn — What Do Investors Expect?

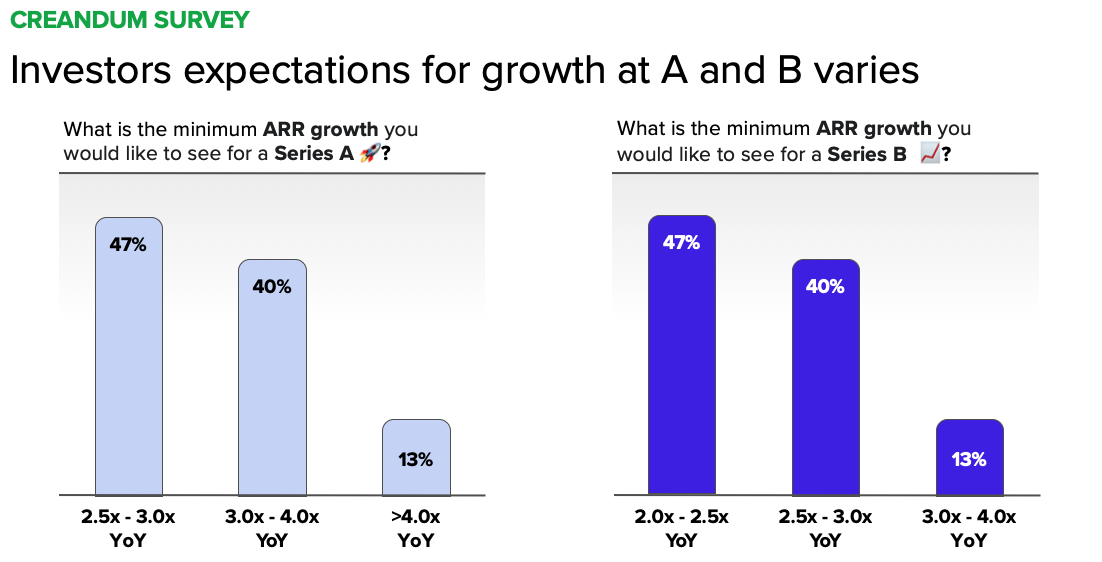

Some good news is that growth expectations have gone slightly down.

Right now, in Series A, it starts between a 2.5-3x minimum growth expectation. Series B starts at 2.5x.

But growth is only seen as very valuable if it’s accompanied by efficiency these days.

So the days of very high growth and burning a ton of money are gone for many companies. Now, efficiency matters, and your burn multiple is an important metric.

What does this mean for Series A and B?

The expectations for Series A are clear, where the burn multiple range is 1.5-3x. That said, expectations are much higher in Series B, and efficiency becomes much more relevant at that stage, where 40% expect a burn multiple between 1 and 1.5 (a great burn multiple), and 53% want to see between 1.5 and 2.

So what should companies prioritize: growth or profitability?

Both.

Growth and burn need to be looked at in combination. High growth gives you a bit more margin for a higher burn multiple, but it still needs to be roughly in line with benchmark expectations.

Prioritization also depends on cash in the bank and when you need to fundraise next.

If you have 3-4 years of runway, it’s OK to go more aggressive in year one. Then, in the year leading up to the fundraise, monitor your burn multiple to meet the metric expectation.

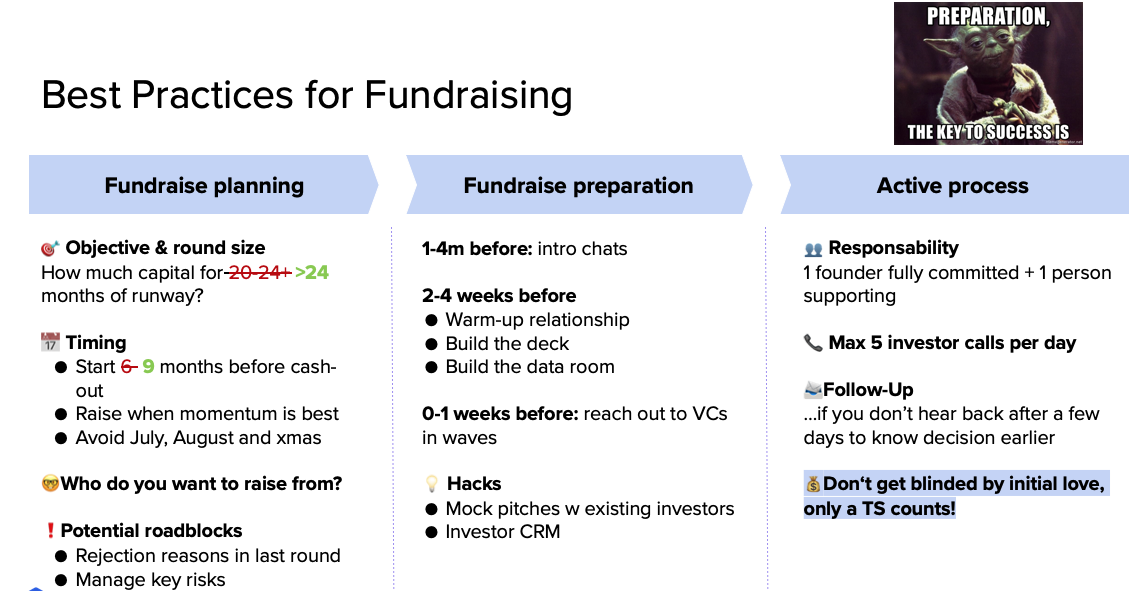

Best Practices For Fundraising

Fundraising is about hitting metrics and expectations. One aspect often overlooked is preparing your fundraise well and thinking strategically about how you fundraise.

How to run a good fundraising process includes:

Planning

- Figure out your goals, how much capital you’ll need for >24 months of runway.

- Figure out timing — Start nine months before cashout, raise when momentum is best, and avoid July, August, and Christmas.

- Figure out who you want to raise from.

- Look for any roadblocks — rejection reasons from the last round and manage key risks.

Preparation

- 1-4 months before — initiate intro chats

- 2-4 weeks out — warm-up relationships, build your deck, and build the data room

- 0-1 week out — reach out to VCs in waves

Some hacks to help with preparations are mock pitches with existing investors so you can gather feedback and investor CRM.

Active Process

- One founder should be fully committed because fundraising takes up a lot of time. They should also have one supporting person.

- Reach out to a maximum of five investors per day. People are worn out at the end of the day, so you want to focus your energy.

- Don’t get blinded by the initial love from a VC. This is their job. Only a term sheet counts!

What does this process look like for a founder in practice?

- Widen your funnel and speak to more funds.

- Take more time and go out there and raise earlier.

- Adjust your valuation expectations.

- Flat and down rounds are happening, so prioritize making a round happen over pushing on valuation.

Key Takeaways

- The market prefers “late” Seed and A rounds with more ARR.

- The average ARR multiple for As is at 25x, for B at 24x, and, at the same time, investors consider 20-30x for Series A and 15-20x for Series B as healthy.

- Growth expectations have gone slightly down, while efficiency expectations have gone up.

- Accumulate enough ARR before raising, prepare your fundraising well, plan more time, speak to more funds, and adjust your valuation expectations.