So if you are outside of fintech and banking, you may not have heard of nCino. But if you’re in the space, it’s a big player.

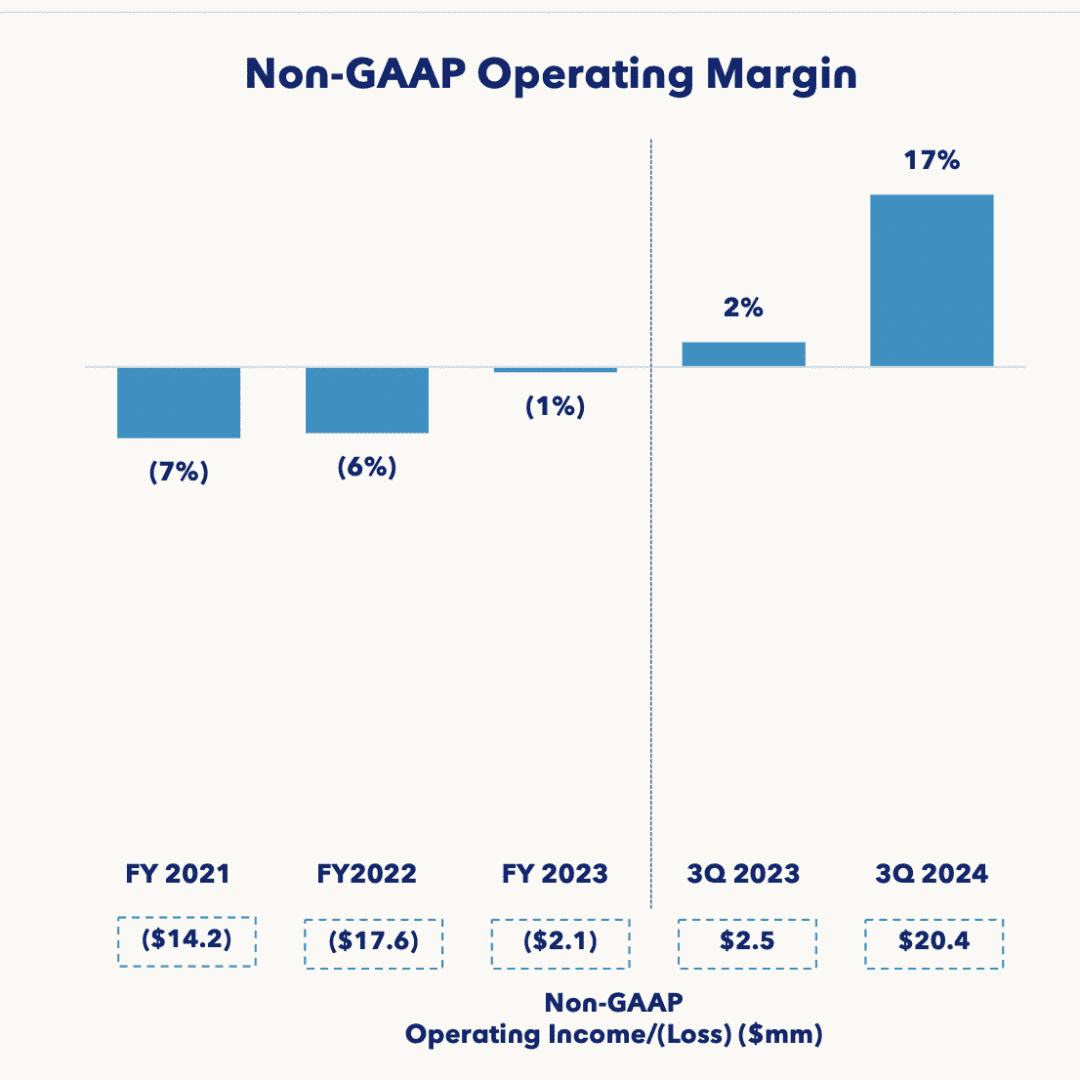

They’re at almost $500m in ARR, with 1,850 customers, now growing a modest but steady 19% and they have gotten pretty efficient, like most other public SaaS and Cloud leaders. Non-GAAP operating margins are now +17%.

They’ve made a few clever acquistions, but haven’t been immune to macro impacts. A year ago, growth was at 48%. Today it’s at 19%. Wall Street seems OK with the change however, as nCino is still valued at $3.3 Billon. Not a huge ARR multiple, but just above the 5x-6x average today.

Let’s dig in.

5 Interesting Learnings:

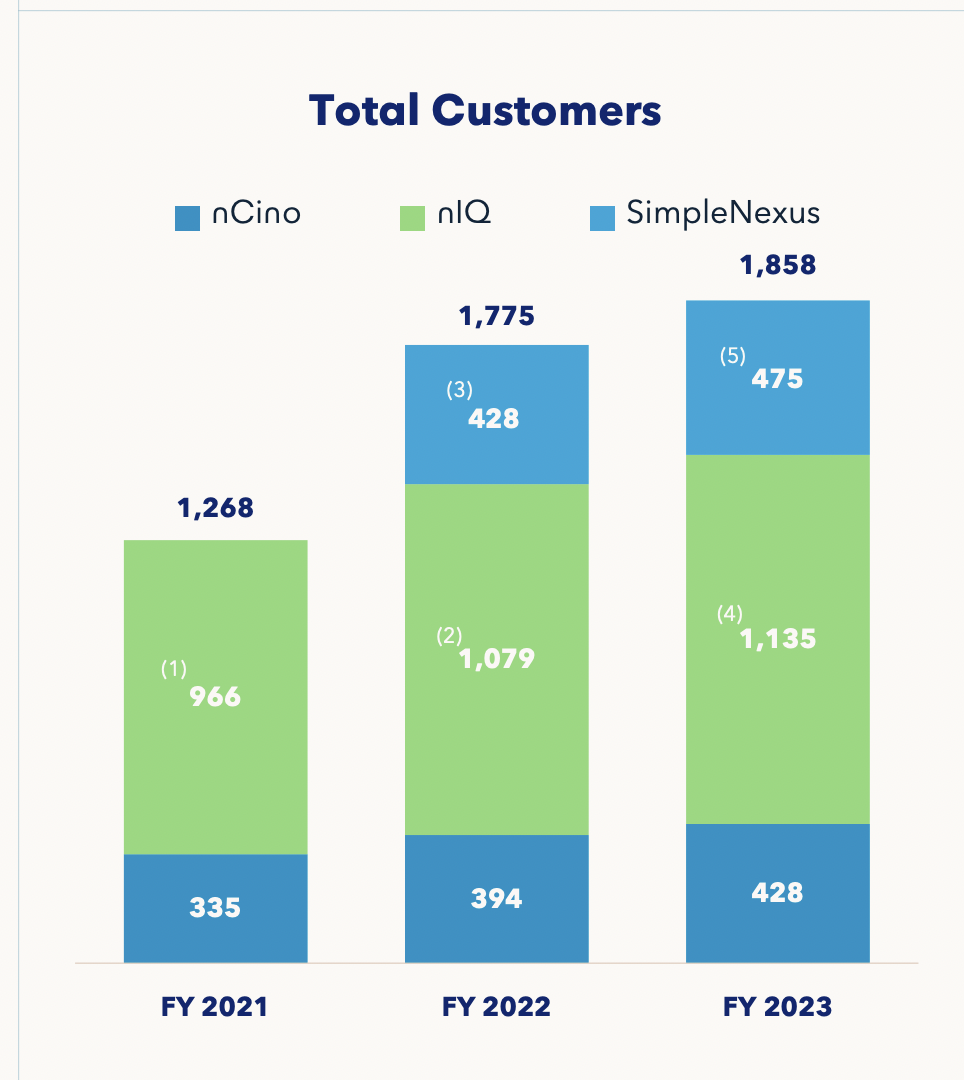

#1. Customer Count Growth Driven in Large Part by Acquisitions

There are only so many big banks to sell to, and nCino’s core customer count has grow slowly but steadily from 335 in 2021 to 428 today. But new products from acquisition have fueled the overall customer count growth to 1,858.

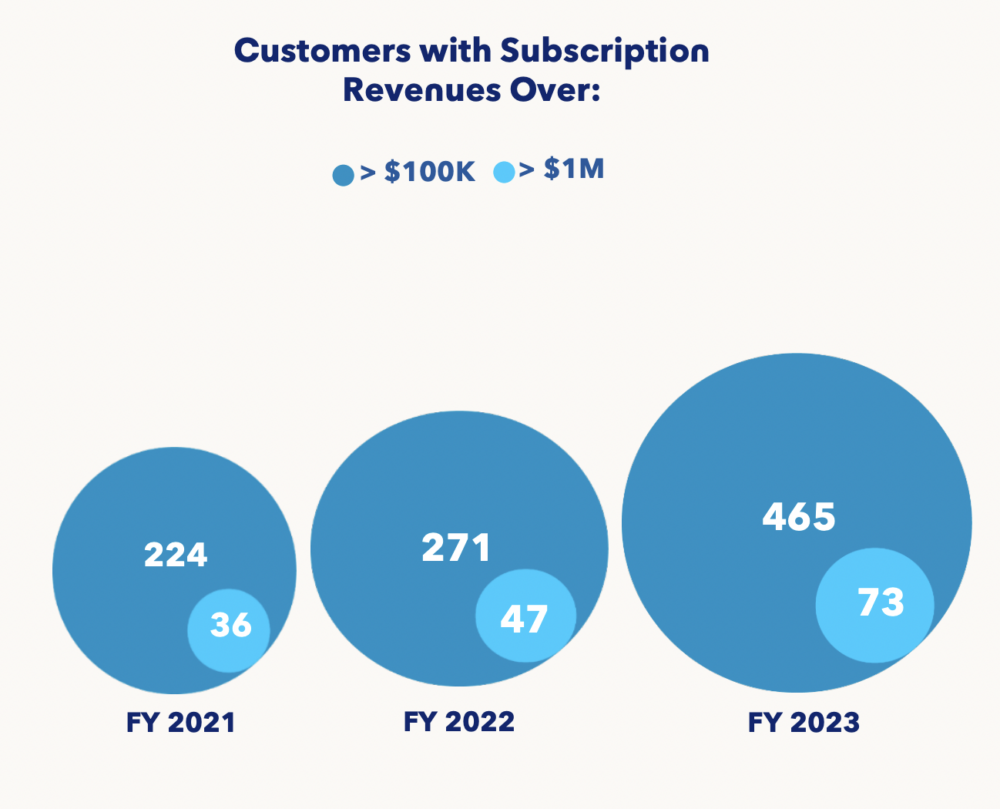

#2. $1M+ Customers Are Key to the Growth Engine

With 73 $1m+ customers. the Big Fish are key to nCino’s slow-but-steady growth.

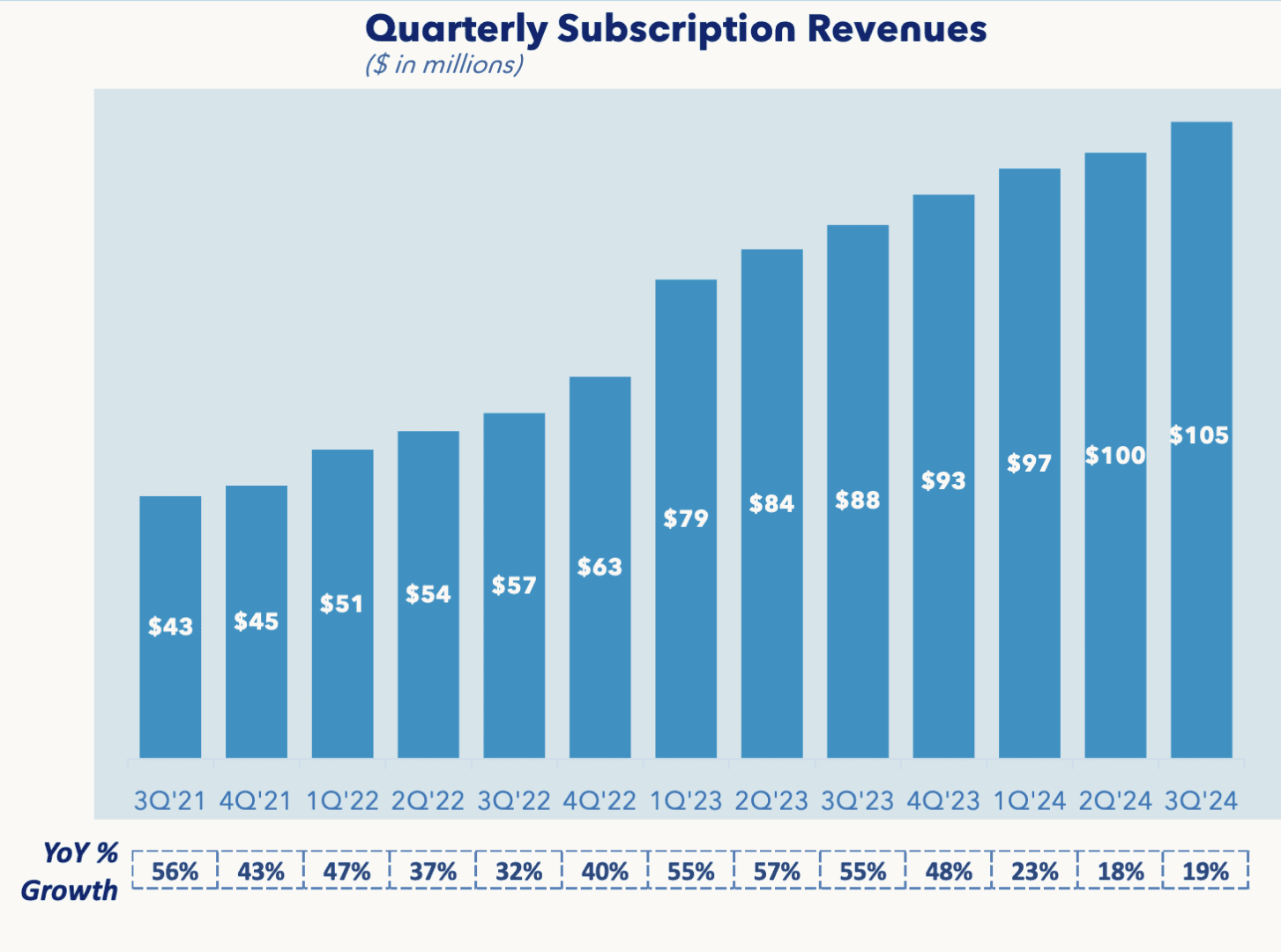

#3. Revenue Growth Has Materially Slowed, From 48% a Year Ago to 19% Today.

In just one year, nCino went from high growth to mature growth. They’re not alone there, but boy it’s a big change in just 12 months.

#4. Gotten Much, Much More Efficient. But Mainly By Cutting.

nCino has flipped the efficiency switch like many other public SaaS and Cloud companies and gotten to positive operating margins (and cash flow) in just 1 year. Impressively so. But it’s done it not by growing, but by cutting almost everywhere, as we’ll see in the next point.

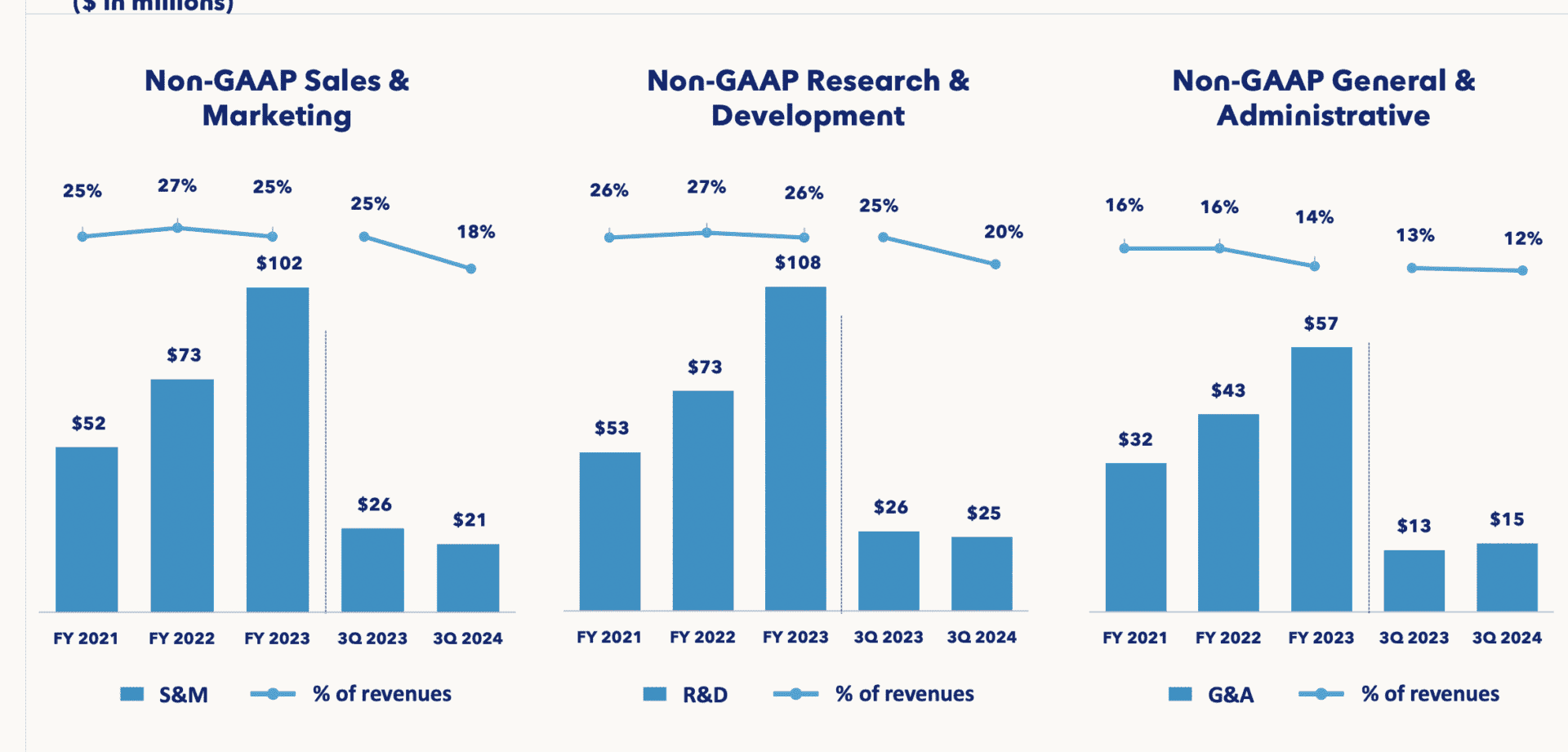

#5. Big Cuts in Sales & Marketing To Get Efficient

Getting so efficient, so quickly didn’t come from just holding the line on expenses. It came from big cuts, especially in sales & marketing, which in just 1 year went from 26% of revenues to 21%. Engineering also took a smaller hit as well.

And a few other interesting learnings:

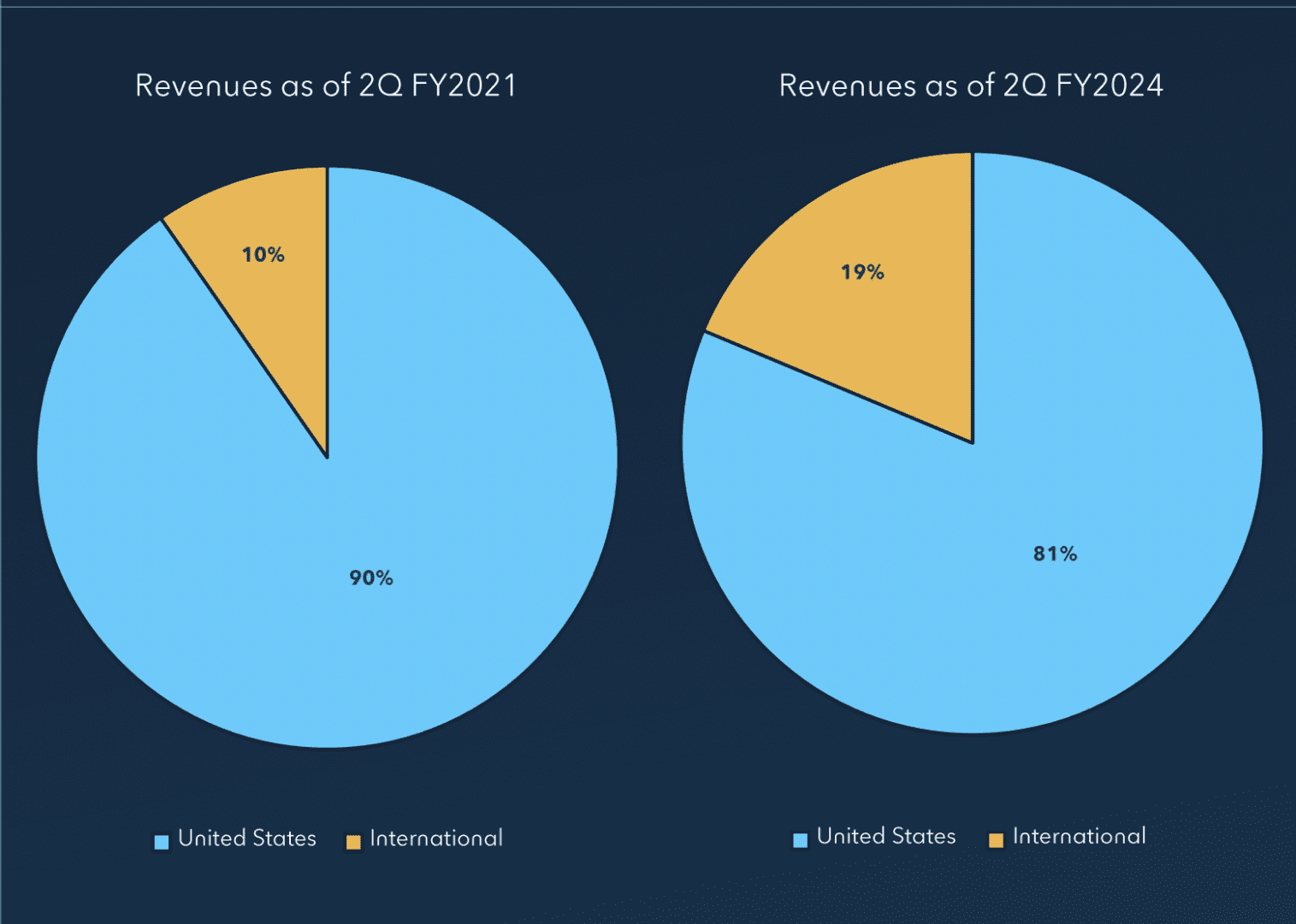

#6. International Customers Are Key to Grow at Scale

SaaS in regulated industries and fintech is often slower to go international than pure B2B SaaS which is simple to “grab and go” across international lines. But nCino has leaned in here and it’s worked. In 2021, just 10% of their revenue was from outside the U.S. Today, almost 20% of revenues come from international.

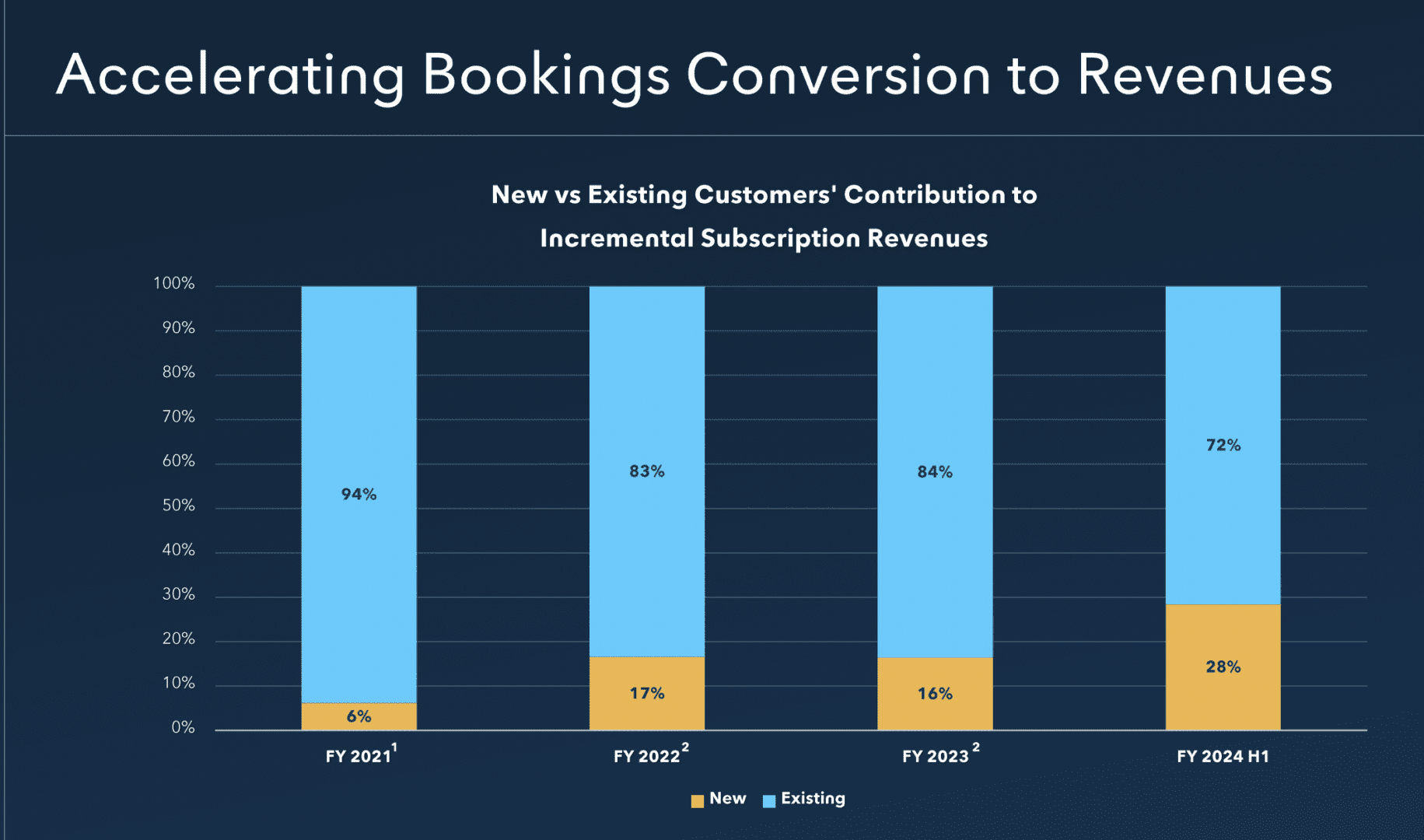

#7. 72% of New Bookings Come From Existing Customers

This is an interesting chart we don’t usually see so precisely — what % of revenue is from new customers vs. the base. 72% of nCino’s revenue is from existing customers.

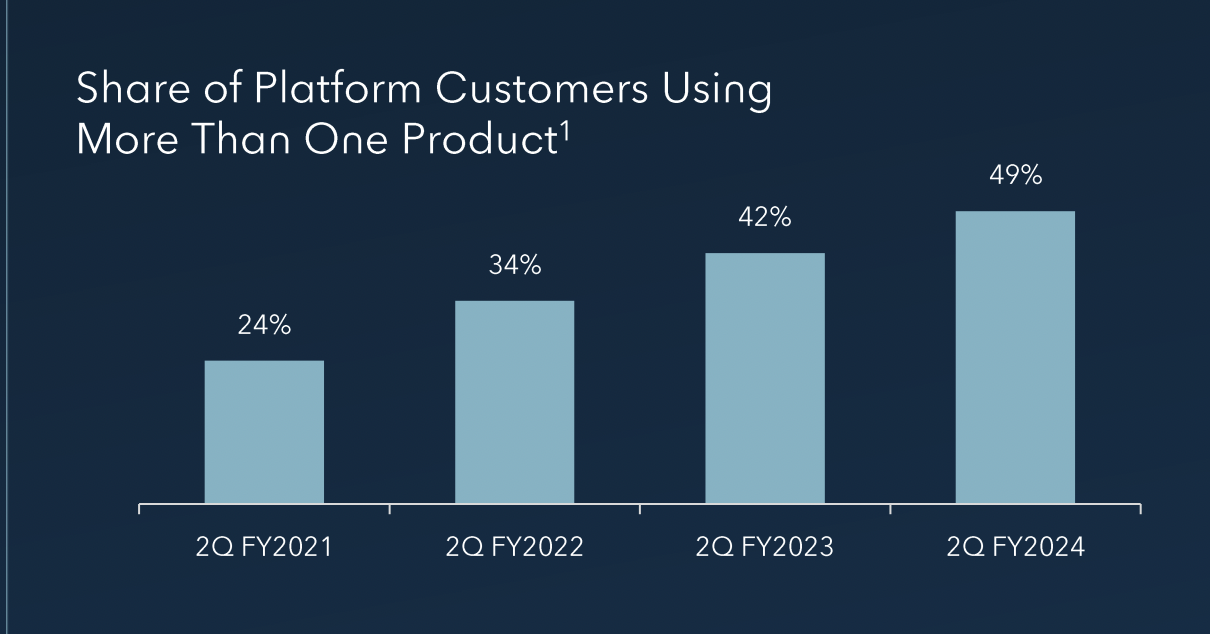

#8. 49% of Customers Use 2 Or More nCino Products

Once again, you just gotta be multiproduct at scale.

A lot to learn!

nCino in just 12-18 months has gone from a high-growth, acquisition-fueled leader to a very mature, slower-growth leader looking to maximize profits and efficiency and hit the Rule of 40.

So, so, so much change.

It’s not just you. It’s everywhere.