SaaS buying has changed. As buyers grapple with expanding technology, higher prices, and a need for efficiency, SaaS companies need to deliver what their audience is looking for to win in the market.

Vendr SaaS Consultant Katie Oates and Vendr Vice President of Customer Team Jeff Swank share eye-opening data and insights into buyer trends from 2023. They review the changing market, buyer trends, and tips for the road ahead.

SaaS Market Snapshot

In Q1 of 2023, Vendr gathered data on SaaS Spending and yielded some pretty interesting results.

Completed Deal Counts for Software Types

This list reveals the types of software with the highest deal counts across Q1 2023

- CRM

- Cybersecurity

- Project Management

- Application Performance Monitoring

- Digital Analytics

- Sales Intelligence

- Business Intelligence Platform

- Cloud Data Integration

- e-Signature

- Sales Engagement

- Video Conferencing

- Version Control Hosting

- Business Communication

- Password Manager

- Cloud Identity and Access Management

Oates breaks down this list: “In Q1, our customers purchased over a thousand different SaaS products, and as you can see, CRM tools are the clear leader with the most deals. Why is this? Well, they’re sticky.” Software that is difficult or time-consuming to remove is more likely to be purchased and renewed.

Further, mission-critical solutions top the list as well. Oates explains, “Software that supports critical infrastructure will continue to be purchased and renewed, year-over-year.” The bottom Line? Businesses spend big money on tools they believe are indispensable to their operations and success.

Top-Purchased Software Categories

This list consists of the top three software categories purchased in Q1 2023

- Sales and Revenue

- CyberSecurity

- Collaboration

Trending Products

This list shows the top three trending new products that companies are purchasing in 2023

- Data Security

- Compliance

- AI-Powered

There is a trend in brand-new software investments taking over the market. Many net-new purchases are for data security, compliance, risk management, and AI-powered tools. So, what’s driving these purchasing trends?

Data Security: Oates reveals that “Costs have risen for cyber attacks by 80% since 2021, and the frequency of those attacks continues to rise. This has exposed an urgent need for improved cybersecurity measures so companies can mitigate risks and protect themselves against evolving threats.”

Compliance: The cost of GDPR compliance has totaled around $9B globally since its introduction. As the average costs of data breaches rise, protections against incidents and costly fall-outs are vital for businesses.

AI-Powered Tools: AI-related purchases in Q1: Made up 41% of new investments in Q1. Oates explains, “Companies are recognizing the need to incorporate AI into their operations to gain efficiencies.”

weakest link.

The Year of the Price Hike

In 2023, companies face a hard reality –– SaaS prices are rising. There has been a 29% increase in ACV in Q1 of 2023 compared to Q1 of 2021. Swank says, “In 2023, we predicted this would be the year of the price hike, and here we are. Contract values are up nearly 30% from two years ago, representing massive growth in company SaaS spend, which is already a top five line item.”

SaaS prices are increasing — 54% of SaaS companies will raise their price this year. Outside obvious contributing factors like climate and inflation, companies face higher expenses for salaries, benefits, and operational costs. But there is even more nuance to the reason behind the price hike.

Why are SaaS Prices Increasing?

- Disrupted Funding. Less investment and reduced funding have caused serious market ripple effects. Swank says, “This year, global funding saw a 53% decline. This has put immense pressure on companies to extend their runway. As a result, we’re seeing SaaS companies develop new pricing strategies.” To mitigate the strain, companies are doing things like raising prices for legacy customers, enacting stricter auto-renew policies, and focusing on multi-year deals.

- Demand for Sophistication and Innovation. Customers want something that keeps up with the ever-increasing practical needs and evolving tech landscape. This means higher engineering costs for companies and, so, higher software prices.

Sales & Marketing vs. Research & Development: Companies realize they’ve previously spent too much on sales and marketing and may want to shift the focus to research and development. However, it’s not as simple as moving the money; since budgets are getting bigger, sales teams must support those budgets.

How Your Customers Are Purchasing SaaS

Increased pricing is causing buyers to be more critical of their tech stack and more mindful of what they buy. They must closely monitor their SaaS spending to cut costs and boost efficiency. Firstly, companies are beginning to label their mission-critical SaaS that generates high ROI or efficiencies. Higher ACV, non-critical SaaS will be the first to go.

Further, companies are trying to figure out how to consolidate solutions to reduce SaaS sprawl. They want to maximize dollar value and limit contracts to renew. They will work with fewer vendors to meet this need.

How We Buy and Sell Software Will Change –– What to Expect

So, moving forward, what can software companies expect from buyers on the market?

Relationships Matter Less, Product Matters More: “As the SaaS landscape continues to grow, it’s becoming easier, actually, to find the best products, evaluate and implement them. So the relationship matters a little less. We believe the most successful companies will aim to drive growth by investing more in R&D, engineering, AI, strategic integrations, and becoming more than just a point solution.” – Swank.

The CFO is Your New Decision-Maker: Most software purchases now need CFO buy-in. Your sales team must loop in the CFO as early as possible, and a business case is likely required to show how quickly ROI and efficiencies can be met.

The Era of Data Transparency: Buyers won’t just make a purchase decision on who they spoke to first and how well the demo went. Pricing and sentiment data will be readily available, so buyers can easily compare products: Competitive bids will become the new norm. Sellers who will thrive in this era are the ones who will lean into this transparency.

The Best Product Wins: Ultimately, the winner in this new era will be the person with the best product. To prepare for the future of buying trends, take a hard look at your product and ask:

- Is your product sticky?

- Is it mission-critical?

- Does it help your customers reduce costs?

- Does it introduce efficiencies that provide a path for less hiring?

- Is your solution all-in-one, or does it consolidate various critical business needs?

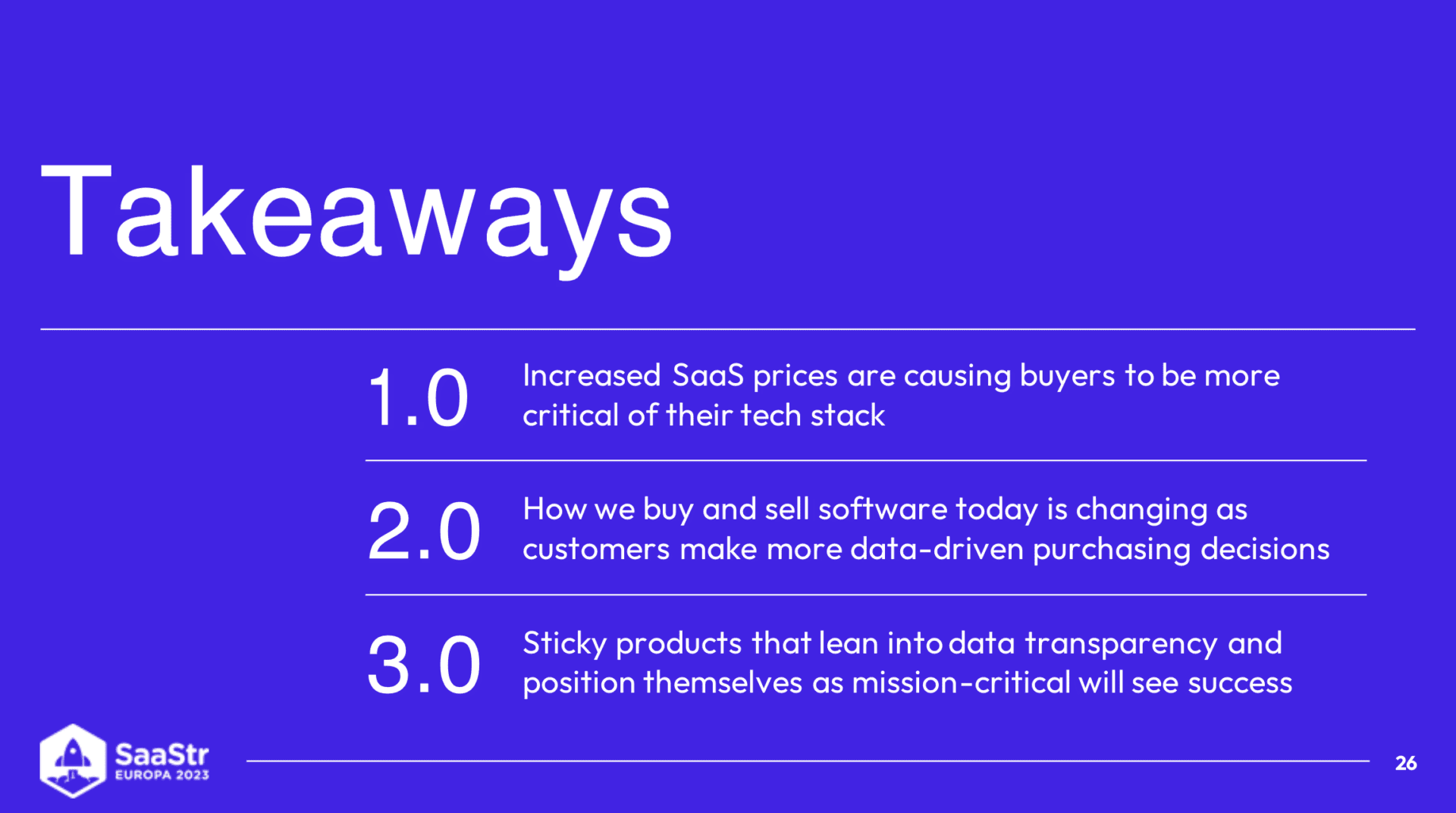

Key Takeaways

- Businesses are holding a microscope up to their tech stack and cutting non-essentials. Mission-critical platforms are the top performers on the market.

- In 2023, prices are increasing for SaaS solutions. Businesses want to reduce tech sprawl, see ROI-generating solutions, and increase efficiencies with their software.

- CFOs are the new decision-makers. Tailor your sales strategies to loop in the CFO as early in the process as possible and demonstrate the business case for your solution.

- The best product will win. Be sure you are investing in R&D and hiring strong engineering teams.