So first a caveat: I know just enough about financial accounting to be dangerous. Second caveat: I’m way, way oversimplifying things.

But with that out of the way, let’s talk just enough about financial accounting to explain why Big Tech Companies both acquire smaller ones — and do corporate VC investment.

Because in the short-term, it often costs basically close to nothing to acquire a smaller startup with cash on hand, or do a corporate VC investment.

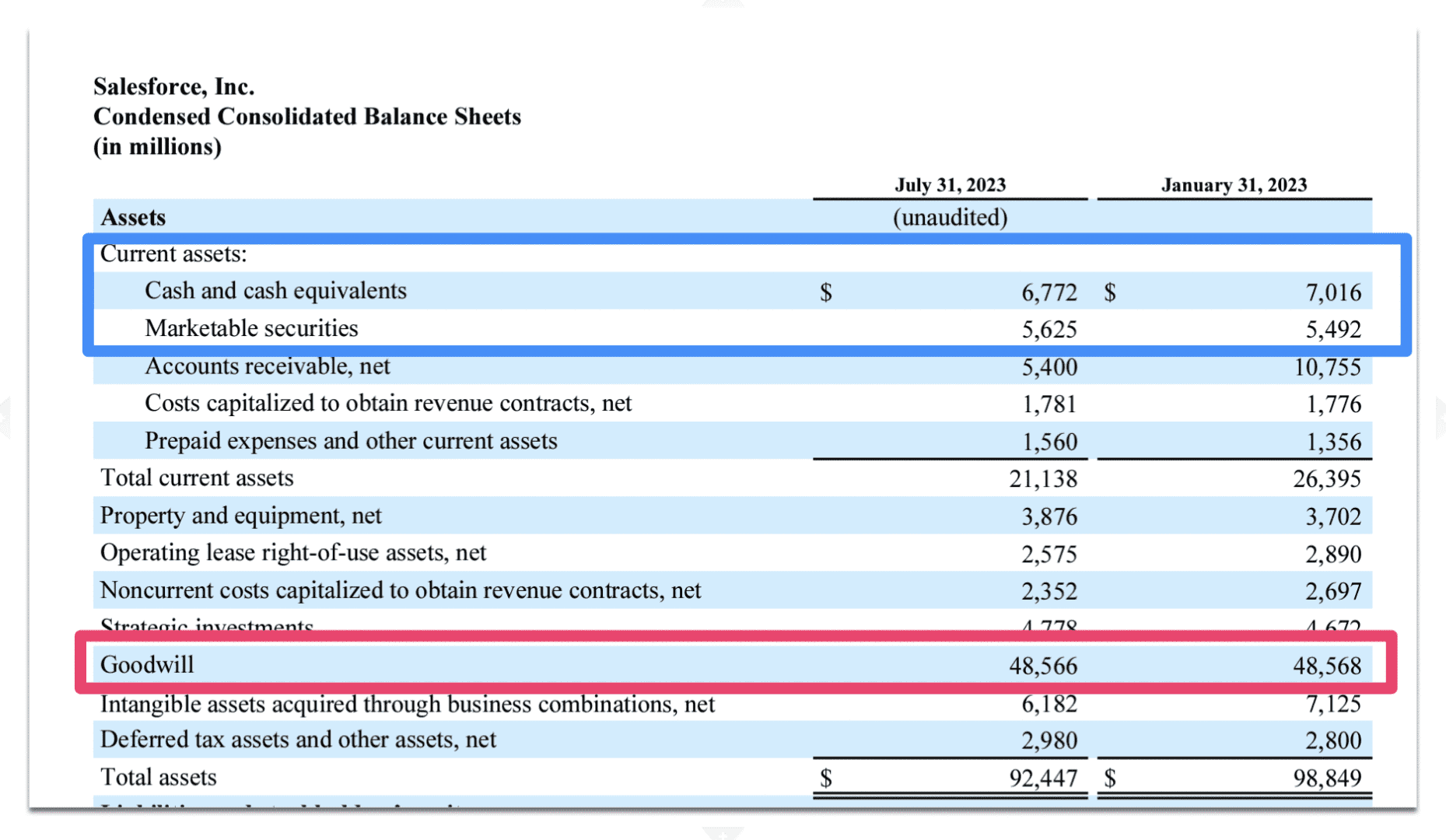

What do I mean? Let’s take Salesforce as an example. It has basically $12.5 Billion in cash in the bank (cash, cash equivalents, and marketable securities) — and much more to come in accounts receivable, another $10.75 Billion:

But here’s the thing: they can’t do that much with that $12.5+ Billion cash. For most uses, it’s sort of trapped there on the balance sheet.

Why not? Salesforce has committed to getting to 30% operating margins, i.e. profits. And every dollar of this $12.5 + $10 Billion that it spends on salaries, on SKOs, on marketing, on engineering, on bonuses, etc. cuts into those margins.

But .. but … investments don’t. At least, not unless the value declines. So if Salesforce invests a few billion in AI startups, and those values at least don’t go down — there’s essentially no cost to Salesforce. Cash goes down, yes. But the balance sheet basically stays the same if the value stays the same.

Similarly, acquisitions don’t cost that much, especially if they are done with cash by a BigCo with a ton of cash (stock deals without buybacks lead to dilution, and thus, lower earnings). A $1B acquisition sounds like a lot, and it is. But if it’s paid with cash, again first there is no dilution, at least not directly. And second, a lot of that cash can simply be converted to other items on the balance sheet, from Goodwill (see that big, big $48 Billion number above) to other asset types. If the acquisition fails years down the road, that Goodwill may need to be written off, and impact earnings for a quarter as a one-time expense. But even there, it’s years later, and a one-off expense. The headcount and other ongoing operating costs do add to expenses and hit earnings, however. That’s why in M&A, acquirers can be oddly more sensitive in many ways to people costs than deal costs.

So no BigCo wants to overpay for acquisitions or corporate VC investments. But just understand they are playing a different game than others. If the value doesn’t go down, and there’s a ton of cash on the balance sheet to fund these investments — the effective financial cost can be low or even zero. There’s still only so much cash to go around, but M&A and corporate VC are one of the few ways to use it without harming earnings.

But hiring 100 engineers? That hits your earnings and profitability immediately.