So one thing that has exploded in SaaS in the past decade is the role of Private Equity buying both public SaaS companies (to take them private, “fix” some metrics, and IPO or sell them again), and generally later-stage private SaaS companies. E.g., Vista bought leaders like Pipedrive, Gainsight, Salesloft and so many others for $1B+ or more.

They are generally looking for good but not great deals. By that I mean, too good a deal on paper at least … then likely the SaaS company isn’t truly a break-out leader. PE wants to invest in leaders, if not necessarily always #1 in a category. Products that are as close to an annuity as possible, that are amenable to efficiency gains.

So what do they pay on average? Well, certainly it exploded in 2021, in my portfolio at least, if perhaps not as dramatically as in the public markets. The startups I invested in that were acquired by PE in the 2020-2021 Boom were acquired for 8x in one case, 12x in another, and 15x in a third. The prices would be lower today for the latter two I suspect.

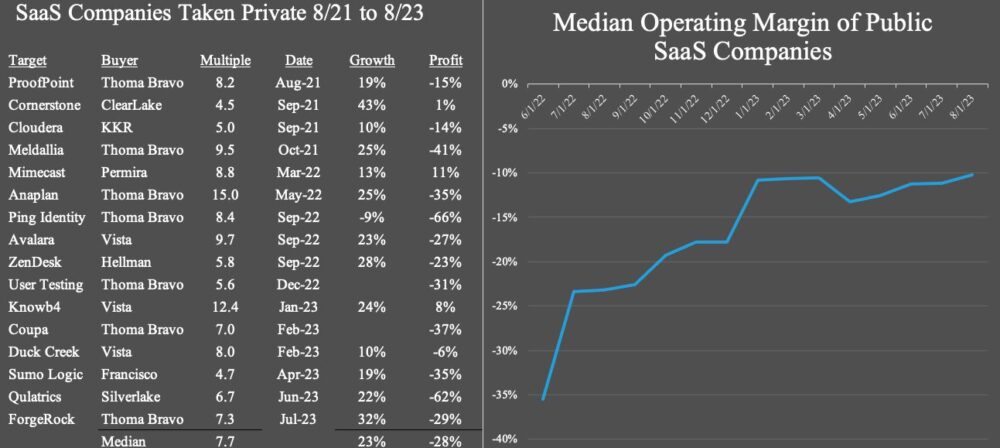

Todd Gardner took a look at a series of public “take private” deals from 8/21 to 8/23, spanning the Boom and the Reset. What did he find?

7.7x ARR was the Median acquisition price in a “take private deal”.

Interestingly, it’s not all that different post-Boom and pre-Boom, as you can see above. But the companies were far more efficient.

Bear in mind almost all PE “take private” deals have to be at a premium to the publicly trading price to get shareholders to agree to do them. So the underlying SaaS companies were trading around 5x-6x or so on average. And also while many of the above names had seen growth slow at scale, bear in mind they are all awfully good SaaS companies. You might be worth less 😉

But 7.7x is interesting to see. It’s what I’ve seen several PE deals happen at recently, and several offers. In fact, just a few weeks back, I had a portfolio company get acquired by PE for almost this exact multiple.

As you cross $20m ARR and become attractive to PE firms (you’ll get e-mails calls, if nothing else), it’s at least a framework to think about what you might be worth to a PE firm.

7.7x.

A related post here: