So it may surprise some of you to learn that it’s not >that< hard to raise venture capital after a rough patch — if things reaccelerate. In fact, it’s pretty common. VCs know the vast majority of startups have a tougher time or two.

But … but … VCs need some proof you are back to growth. They need at least 3 months of continuous, strong growth.

So this is a super simple post, but I think an important one. VCs know sometimes, something changes. A new great VP. A change in the market. An amazing feature. Sometimes, it’s just timing. Sometimes, great startups are too early to a market. Procore didn’t really take off until the iPad did. UiPath took 10 years to get to $1m ARR … and then it exploded to $1B in ARR. It was early to automation.

3 months though, is the minimum. VCs really will fund someone with 12 months of low growth. But then you need proof it’s changed. 3 months — minimum. 4 is even better.

Get 3-4 great months of growth under your belt, then go raise that VC round.

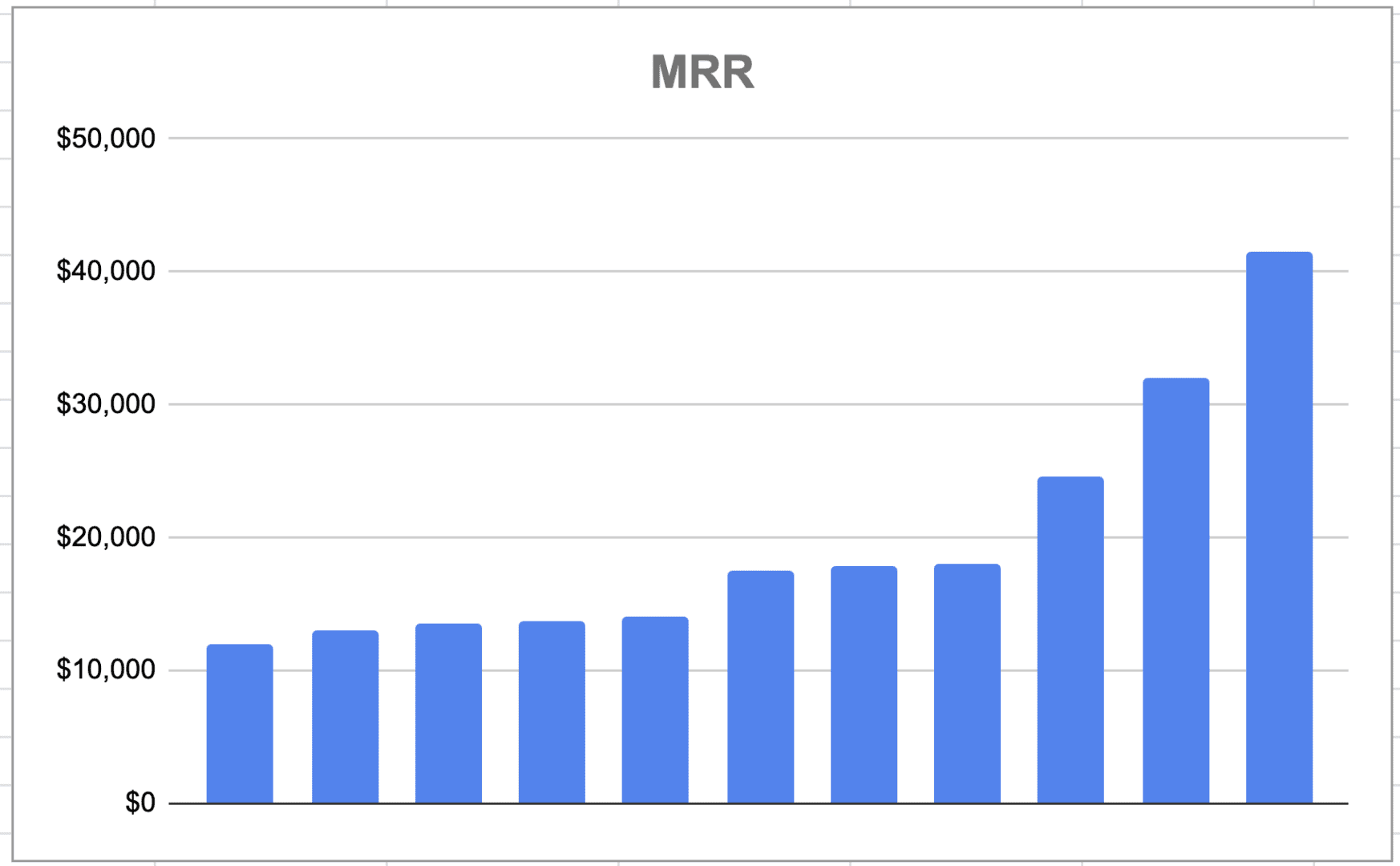

Look at the chart above. You’ll see two stories in one simple chart.

The first, of a startup that got a handful of customers,. but then struggled. And the second, of a startup that then finally made it all click. That’s now leaving the station.

That’s the one earlier stage investors want to bet on.

A related post here: