So one of our recent themes on SaaStr is that while things are still tougher for almost everyone that the go-go days of 2021, in at least some ways, they seem to have bounced off the bottom and are at least getting easier than before:

- Top Cloud and SaaS stocks are up 31% this year. Now they still are way down from their 2021 highs. But +31% is real.

- Top Cloud and SaaS stocks are trading at 15x ARR or more. And top quartile is approaching 10x ARR. Now this is nothing like the 2021 days. Nothing. But it’s way off the lows of earlier in the year.

- Inflation appears to be down, and interest rates have mostly peaked. We’re all macro experts in SaaS now! But inflation does seem to be way down in the U.S. at least, and interest rates appear close to the maximum.

- We’ll start to lap tougher times. Growth has slowed for almost all Cloud and SaaS leaders this year, but that also makes maintaining and even beating that growth next year much easier.

- Almost everyone has gotten much more efficient. The top startups all are more efficient and in many cases break-even. This will make them much more attractive in the current markets. Everyone got into better shape, with better unit economics, the past 12 months.

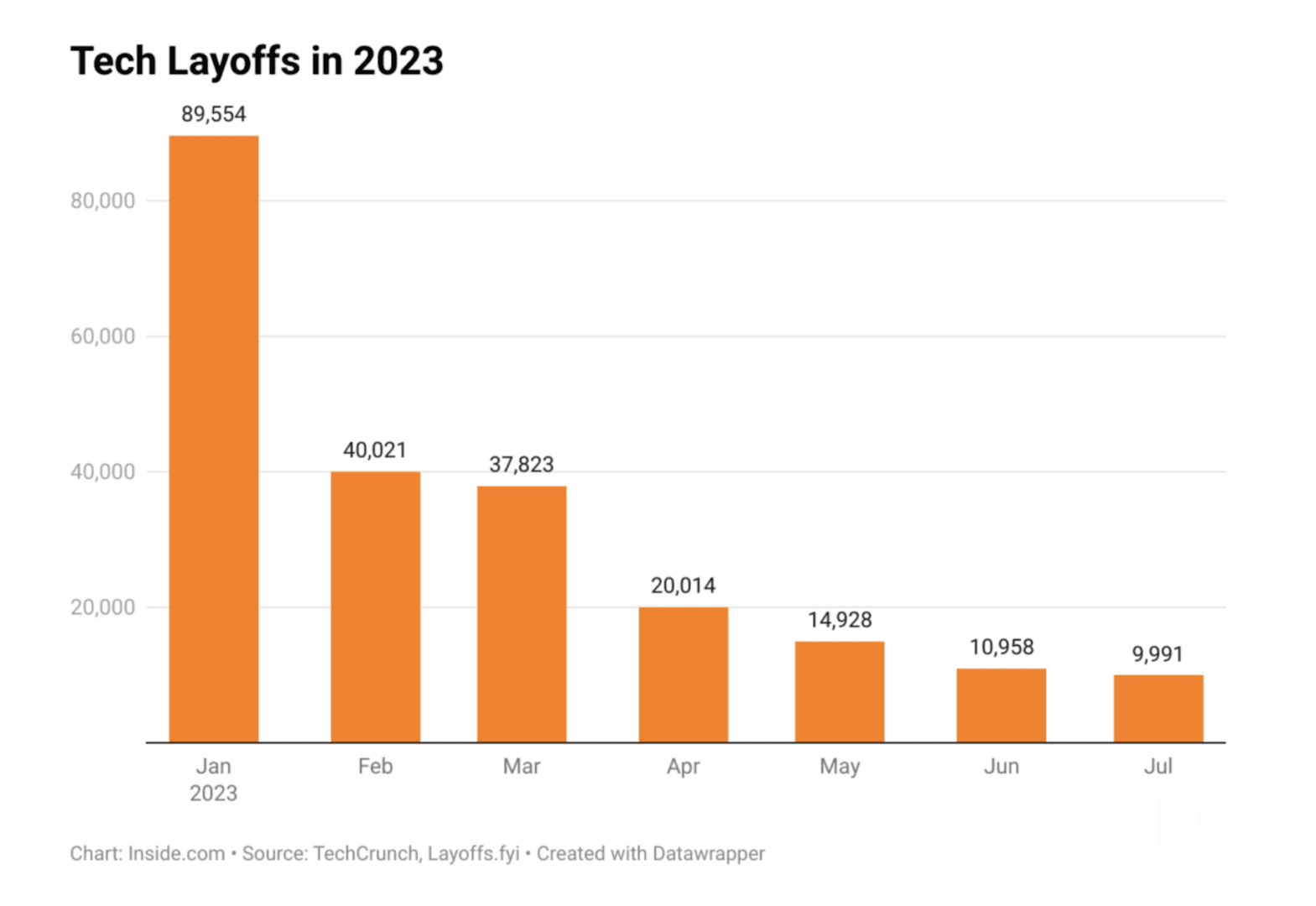

- Layoffs are way down in tech. They’re at a 7 month low.

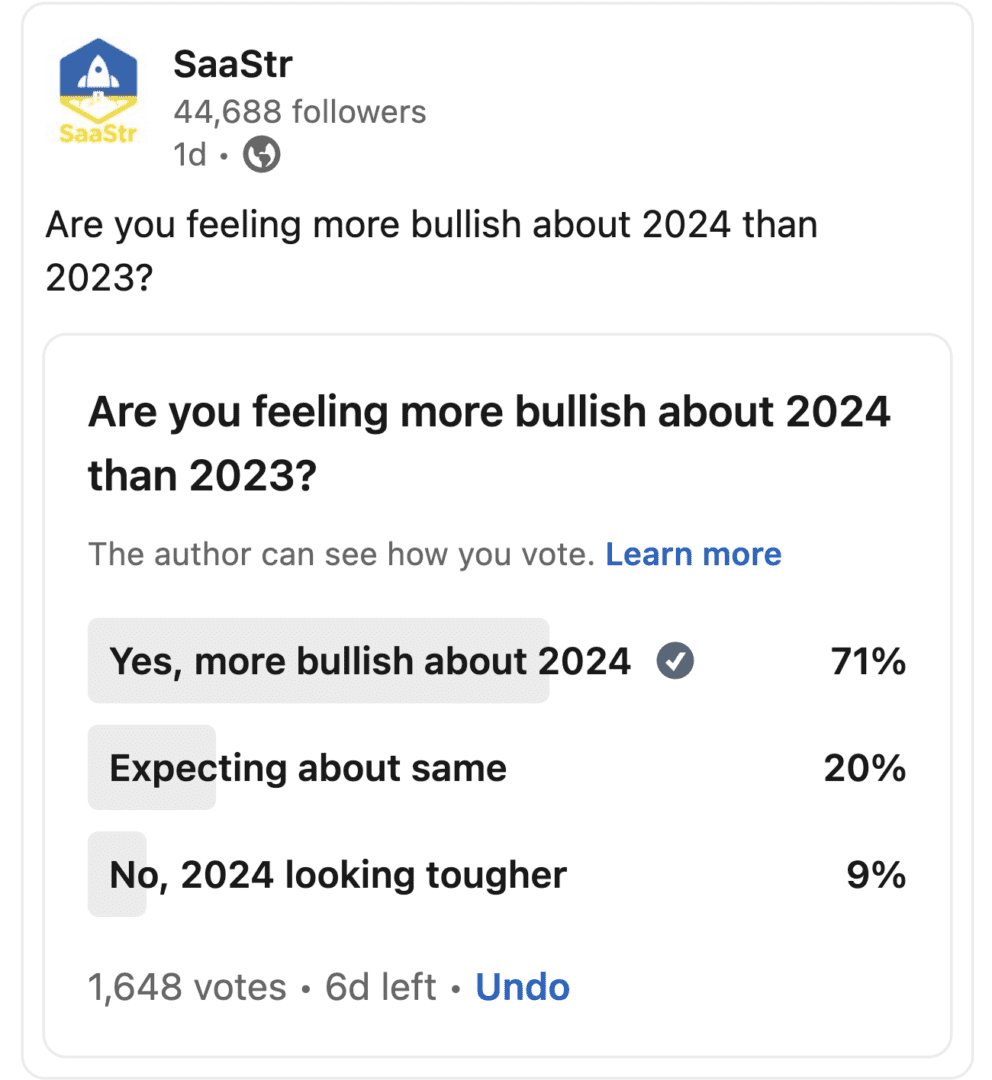

Our latest SaaStr survey confirms that’s how you feel too. ~1,700 of you responded, and a full 71% are feeling more bullish about 2024 than 2023.

And only 9% think things will be tougher:

It’s a good sign.

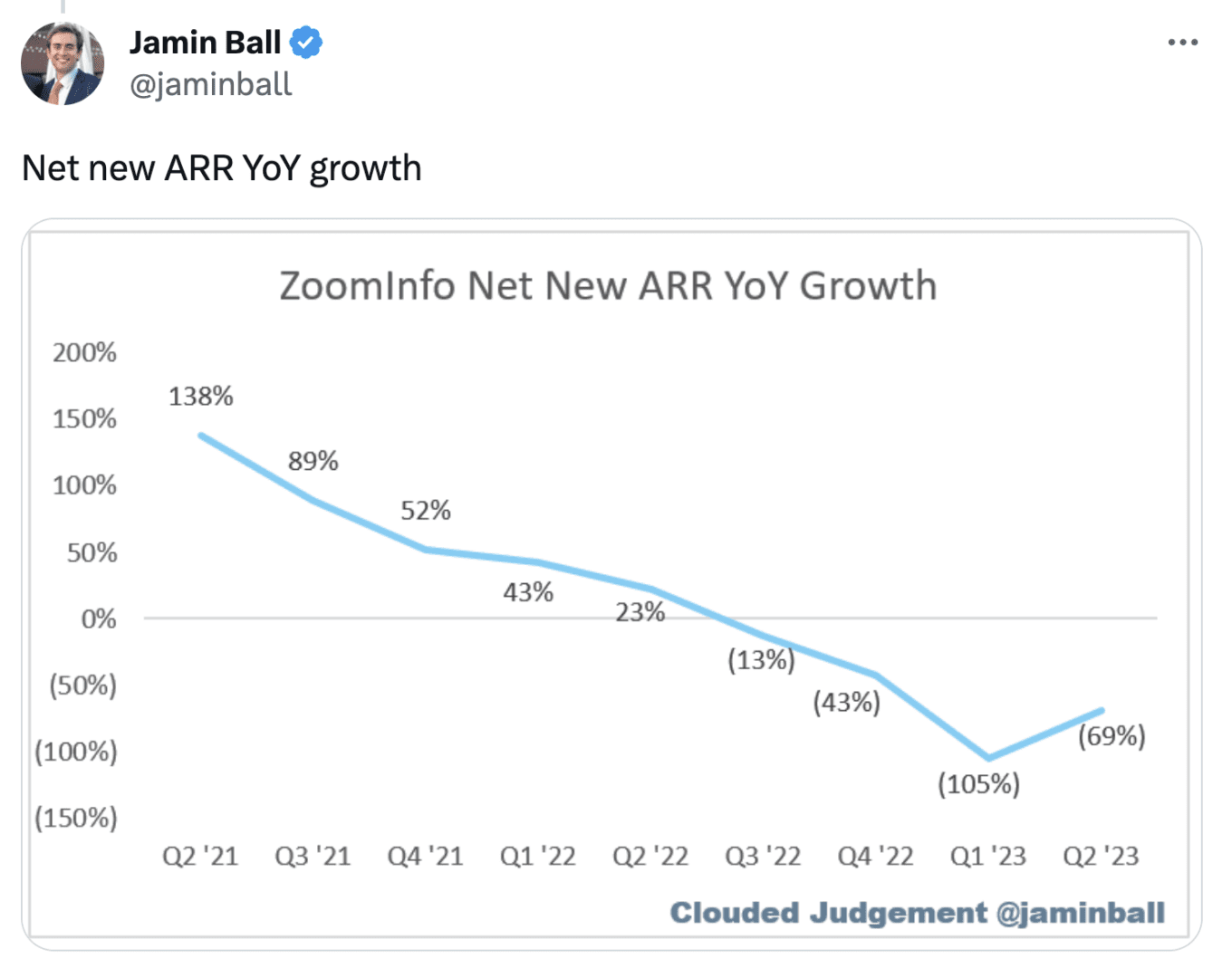

I also found this recent chart from Jamin Ball on ZoomInfo’s latest numbers interesting, since ZoomInfo is one of the top bellwethers in the sales and marketing space.

Yes, things are tougher for ZoomInfo now than in the Go-Go Days. But they are less tough than last quarter:

More here:

(Gonna Get Better image from here)