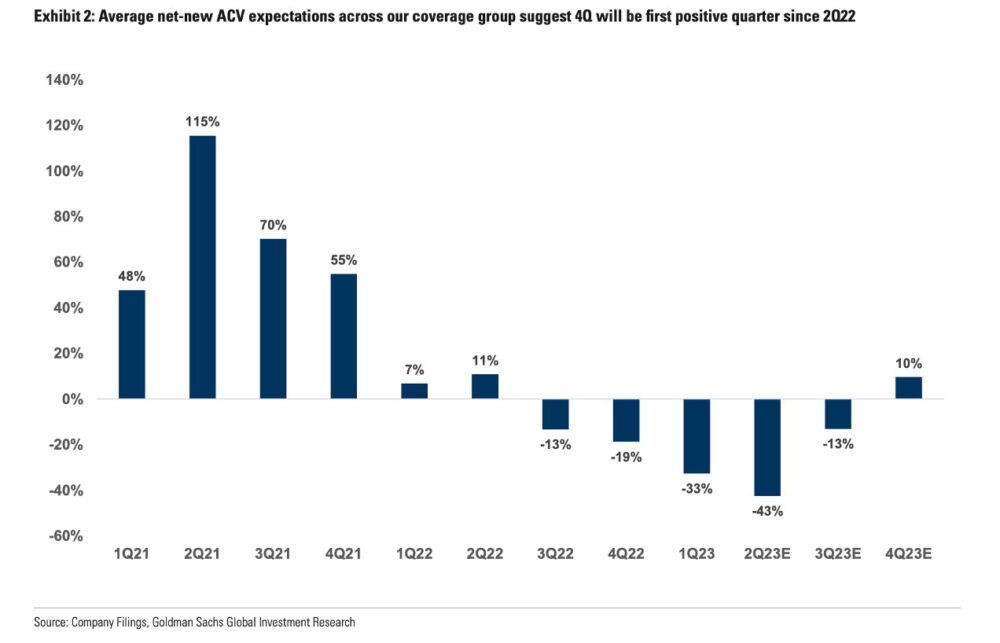

So don’t look now, but things are getting a smidge better in SaaS. It’s still tough out there for many, and selling is challenging. Goldman Sachs is now predicting the first re-acceleration in ACVs in years:

AWS, while still growing slower than Azure and Google Cloud, in just this last quarter saw a pick-up in new workloads:

Takeaway from AWS: Tailwinds of new workloads starting to overtake headwinds of optimizations.

AI will only accentuate this. I spoke with a large enterprise recently who said "I've been surprised how quickly our spend on AI workloads has eaten into our optimization savings"

— Jamin Ball (@jaminball) August 3, 2023

And:

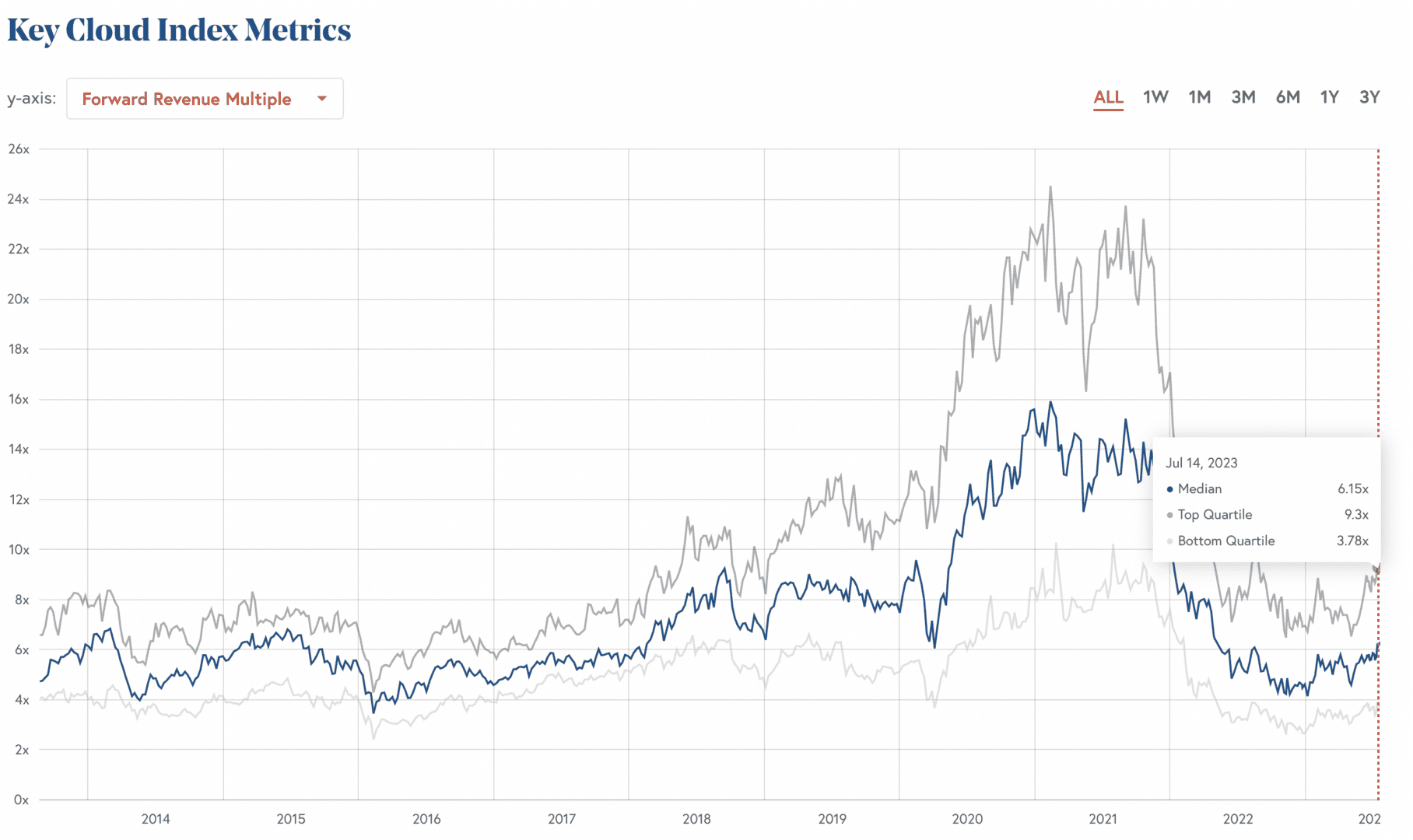

- Top Cloud and SaaS stocks are up 31% this year. Now they still are way down from their 2021 highs. But +31% is real.

- Top Cloud and SaaS stocks are trading at 15x ARR or more. And top quartile is approaching 10x ARR. Now this is nothing like the 2021 days. Nothing. But it’s way off the lows of earlier in the year.

- Inflation appears to be down, and interest rates have mostly peaked. We’re all macro experts in SaaS now! But inflation does seem to be way down in the U.S. at least, and interest rates appear close to the maximum.

- We’ll start to lap tougher times. Growth has slowed for almost all Cloud and SaaS leaders this year, but that also makes maintaining and even beating that growth next year much easier.

- Almost everyone has gotten much more efficient. The top startups all are more efficient and in many cases break-even. This will make them much more attractive in the current markets. Everyone got into better shape the past 12 months.

- And … there are a lot of really, really good SaaS companies ready to IPO. Let’s dig in there.

The bar for a good SaaS IPO is roughly $200m ARR, growing 30% or more, and hitting “The Rule of 40” — i.e., being pretty darn efficient if growing isn’t epic.

Just a few candidates:

- Databricks at $1B+ ARR (!)

- Gusto at $500m+ ARR

- Klaviyyo at $500m+ ARR

- Egynte at $200m ARR

- Gainsight at $200m ARR

- Algolia at ~$200m ARR

- Talkdesk at $200m+ AAR

- Greenhouse at ~$200m ARR

- Dataiku at ~$200m ARR

- Checkr at $200m+ ARR

- Rippling at $200m+ ARR

- Deel at $200m+ ARR

- Brex at $200m+ ARR

- Navar at $200m+ ARR

- Stripe at … a lot of ARR

- and the list goes on and on. That’s just a sample.

It’s really just stunning how many really, really good SaaS companies are at $200m+ ARR. Some have had harder times the past 18 months than others, but all are more efficient.

I suspect a ton will IPO in 2H’24. The floodgates will open, and everyone will go out. And it will really feel like Good Times All Over Again. Why not even faster? Why not 2023? It’s just too fast. Best case, you can IPO in 6 months. And you also need a few good ones to “go out” first to get the market excited. A Stripe and a Databricks doing strong IPOs first, for example, would get the markets excited again.

So the flood of strong SaaS IPOs is likely to not really kick off until later in 2024.

When will the IPO window open again?

What will be the catalyst of it’s opening?

🔥 episode with @jasonlk coming next week! @altcap @rabois @bgurley love your thoughts and if you agree with 👇 pic.twitter.com/8DR0f5FqlW

— Harry Stebbings (@HarryStebbings) August 4, 2023

And times will be good again — except different. We’ll never be able to spend the way we spend in 2021. And multiples and market caps will be lower. Trading for 10x ARR will remain a challenge for all but the best.

But watch for The Flood of Great SaaS IPOs to come later in 2024. It will be glorious. I’m excited for it. And proud to have led the seed rounds in several!