So I’m pretty bullish on SaaS overall, and have been for quite some time 🙂

And I’ve even been bullish the past 18 months, even with the headwinds some have seen:

- Sure growth is down at top Cloud leaders, but it’s still strong in absolute terms

- The best SaaS and Cloud startups that solve real, big problems are still exploding

- The U.S. economy overall remains very strong

- Many Cloud and SaaS leaders from Salesforce to Samsara to Monday have resumed hiring

- Secular trends still favor SaaS, spend still going up, even if inflation and vendor consolidation don’t always make it feel exactly like it

These aren’t the Best of Times in SaaS, but in many ways they are still very good times. Just nothing like 2021.

But there is one worry I have, that I’ve been talking about for a while, that now is seeping in deeper. Just one worry:

Multiples

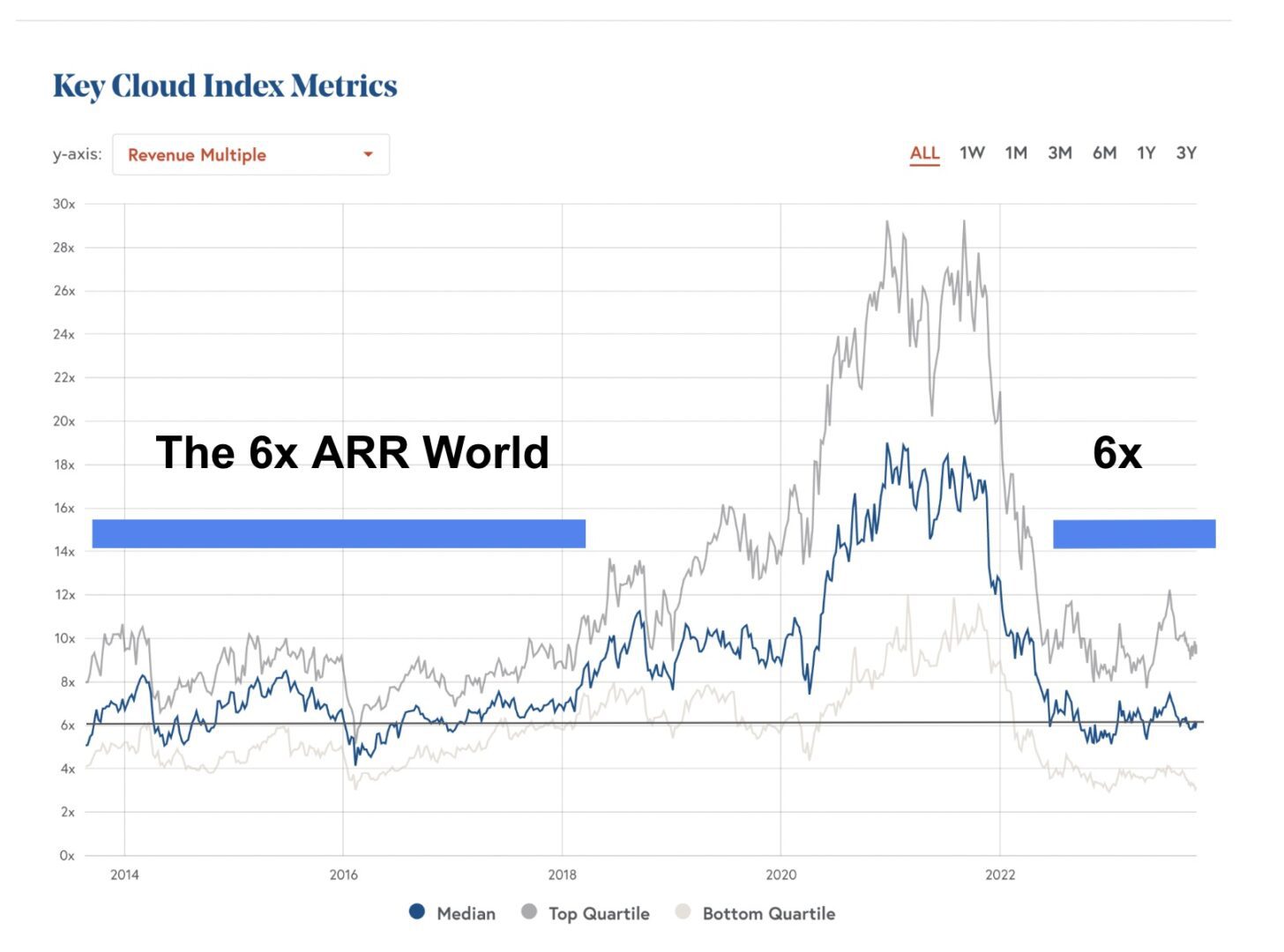

How much leading SaaS companies are worth as a multiple of revenues. The reality is, as you can see in the above BVP chart, the Median public SaaS company — a pretty high bar right there — has traded around 6x ARR. Those multiples went up in 2018 and 2019, and things were Better. And then they exploded in 2020 and 2021 to record multiples.

Now it makes sense multiples should be lower today. Yes, interest rates are at recent highs. And yes, there’s still a big overhang from overspend in 2020 and 2021, and the App Layoffs aren’t completely over.

But this low? I just don’t know. We’re all ZIRP experts now, but I’m not convinced it’s that simple. I’m not expecting a return to 2020 and 2021 multiples :).

But I think a lot of us are betting on a return at least to 2018-2019 multiples. To a 8x-10x world.

Growth investors really need it. Higher burn rate models need it. M&A is boosted by it.

SaaS is hard enough already. It was a lot harder in the old days. I’m hoping, given the massive positive trends in business software, and ultimately, a lowering of interest rates, multiples reflate a bit.

But I am starting to get a bit nervous. If nothing else, for planning purposes, I think we should all plan to stay in a 6x world for the forseeable future.

If even Klaviyo, one of the most impressive SaaS IPOs of recent memory, doesn’t trade at 10x ARR … well, my friends, it’s still tough out there. It’s fine for a while. But it’s now been … a while.

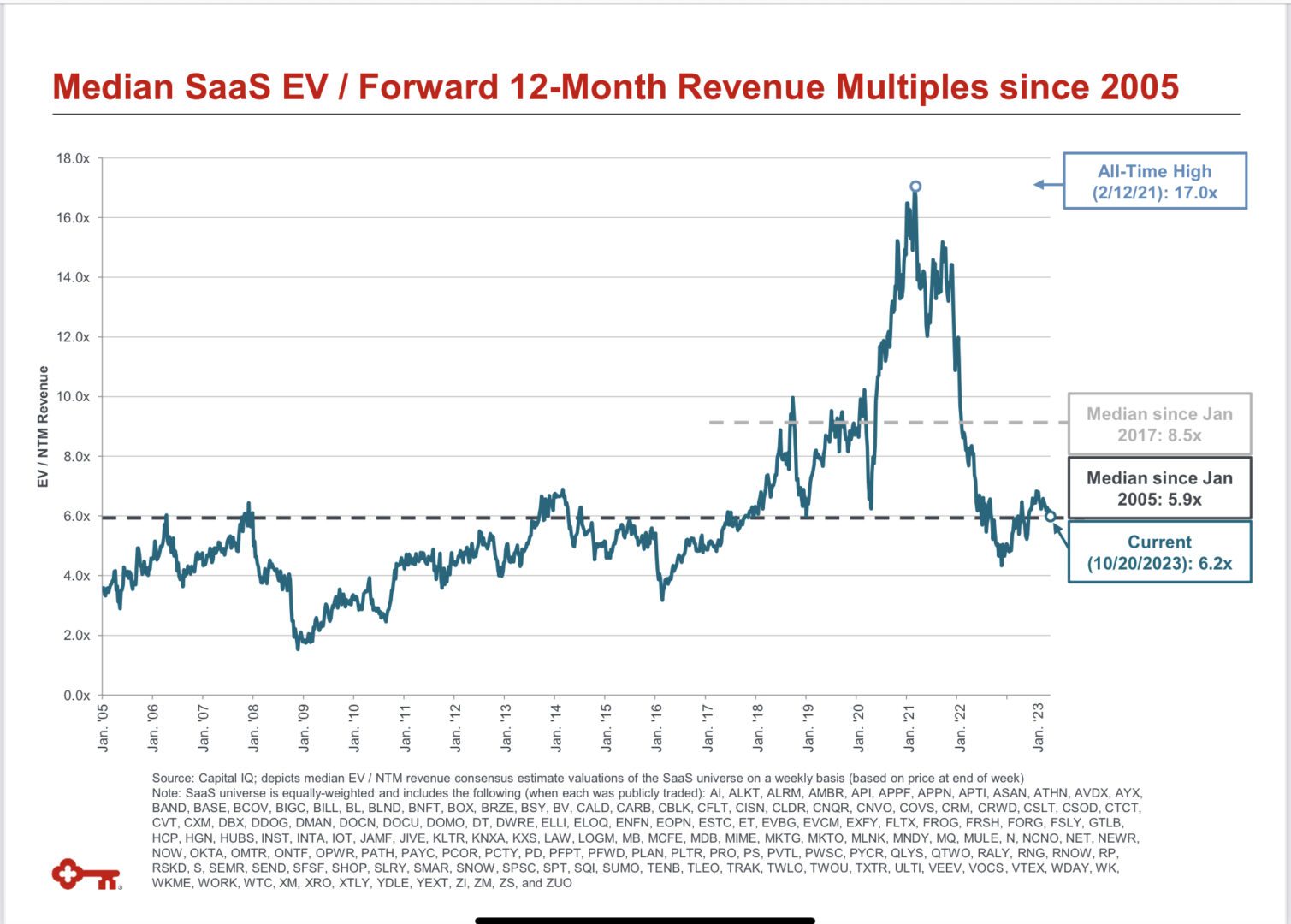

Keybanc also nicely summarized the 6x multiple here:

If we see higher multiples in 2024, that will in many ways make things easier on all of us.

But right now, while I believe, while I want to believe … there’s no evidence multiples will reflate anytime soon.

Founders need to deeply understand this.

______

A great related deep-dive with 2 of the greatest growth investors here: