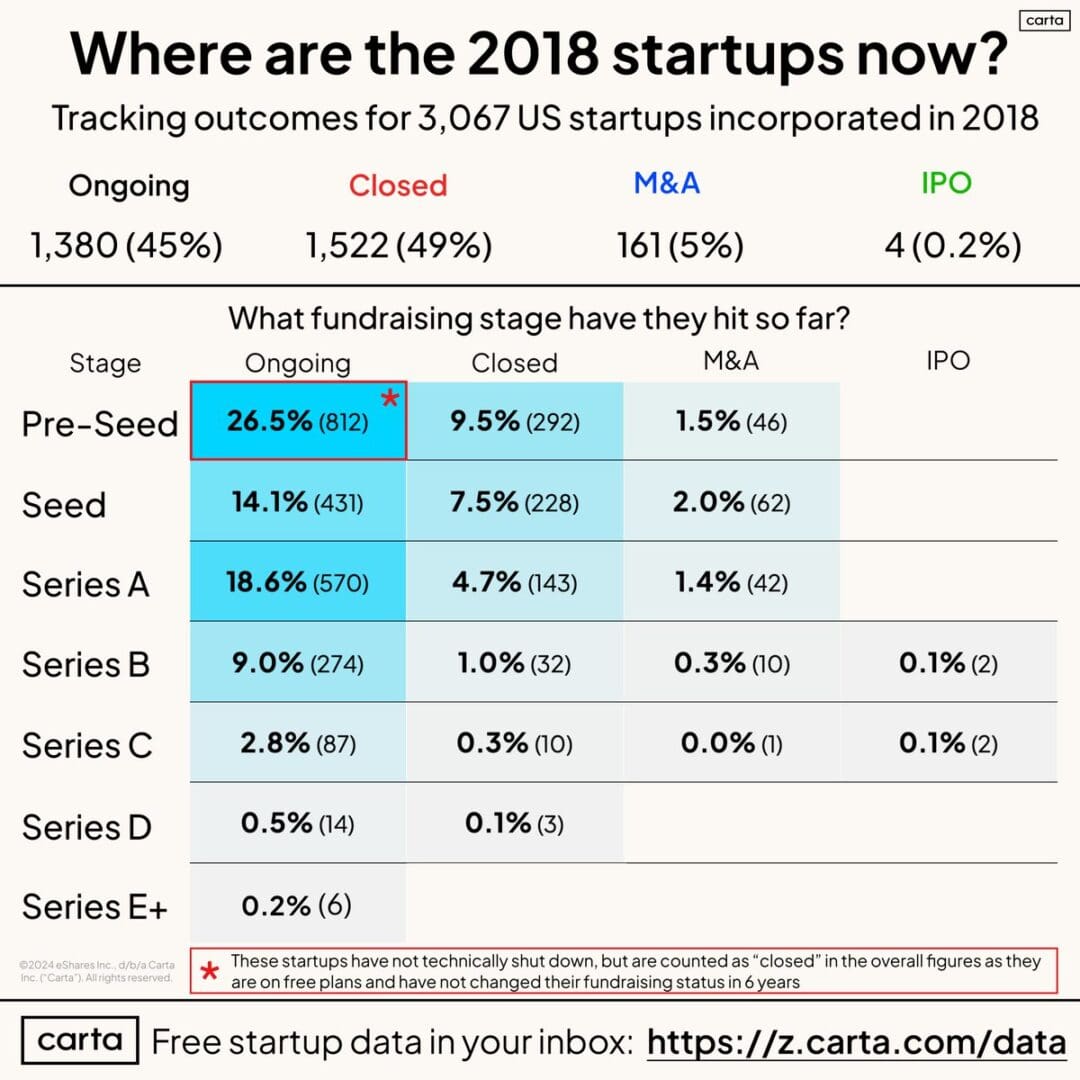

So Carta put out some recent data I found very useful on how many startups raise another round, and how many sort of quietly wind down, in the first 5 years or so after being founded (from 2018 to early 2024):

Almost none IPO’d in the first 5 years, but that just makes sense. It takes at least 8-10 years, on average, to IPO these days. And half the Seed stage startups had shut down by Year 5. That sounds about right to me.

But if an IPO is almost impossible in just 5 years, what about an acquisition?

This is where we have some good data, albeit not enough. About 5% of startups on Carta were acquired in the first 5 years.

What’s less clear is how many were acqui-hires or acquisitions for a very small amount. I’m going to guess based on my experience that at least two-thirds have a very modest exit. And only 1/3 of these have an exit for 3x-10x the price of the last round, i.e. enough for anyone to make any money.

So my educated guess from this data: 1%-1.5% of startups have a “good” exit in the first 5 years.

That sounds pretty tough, and I guess it is. But it also means just plan on going longer. A number of my best “exits” had no great M&A offer the first 5 years, and a number of others had soft offers that fell apart in the end.

Go long. If something great comes up first, maybe take it. And be optimistic, too. But realize it may be years 6-10+ where you build the real value. 5 is fast in SaaS and B2B.

"When to Sell Your Company: Avoiding Bad Advice" @HarryStebbings + @jasonlk

I think I've given some pretty good advice over the years, especially on scaling revenue. But perhaps my worst advice has been on when to sell your startup.

Here's what I got wrong: pic.twitter.com/TNkvgbXvXf

— Jason ✨Be Kind✨ Lemkin 🇮🇱 (@jasonlk) March 17, 2024

And in any event, know to get to a $1B+ exit takes on average 11.7 years.

It’s the second 5 years where the real value starts to compound 🙂

More on that data here: