The year is 2004. Amazon’s business is being challenged on all fronts.

At $18 billion, Bezos’s largest competitor is a $33 billion eBay. Footfalls at a few maverick brick-and-mortar stores (like Best Buy) have only been increasing annually. Toys ‘R’ Us just issued a fresh legal procedure suing Amazon for violating an exclusivity contract. And, come holidays, Amazon’s website collapsed multiple times, inviting the ire of customers and media alike.

If you were a betting person back then, you wouldn’t bet on Amazon.

Nearly two decades later, here’s how Amazon is faring against its old rivals eBay and Best Buy (meanwhile, Toys ‘R’ Us has already shut shop) –

Amazon v/s competitors [2023]

February 2005 – the launch of Amazon’s Prime bundle – was the company’s ‘Solksjaer’ moment, on which most of its present success hinges!

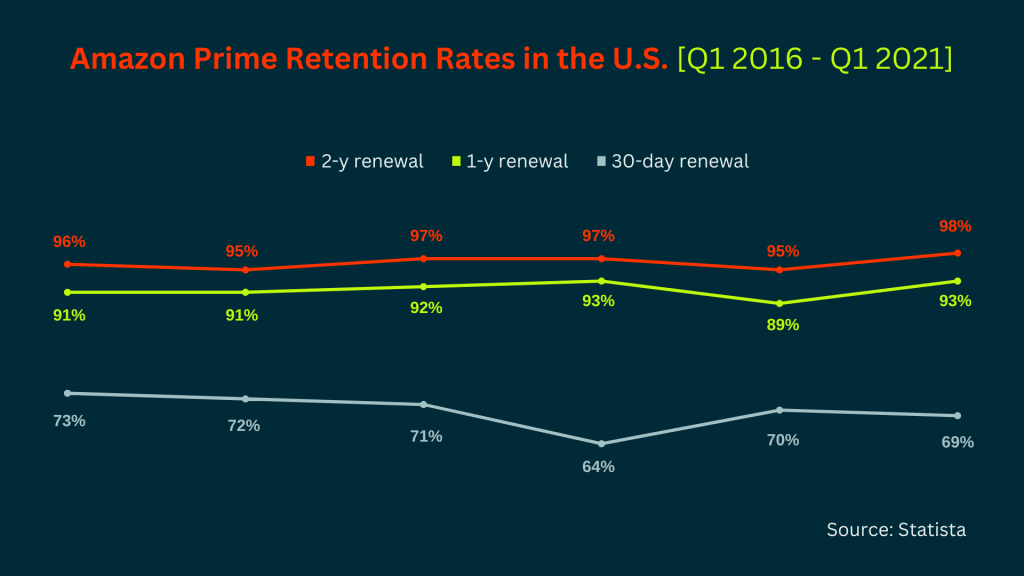

Yes, bundling free shipping, priority delivery, OTT, and membership-based discounts was a great acquisition moat. But Prime’s biggest value driver for the business is its mercurial retention.

Amazon Prime has seen sustained sky-high retention figures [Source]

Retention, for Amazon (as for other businesses) offers compounding advantages. The average Prime member spends $1,400/year compared to $600/year for non-Prime customers (less than half). On the other hand, an annual commitment cost helps Amazon achieve better unit efficiency and subsidize costs for the customer too.

In the end, retention has a significant impact on both margin and growth. It isn’t surprising that 87% of the 300+ businesses we asked said retention was a priority over customer acquisition.

Download the complete State of Subscriptions 2023 report

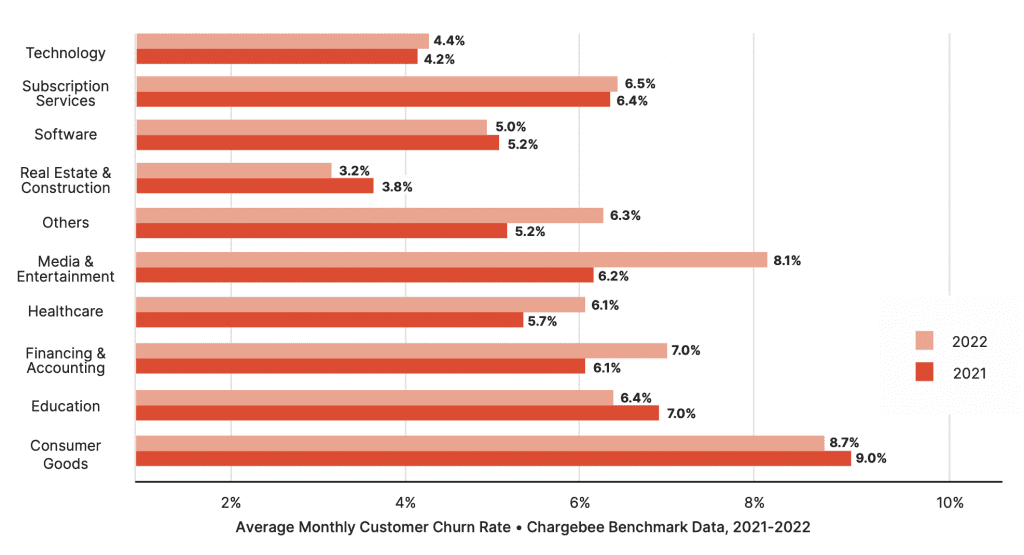

Churn has been consistently growing across industries and domains. The same report confirms that we are officially now in the retention era, marked by –

- High demand volatility

- Slower (and less converting) lead-to-deal cycles, and

- A focus on sustainable growth.

Source: 2023 State of Subscriptions Industry Report

So, how do you unlock the latent powers of retention sooner than later, and what can help you find your ‘Prime moment,’ so you can scale with minimal expense overheads? Read on to find out –

Ways to radically improve SaaS retention

Improving retention (and, therefore, expansion revenue) is easier said than done. Many don’t realize it doesn’t always take a new tool, a bombastic discount campaign, to keep your customers close to you. It takes discipline.

Let’s look at a few small step-changes and retention strategies that pay significant dividends through a downturn.

1. Build a ‘company-wide’ alignment on your churn goal

Retention has a cold start problem – i.e., the problem with solving for retention isn’t that people don’t prioritize retention enough. It is that, even when they do, they treat retention solely as an art, not a science. Despite the focus on retention, only 71% of businesses have an established churn target.

In an (earlier) survey, we asked people who they thought should be the primary KRA owners on a churn target (if they had one). The result was as ambiguous as it could get –

Source: Why you need a churn goal, and who should own it

The lack of a unanimous winner is primarily because, in broad terms, customer churn never happens at a certain point in their journey. Sure, there is a time when someone finally clicks the big red button, but churn truly is a culmination of all unmet expectations throughout their journey as a customer. Often right from becoming a customer.

As entities intended to solve a problem for a particular set of users, subscription businesses need to set company-wide churn goals and tie them back to team-based KRAs.

Having a company-wide churn goal means marketing has to be accountable for lead quality and volume. You must incentivize sales to build customer LTV than just getting customers to sign an agreement. Product decides roadmap and resource attribution with a customer-first philosophy. And all teams ultimately must assist customer success to ensure the end-user receives the attention they deserve.

You are more likely to retain your customers when you make everything about them.

“Even after we hired a dedicated support team, our designers and developers continued to respond directly to customers in our support channel. They liked being close to customers. Yes, it took time away from coding or designing (sometimes 20% of an engineer’s time or more), and, yes, sometimes our customer support manager cringed a little when we said the wrong thing, but support—especially in the early days—was a key part of how we did business, and we couldn’t imagine doing it any other way.“

– Sho Kuwamoto, VP of Design, Figma [in an interview with Lenny Rachitsky]

Today, Figma has >150% NDR, gross margins of 90%, a $400M+ ARR, and is growing 2X+ YoY even after ten years of being in business.

Having a company-wide churn goal and communicating attainment rates with a clear visibility of progress goes a long way in rallying all teams together.

Remember our 2023 State of Subscriptions Industry Report? 82% of the businesses that expressed positive revenue growth this year also have a published churn target.

More importantly, even if you have a churn goal, “bringing focus to who owns this goal and helping get organizational alignment will define the success of your retention strategy, even before you start,” according to Carl Nightingale, Head of Product for Chargebee Retention.

Capture retention data throughout the customer lifecycle

Across most of the tech that helps you collect and recognize revenue, data remains a black box. Yet data is also what enabled Spotify to build its fabled recommendation algorithm, transform ride-hailing revenues with Uber’s surge pricing strategy, and to this day, control most decisions taken by businesses every day.

Yet even as most acquisition-focused teams from sales to marketing are armed with an arsenal of predictive data and metrics (from lead-quality mapping to email conversion rates and more), data for retention has largely been siloed into –

- Churn/deflect/save rates,

- Net dollar retention, and

- NPS mapping

For retention data to be valuable, you must capture it across all touchpoints in a business. Here’s how to build full-funnel retention monitoring:

Key indicators to predict churn

Minor symptoms of disengagement usually precede churn. These are foreboding signals that a customer is unhappy or has outgrown your use case. While the thresholds of these indicators are primarily dependent on your business, these are the more common ones:

- “Often, a churn event is pre-dated by some drop-off in usage or users logging into a platform, which typically happens three to six months ahead of an actual churn event. While they can be hard signals to track, they are often the strongest,” Carl said.

- Contract details often provide the most straightforward signals to predict churn. Information about previous downgrades, card and other on-file payment method expiries, invoice defaults, and more can signal potential customer loss and be intercepted earlier. Chargebee’s revenue growth management platform captures these and more, building finance preparedness ahead, engaging dunning and customer success, and preventing voluntary and involuntary churns before they happen.

- Change in primary POC often forces an uncomfortable re-rationalization among customers. Once your existing customer champion departs, you must move quickly to renew your trust with the new POC or risk being replaced by another business willing to do so. A proactive customer success team solves most of this; otherwise, look for user changes, additions, and removals on your platform.

- A spike in cancellation page visits is also symbolic of customers reconsidering their relationship with your business. Multiple such visits signal that they struggle to find value in your product. It indicates the need for a proper onboarding flow, better customer education around your product, or even better ICP fitment.

- Monitoring customer pulse through NPS surveys is a great way to continuously gauge engagement, identify disgruntlement, and understand the core issues plaguing customer value delivery.

- Identifying legacy churn rates across periods helps you understand which step in your customer journey is most impacted by customer churn. It enables you to set up guardrails for retention improvement.

Understand revenue impact from retained customers

‘Success is a mindset’ is a cliché. Success requires context is truth. Without context, Spencer Silver’s accidental discovery of light adhesives (ones used in Post-it notes) was just a failed attempt at making the next super glue.

Similarly, without context on how saved customers contributed to ‘revenue growth,’ retention remains merely a plumbing job to fix leaks.

Advanced retention reporting helps you asses the total revenue impact of your saved customers, whether lost revenue through downgrades or the value gained from upsells or cross-sells. This data points directly to the result of your retention strategy on your expansion revenue and business growth.

Chargebee’s retention reporting enables businesses to look beyond standard metrics and focus on how retention can move the revenue needle by tracking:

- The total revenue impact from retained customers (upsells, cross-sells, and more)

- Total reactivation value

- Average activation orders

- The average number of forward actions (upsells/cross-sells, upgrades), and more

3. Personalize retention flows

“Don’t find customers for your products, find products for your customers.”

– Seth Godin

The same principle governs customer segmentation in marketing organizations across businesses. Instead of spreading the net more comprehensively and attracting customers hoping they find value in your product, acquisition channels can identify customers with a specific unmet need and then reach out to convince them of the solution.

Yet, the same philosophy is rarely applied to retention. More often than not, retention offers at the point of cancellation are static. A blanket percentage or value discount across the same cancel page is displayed to every churning customer.

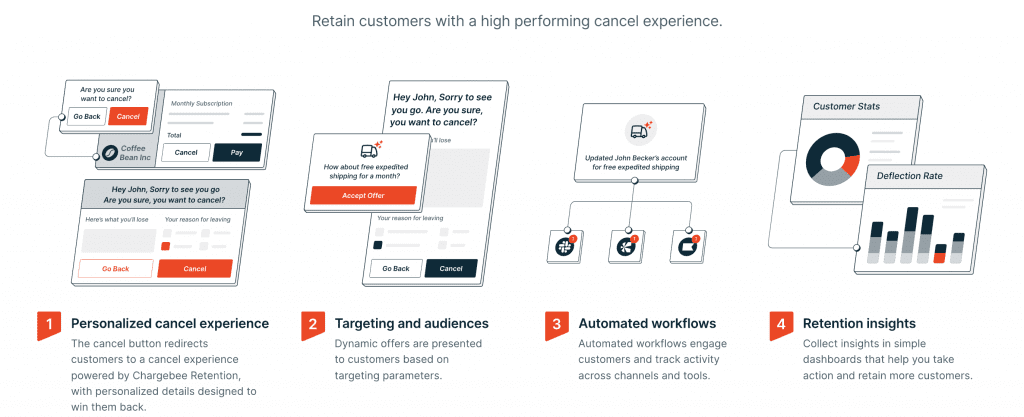

Retention personalization, on the other hand, is more mindful of your customer’s needs/behaviors, their unique relationships with your business, and the reasons they cite for leaving you. A personalized retention strategy typically has the following abilities:

It ensures that every cancel experience is unique to the customer and needs to mitigate the individual customer’s pain rather than with the intent to offer up a Hail Mary defense against churn.

Retention personalization with Chargebee presents custom/dynamic offers and discounts based on customer churn reasons making churn deflection feel as warm as a fresh-baked pie. It is known to save up to 40% of all canceling users.

4. Lead the charge against churn with technology

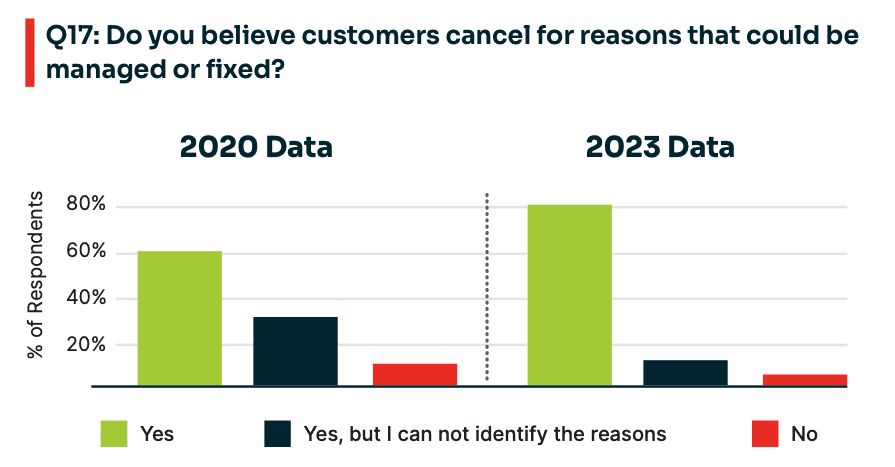

Over the past couple of years, the increased retention-mindedness has helped businesses across domains identify the reasons for churn better.

Despite that, churn continues to climb. While customer sentiment does impact how churn rates behave, the bigger problem is that businesses haven’t done enough to solve retention at scale.

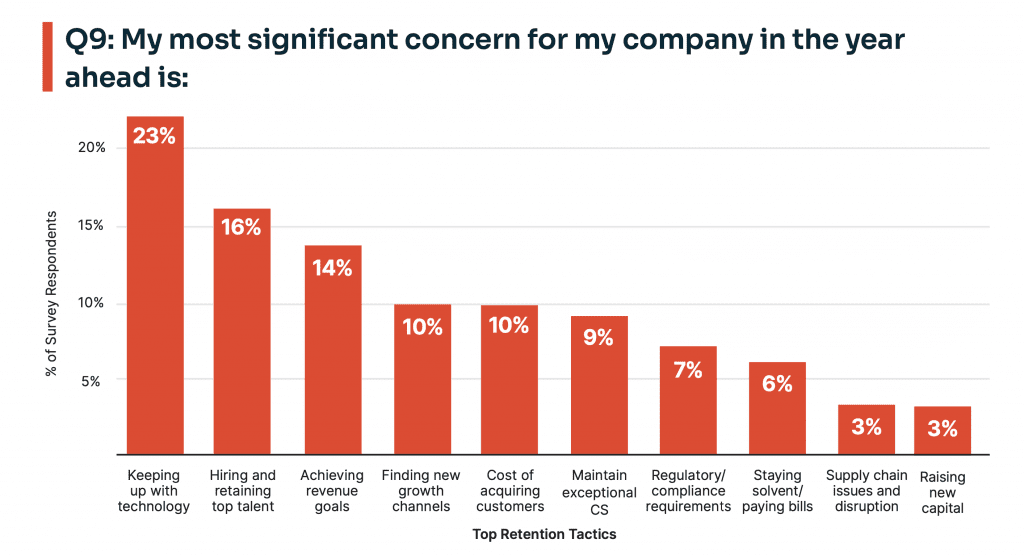

The leading concern for businesses when trying to win the retention game is that they need to catch up to technology.

As churn increases in scale, full-funnel retention tools help automate the entire retention workflow, keep your finance, customer success, product, and marketing gunning for growth, and enable you to sleep that little bit better by reducing time (and revenue) loss due to manually maintaining records and building relationships.

Yet, ‘cutting costs’ and ‘investing in growth’ are never mutually exclusive. Suppose you’re a retention project leader discouraged from magnifying expenses (i.e., investing in new tools). In that case, you must focus on how retention can help businesses expand their cash runway and financial health.

“I get it. The pressure to cut costs and drive growth is coming from the top, and there’s very little you can do about it until you change the narrative.”

– Brian Solis – “The Paradox Of Doing More With Less” [2023]

Neck-deep amidst a bevy of renewals in the pandemic, fleet management leader Motive doubled down

on rapid hiring to service a large B2B and B2C customer base. They soon realized that handling renewals and ensuring retention at the scale needed fewer hands and more automation to be truly effective.

They supplemented their people’s efforts with retention automation from Chargebee. Motive could track and understand customer churn closely by automating their retention and cancel workflow.

Additionally, improved data analytics helped them bring structure into solving customer problems in real time.

As a result, with improved retention rates, Motive grew 80X in 3 years while being more cost-effective.

“At that time, partnering with Chargebee Retention enabled us to better care for all customer segments simultaneously, helping us save a good chunk of our revenue when it really mattered.”

– John Gleeson, VP of Customer Success, Motive

Rinse, repeat, retain: Better customer retention means sticking to a process

Subscriptions remain a solid driver of predictable revenue – a rare commodity in a down economy.

In SaaS, subscriptions (despite new and novel monetization models) are the lifeblood of their valuation multiples and fuel their business growth ambitions. But building a retention engine, hoping it would transform your customer’s perception of you, is more ambitious than believing that the world would run out of toilet paper.

In truth, customers expect value from you even before they sign up. Customer loyalty, therefore, cannot afford to be a knee-jerk focus, it must be thought of even before you get them through the door and throughout their lifecycle:

CX-building happens throughout the customer journey

Retaining a customer is only part of the job. If you’re not following through with corrective action or solving the unmet need that drove a customer to the cancel page in the first place, you are risking your place as a solution.

Understand that customers won’t always lend a pre-emptive signal before they churn, and by the time they do, they might have already made up their minds. Instead, use your intrinsic revenue tools to glean passive signals on product usage, delayed or deferred payments, even the frequency of plan changes that help you identify at-risk customers from the lot, and help your customer success team drive better retention rates.

Clickfunnels used the same idea, to improve their retention rates by 230% with a little assistance from Chargebee Retention. Today, we work with thousands of subscription-focused businesses (from Vital Proteins, and Pret a Manger, to Motive, Unbounce, and more) to drive their retention strategies, uncover lost/hidden intent and context, and power personalized cancel experiences that convert.

If that sounds like something you need a hand with, here’s a taste of what hyper-converting retention flows really look like – here.

Or, if you’re looking for advice on more strategies for retention success, check out our additional resources: