It’s Time to Heal is a special package about engineering the future of bio and healthcare. See more at: https://a16z.com/time-to-heal/.

Virtually every company in biotech claims to have a platform. But historically, platforms weren’t particularly productive when it came to producing multiple new therapeutics. If successful therapeutics are the golden eggs of the biopharmaceutical industry, platforms are the geese, most of which produce few (if any) golden eggs. That’s because each effort to discover a disease target, and develop a molecule that hits that target without causing toxicity elsewhere, is a low-throughput, bespoke process—thanks to biology’s incredible complexity, strategies and solutions that work against one target are likely irrelevant for the next one.

Since most of a company’s value has historically been ascribed to its therapeutic products (or “assets”), biotech companies have a multi-armed bandit problem: Why spend resources feeding the goose? Better to identify an asset that has a shot of being a golden egg and invest in incubators. So companies tend to starve their platform in order to nurture a potential product.

But fertile geese are coming. New kinds of platforms are taking us from bespoke craftsmanship to industrialized drug development. These new industrialized platforms will transform the industry in much the same way that happened when we went from single “job shops” in the early days of automobiles—where raw materials like steel and rubber crafted from start to finish by hand into a trickle of early cars—to assembly line production, with standard components that could be iterated for new models. They will change what we can make, how we make it (and how fast), and how the entire industry is structured.

Fertile geese are coming. New kinds of platforms are taking us from bespoke craftsmanship to industrialized drug development.

Biotech reaches the industrial age

In engineering-based platforms, like those that help build apps or automobiles, investing in the platform itself means benefits accrue and compound over time, translating into faster and cheaper improvements in process and product. An upfront investment in these platforms enhances the entire industry with new knowledge and capabilities, yielding an ability to “stamp out” future products more efficiently. And, like other platforms, they are the foundation on which many future applications—therapeutics and diagnostics—can be built.

New industrialized platforms built on powerful new breakthrough technologies such as biological engineering and artificial intelligence amplify two key superpowers: interrogation and intervention. They allow us to interrogate the dark corners of biology at unprecedented scale and detail, like rapidly decoding full genomes down to the single cell resolution. Or they allow us to intervene against disease in new ways, by enabling us to engineer complex biological systems (like cell and genes) with specific functions.

We have already seen the benefits of this kind of industrialization. Illumina’s next-generation sequencing platform enabled us to decode organisms’ entire genomes virtually overnight, which has dramatically impacted drug discovery and diagnostics development. Now we’re seeing the advent of the rise of intervention platforms: platforms that give us the ability to engineer bits of biology—mRNA, genes, cells—to create programmable medicines. COVID19 has given us a powerful glimpse into how this can work. DNA sequencing technology meant we had a digital copy of the virus genome in January 2020 before the biological version reached our shores. Because Moderna had built a machine over the last decade to design and produce mRNA therapeutic candidates at massive scale, the company designed the final version of its vaccine within 48 hours of analyzing the virus genome—a matter of swapping out the “4 letters of life.” said CEO Stephane Bancel. This same dynamic allowed BioNTech to rapidly redirect its mRNA technology platform from cancer to COVID in a matter of weeks; the company estimates it can manufacture updated versions against emerging mutant strains in as little as six weeks.

We used to grow our vaccines; now we can print them. That’s a big deal. But what’s an even bigger deal is that these programs are just the first in a long list coming that will benefit from the same underlying platforms.

We used to grow our vaccines; now we can print them. That’s a big deal. But what’s an even bigger deal is that these programs are just the first in a long list coming that will benefit from the same underlying platforms. The rise of productive platforms will impact much more than just vaccines. It will transform all areas of biotech, from small molecule discovery, protein engineering, genome editing, gene delivery, cell therapy, and more.

Vertical integration vs horizontal infrastructure

Industrialized platforms enable potential new business models. If platforms are 10x or 100x more productive or can produce 10x or 100x better products, everything—from how you build a company, to how you invest in it, to how you think about value creation—changes.

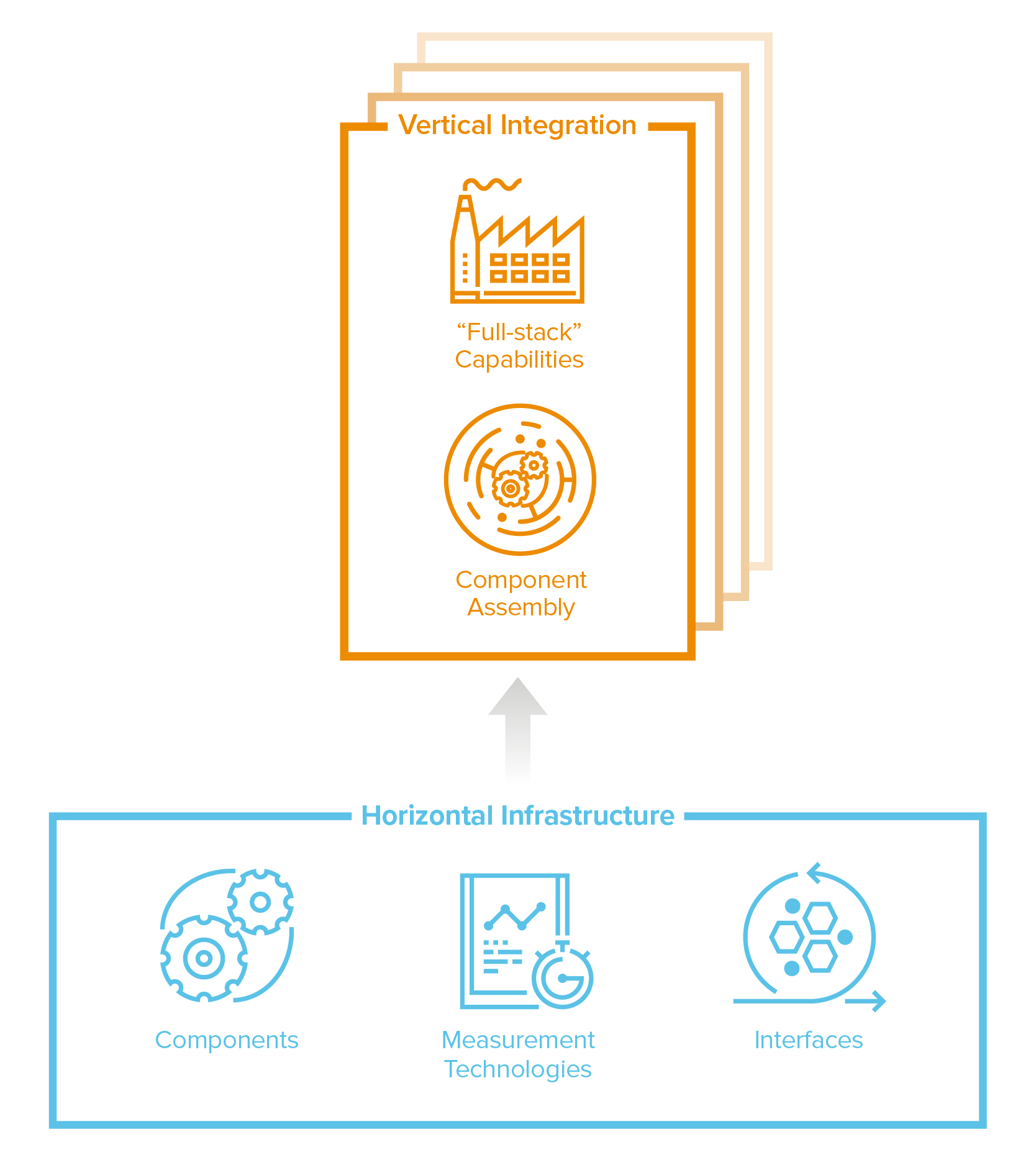

The default mode for this industry has been vertical, full-stack integration: build the entire machine to make the end product. That’s still a highly valuable approach, especially when you compound the productivity of each part of the stack. Take cell therapies, where the process is the product: it’s incredibly complex to assemble a collection of specialized genetic and cellular components engineered for a specific function and to manufacture them at clinical-grade quality and scale. Leading cell therapy companies like Tmunity or Lyell have invested deeply in building a vertically-integrated stack to maximize productivity, assembling all the research, clinical, and manufacturing capabilities to produce these complex cell therapies at scale from start to finish—a factory to industrialize these processes for all their products—and every improvement accrues to each subsequent version of cell therapy they produce.

The API Economy for Bio

But now, the horizontal model is coming to biotech too. Because most traditional drug development programs are essentially independent discovery efforts, selling components or generalized infrastructure across the entire industry wasn’t really a viable option (too much customization needed). But, with the rise of programmable medicines, the industry increasingly needs and is building components, processes, and interfaces that can be applied broadly. These modular components and tools can be swapped in and remixed across a wide range of applications. Instead of building the machine, you can now build powerful cogs that power many machines.

Programmable medicines will create demand for critical components. In gene therapy, for example, there’s a critical need for more reliable, safe, cell-specific AAVs, the workhorse delivery vehicle. Instead of developing its own therapies, Dyno Therapeutics has opted to provide access to its custom AAVs broadly, to partners like Novartis, Roche and Sarepta in deals valued in the billions of dollars. Guide Therapeutics and GenEdit are taking a similar approach for LNPs (the delivery vehicles for our mRNA covid vaccines!) It’s possible that we will soon have marketplaces for other plug-n-play components like cellular switches, sensors and logic circuits for precision control.

Another horizontal opportunity is the ability to measure something new at massive scale or resolution, creating new knowledge that accelerates the entire industry. Like Illumina did for DNA, new cohorts of “Illumina for X” companies are developing measurement technology platforms to affordably and comprehensively illuminate new aspects of biology, like proteins, metabolites or cell morphology. 10X Genomics enables analysis at single-cell resolution; Nautilus Bio aims to deliver us the entire human proteome.

And lastly, you can build tools that take “dirty” interfaces—where laborious effort and some serendipity are often needed to make things work—and make “clean” interfaces to access, organize and potentiate the messiness of biology. Asimov, for example, has developed a platform where software is used to directly program sophisticated functionality into living cells. If clean-interface capabilities are sufficiently broad and transformative–if they make the impossible, routine–these platforms have the potential to become the elusive application programming interface in biology.

So which do you choose?

Let’s say you’re a company with a platform that could be used either to develop your own proprietary pipeline of potential blockbusters, or to help create many more drugs for other companies. Traditionally you would focus on nurturing your own golden eggs. But in this era of industrialized platforms, that may no longer clearly be the best path forward. Maximizing value may mean becoming the company that provides all the picks and shovels to the gold rush.

Vertical Integration

Generally speaking, going full-stack requires significant amounts of capital in order to build the fully-functioning machine. And in many markets you have incumbents that have already made significant investments in legacy systems. So how do you know if the juice is worth the squeeze?

- What is the relative value of integration using your platform technology? Is the whole greater than the sum of its parts? Does your platform offer the central capability needed for integration? In cell therapy, for example, the biggest challenge has been to engineer cells into a functioning therapeutic and to manufacture them in a scalable manner. Since that’s the hard part, the value is in the whole machine—not just one cog.

- Is there compounding potential for future products? Can you make things no one else is capable of making? Is there a steep learning curve with significant potential for tuning and iteration? If version 3.0 of a programmable medicine is built on the foundations of versions 1.0 and 2.0, it makes sense to keep that capability in-house and own an increasingly differentiated product pipeline.

- What is the bull’s eye value for your platform? Is there a single, super valuable vertical that dwarfs other applications? Let’s say you have a platform technology that allows you to discover new targets. If those targets matter most in one specific disease, that warrants focus. In those cases, the vertical opportunity is likely stronger than a horizontal one that may dilute your focus across multiple lower-value applications.

Horizontal infrastructure

As new markets grow and mature, the riches are in the niches. If you’re offering components, capabilities or interfaces, the key question is, how many widgets can you sell—and how valuable are your widgets?

- What is the breadth of applicability of your platform (i.e., how many widgets)? If you have a technology platform that could be applied broadly, that represents more opportunity than you could ever develop on your own. So if you have a really productive platform—that produces widget you can sell for many different purposes to many different buyers—you should focus on selling that widget.

- What is the criticality of your technology (i.e., how valuable are your widgets)? If your technology can be substituted easily or doesn’t strongly contribute to the final product, like a screening methodology, its low perceived value to customers/partners will affect both your sticker price and upside potential in partnerships. On the other hand, a core enablement is exceedingly valuable, even if there isn’t a very long list of buyers. Gene therapies only work if they can be delivered to the right cells, so companies developing these genetic payloads will seek to secure these critical delivery vehicles from specialized providers.

- What is the demonstrability of your technology? How long will it take to know whether your platform’s component or contribution works or has been validated? If your widget has been used elsewhere, there’s already proven value. But new technologies that take time to “read out” are risky. In cases where you have a long time to demonstrability—often the problem for many target discovery platforms—it’s a challenge to sell a solution to others before you’ve proven the value yourself.

(But it’s really both)

If biology has taught us anything, it’s that rich ecosystems can support multiple winners. Vertical-first business models can focus on creating high-value outputs at increasing speed, scale and sophistication. Horizontal business models enable the efficiency of “free trade” where niche, specialized players can focus on the piece of the puzzle that is their core competency.

This journey is treacherous—if you don’t know who you are or where you’re going, you’ll never reach your destination.

But dominant platforms don’t stay in their lane for long. Even if they begin one way, they often evolve into a hybrid of both models. Take Illumina, primarily a horizontal company that has begun to add verticals: the dominant next-gen sequencing platform has brought full-stack testing and diagnostics businesses into the fold. As applications for programmable medicines explode, horizontal providers of the most valuable components may choose to invest in their own proprietary therapeutic pipelines. And companies that start with a vertical play may—as their capabilities become central to other players’ core functionality—“go horizontal” too. Lonza, for example, offers fully vertically-integrated CDMO services to the biopharmaceutical industry, but has also begun offering end-to-end automation infrastructure to players investing in their own manufacturing capabilities.

So this is really about where to start, and how to win, but not necessarily where you’ll end. This journey is treacherous—if you don’t know who you are or where you’re going, you’ll never reach your destination. Start ups with powerful platforms need to figure out where they will most quickly have the highest impact and traction. You need to find success first on one axis, so that you can ultimately fund success on both.

-

Judy Savitskaya is the cofounder of a stealth startup.

-

Jorge Conde is a general partner on the Bio + Health team at Andreessen Horowitz, focused on therapeutics, diagnostics, life sciences tools, and software.