Q: How does my CAC recovery time affect the rate at which I can grow, without taking on any outside capital?

A: It relates directly; the more quickly that you can recover your CAC dollars, the more quickly you can use existing customer generated revenues to fuel additional organic growth. In all practical regards, this economic relationship is the geometric growth factor which is precisely the opposite of churn.

CAC recovery time is an extraordinarily important metric in the SaaS world. Simply put, it is the amount of time (typically measured in months), that is required to recover the cost of acquiring a single additional customer, when considering the fully-burdened contribution margin of that same new customer.

Our last post on LTV includes a calculator that determines your CAC recovery time as a function of ARPC, Contribution Margin %, Churn, and your Discount Rate (weighted average cost of capital, or WACC).

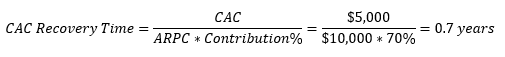

By way of example, let’s assume that our example company MidChurn sports a $10,000 ARPC (Average Revenue Per Customer), a fully burdened Contribution Margin of 70%, and an average CAC across all customers of $5,000. (For the purpose of this example, we will ignore segmentation effects, while remarking that they are often the source of tremendous insight regarding exactly where CAC dollars should and should not be invested.) CAC recovery time in this simple example is 0.7 years (CAC of $5k, dividing into 70% of $10k ARPC, yielding ~0.7 years).

What Does Your CAC Recovery Time Say About Your Business?

The fact this figure is less than one year indicates clear health; CAC recovery times of up to 18 months can be considered sustainable, however clearly shorter recovery times are better.

Now, assuming that there is no delay between the investment of CAC dollars, and the acquisition of a new customer – in other words, assuming that growth is entirely bound by the dollars that we have to spend acquiring new customers, that we know the average CAC, and the delay between investment and acquisition is negligible (none of these assumptions are realistic, but for the purposes of this example, please bear with me), then the rate at which we acquire new customers is 100% bound by our CAC recovery time.

Let’s continue the example: MidChurn invests $5k to acquire a customer that produces $7k / year in re-investable contribution margin. Ignoring fixed expenses, this means that for every new customer landed, that new customer generates enough contribution margin to fuel the acquisition of another new customer in 0.7 years.

What we have articulated is another geometric growth factor, which offsets nearly exactly the opposite phenomenon, which is churn. In other words, if MidChurn experienced absolutely no customer attrition and no delay between CAC investment and customer acquisition (and, had an unlimited number of customers available and willing to buy, assuming the marketing and sales dollars are invested), then it would grow precisely as a function of its CAC recovery time. Even netting our assumed annualized churn of 31% against this figure yields 170% annualized growth which, if our assumptions hold indefinitely, assures that MidChurn will continue to nearly triple revenue year over year, without cessation.

This example is not particularly farfetched: we regularly discover companies with little to no outside funding, achieving 100%+ annualized growth, serving the SMB-market and fading double digit annualized churn with little to no ill effect.

CAC Recovery Time vs Churn

The other conclusion that one draws from this analysis is that the efficiency of customer acquisition, as measured by the CAC recovery time, is significantly more important than churn, all other factors being equal.

As a final example of this organic growth formula in action, let’s ask the question: assuming no outside investment, would you rather own ‘Company A’ with 5% annualized churn, but a 2 year CAC recovery time, or a ‘Company B’ with 50% churn and a 6 month CAC recovery time? (How the answer to this question would change if you took on outside Growth Capital will be the subject of a future post).

The answer is simple: ‘Company A’ has the potential to grow organically at a maximum of 55% taking into account a 95% retention rate, whilst ‘Company B’ has the potential to grow at 252% in spite of just a 50% retention rate; there is no comparison - the typical obsession with churn absent consideration of CAC recovery time simply doesn't make sense (again, acknowledging that we have assumed no bounds to nor delay between investing CAC dollars and finding and signing up customers, which is clearly not entirely realistic; adding a delay changes the math somewhat, and the assumption of unlimited customers is also worth challenging, but reamins realistic for a growth stage company serving a new market).

What should your CAC Recovery Time Be?

Only your data can accurately answer this question. Please try our calculator below to determine your maximum theoretical organic growth rate and CAC recovery time, inputting ARPC, Contribution Margin, CAC and annualized churn.