Dear SaaStr: How Much Of My Startup Do I Need to Sell In Each Venture Round?

It definitely can vary based on what type of investor.

But for venture-backed start-ups raising from more traditional funds (the ones you’ve heard of), here are some rough rules:

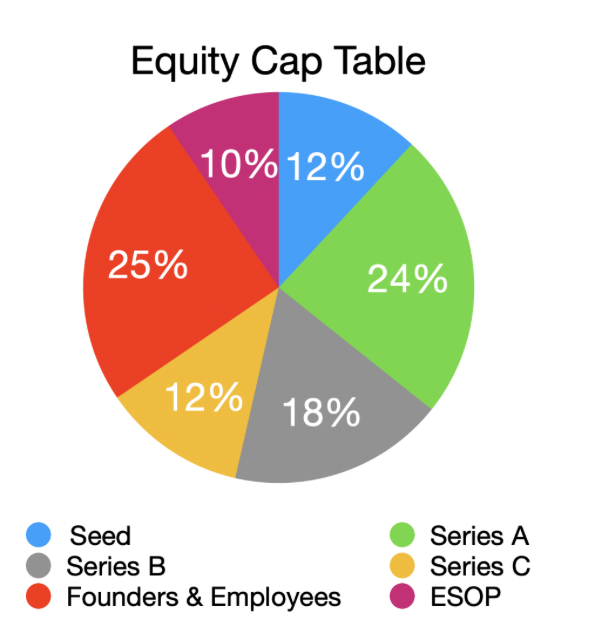

- Seed VCs would like to buy 10%, sometimes 15%, if they can. They often “settle” for a bit less.

- Series A VCs would like to buy 20%. They’ll often settle for 15%, but ideally not much below.

- Series B VCs would like to buy 15%. Settle for 10%.

- Series C VCs would like to buy 10%

- Series D VCs would like to buy 5%, or at least, be able to deploy at least $20m-$30m

These ownership percentages are pretty rough guidelines, but they are based on general rules about what it takes to “return a fund” for Series Seed through Series B, and to at least return 20% of the fund for Series C and later deals. And if a VC truly believes a deal will be a decacorn, they can take a bit lower ownership if they really truly believe it’s a generation investment. But too small an ownership stake, and it’s just too hard for almost any investment to return enough absolute capital to “return a fund”.

I.e., to simplify, imagine a $200m Series A fund and a $1B exit — something pretty rare, but what VCs are going for. If they purchased 20%, that would return $200m … and thus return 1x the fund. The goal is 3x overall or better. As you can see, it’s hard.

One thing a lot of first time founders don’t quite realize when raise VC today is that there has been a “retreat to ownership”

Yes, valuations in most cases are down. A bit at seed, a ton a late stage.

But more than that, top VCs don’t want to cut corners on ownership today.

— Jason ✨Be Kind✨ Lemkin (@jasonlk) April 19, 2023

Having said all that, angels, “non-traditional VCs”, and other sources of capital may be less concerned about returning the fund. Corporate VCs, for example, usually aren’t that concerned with ownership. Successful founders that are angels usually aren’t that price sensitive, as long as they don’t feel ripped off. And sometimes, mega-funds will write small checks to “get to know” a start-up, even if the stake is very small. But normal, traditional VC funds and investments will roughly follow the above rules.

A related post here:

(cap table image from Thomas Tunguz’s post here)