Large corporations and enterprises have their hands full when it comes to tracking spending—from travel expenses to general business and SaaS costs, keeping an eye on every charge is no easy task. Luckily, expense reports are becoming a relic of the past.

Finance leaders and procurement teams looking for a new, modern solution for travel and expense management have found one with Mesh Payments. It’s an all-in-one, global travel and expense management solution, giving you complete control over enterprise spending with real-time reporting, accounting automations, and complete travel flexibility.

Mesh Payments: The Good and the Bad

Mesh Payments has undergone a full makeover and now boasts a revamped style. As of August 2023, Mesh is a truly global expense management solution—one that not only manages your business expenses but also all of your travel expenses like taxi rides and international flights.

With this new iteration, Mesh is aimed at global enterprises. Its virtual corporate cards and all-in-one dashboard allow finance teams to track and manage entities across the globe in multi-currencies.

It is essential to note that Mesh cards are not credit cards in the traditional sense, and they act more as prepaid debit cards. Also, Mesh cards might not be accepted everywhere, so your literal mileage may vary.

Nevertheless, Mesh has a lot going for it, and can take you very far.

What Mesh Payments Is Good At

Travel and expense management: Mesh Payments has leveled up its offerings with the release of its new travel management solution, providing global enterprises like yours with an all-in-one platform to manage travel and business expenses.

With this latest product launch, Mesh brings together the convenience of online travel booking with the control and visibility of integrated corporate cards and automated expense reporting. Now your company can seamlessly manage the entire spend lifecycle from travel planning to reimbursement—all within Mesh’s unified system.

At its core, Mesh enables the flexibility and localization your business needs when operating globally. The multi-agency and multi-currency support empowers you to work with your preferred travel providers worldwide while paying and reimbursing employees in local currencies. This streamlined experience increases compliance and reduces foreign exchange headaches.

And while travel management is the shiny new feature, Mesh also delivers AI-powered expense automation tools that make its solution stand out from competitors. The system automatically matches receipts to corresponding transactions in real time, even when they are across the globe, eliminating the need for manual expense reports.

Travel management dashboard: Mesh’s new travel management dashboard provides the oversight and control you need to rein in business travel spending while still giving your team the flexibility to book trips that meet everyone’s needs.

With a centralized view of all employee travel, you can monitor real-time spending across the organization and ensure compliance with your policies. You can easily approve or suspend card use right from the dashboard to prevent unwarranted purchases before they occur.

Mesh also enables you to consolidate all your preferred travel agencies and management companies into one platform. You can tailor booking workflows based on regional or local needs, and choose specialized corporate travel agents for executives. This means you can streamline global business travel exactly how you want to.

Employees booking through Mesh get the best of both worlds with online and offline options for trip planning. The system even stores individual preferences and corporate rate discounts for hassle-free future bookings. There’s even in-app messaging with travel agents that keeps everyone looped in.

The dedicated travel expense dashboard provides visibility not just into total spend, but also into granular trip details. You’ll have the insight needed to clamp down on rogue, out-of-policy bookings before they even happen.

Spend management: Mesh gives your finance teams the comprehensive visibility and control they need to optimize all business spending—especially those tricky SaaS subscriptions.

With Mesh, all payment data flows into a unified dashboard to eliminate tedious manual collection across siloed systems. Your finance managers get an invaluable bird’s-eye view of company-wide spending, enabling them to spot opportunities for savings with context behind it.

When it comes to SaaS management, Mesh really shines. You can consolidate all subscriptions under one roof and leverage detailed reporting insights for each one. Features like virtual card issuance, configurable controls, and instant cancellation empower you to stay atop of these expenses.

For example, you can set spend limits and alerts to prevent overages on any given SaaS subscription. If a tool is no longer delivering value, you can cancel it immediately right from the platform with one click. There’s also automatic syncing into accounting systems that can remove the guessing game at the time of reconciliation.

With all of these tools at your disposal, Mesh helps you tighten up budgets without limiting operational agility across your business.

Worldwide capabilities: As an internationally accessible company, you probably need a spending management solution that can power localized operations everywhere you do business—and stay 100% compliant. That’s where Mesh Global comes in.

Mesh lets you manage international entities from a unified dashboard while still meeting local rules, regulations, and requirements. You can hold balances in local currencies, issue multi-currency cards, and seamlessly integrate with in-country enterprise resource planning (ERP) systems—all from one centralized hub.

The global capabilities of Mesh also help streamline travel and expenses across borders. Employees can be reimbursed or pay vendors in local cash without requiring you to handle tedious international wires and currency exchanges.

With support for over 140 countries and over 200 currencies, plus assured compliance via localized payment processing capabilities, your finance team gets major flexibility without the headache.

Real-time insights: Mesh gives you true visibility and useful reports on employee spending so you can stay both nimble and in control.

It offers customizable data reporting that allows your team to oversee spending by department, project, or region. This allows you to filter out the noise and zoom in on what matters most.

Mesh’s AI-powered platform also provides actionable recommendations to optimize spending and make prudent budgeting decisions. For instance, it analyzes trends across travel, recurring charges, reimbursements and more to flag unnecessary costs.

Looking ahead, you can also forecast upcoming cashflow based on historical data and planned trips, events, or growth initiatives. Mesh helps you predict future spending patterns so you can allocate funds accordingly.

That said, Mesh also keeps watch in real-time. If unusual activity occurs, such as large unauthorized purchases, it triggers instant notifications so that potential fraud can be addressed right away.

With Mesh’s robust reporting and insights, you gain an invaluable view of both high-level trends and granular transactions. This is key for monitoring your financial strategy without limiting your team’s ability to operate efficiently.

Virtual and physical cards: Mesh makes it easy to issue virtual and physical corporate cards, providing both your team with spending power and you with oversight.

You can instantly generate any number of virtual cards right from the dashboard and then configure parameters like spending limits and expiration dates. Activating and assigning cards to employees for immediate use is as simple as a few clicks.

Mesh also has its own patented way of linking virtual and physical cards together to enable seamless online and in-person purchases, called Plug & Pay. These cards come with configurable spend controls that align with your company policies, providing oversight without limiting your team’s ability to purchase necessary items for travel and business. The physical cards provide the control of virtual cards with the flexibility for situations where cards are needed.

No matter which card gets used, all the insights into spending will still be there. Every transaction gets rolled up into Mesh’s reporting so you get a unified view of the spending picture.

When it comes to controls, Mesh cards deliver with granular options to tailor permissions, set alerts for large purchases, require additional approvals, and more. You have the security to build guardrails aligned to your policies, and employees have the freedom to add cards to mobile wallets for easy accessibility.

With the advanced configurability and security of Mesh cards, your team gets payment flexibility while finance leaders maintain oversight and prevent misuse—truly the best of both worlds.

Built-in policy and spending controls: Mesh equips you with an array of built-in policy and spending controls to ensure your corporate cards and related purchases stay within budget and compliance guidelines.

For starters, real-time enforcement bakes your policies right into virtual and physical cards. That means transactions are screened to block non-compliant spending before it happens.

Automatic receipt matching provides real-time visibility, allowing you to confirm travel and entertainment purchases adhere to limits, so no extra policing is required.

If you want to configure notifications to alert you when sizable transactions occur so you can approve or block them as needed, you can do so easily. You can also limit transactions by vendor, set category-specific limits, and suspend cards with one click.

When it comes to travel, it’s easy to apply trip-specific policies surrounding airfare, hotels, restaurants, and more to rein in costs. Cards can be activated for use only during approved travel times, and deactivated thereafter.

Employee spending can also be capped at daily, weekly, or monthly to drill down purchasing control types.

If an employee leaves the company, or if a SaaS is no longer needed, you can instantly cancel cards or subscriptions directly through the platform.

With impressive controls like these, Mesh gives you a ton of power over payments while still remaining compliant. This makes it easy to keep your policies in order and stick to your budget.

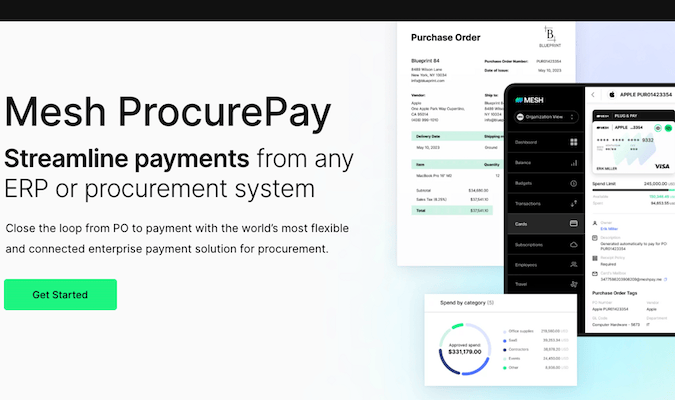

Procurement payments and accounting automations: Mesh takes the pain out of procurement and accounting with seamless integrations and automations to simplify your entire payment workflow.

To eliminate manual reconciliation work, you can auto-sync transaction data with enterprise resource planning platforms like NetSuite, Quickbooks, Sage Intacct. Your accounts will automatically stay up-to-date as spending occurs.

Invoice scans are processed using optical character recognition (OCR) technology that reads text from images and digitizes them automatically, extracting key details like vendor, amount due, and invoice number. This makes it possible to automate receipt matching with transactions and removes the hassle of manual data entry for expense reports.

Plus, if you want to stay informed throughout the process, automated notifications can be sent to you over email, text, Slack, and more.

With automated data workflows over payment requests, approvals, and reminders, Mesh keeps your accounting process moving smoothly so your finance team can close the monthly books in record time.

Mesh Payments’s Potential Drawbacks

Mesh cards are not credit cards: It’s important to understand that Mesh cards operate differently than traditional credit cards in a few key ways.

First, Mesh cards work more like prepaid or debit cards, requiring your finance team to maintain a positive balance for transactions in order to be approved. Without sufficient funds loaded, payments can be declined when employees attempt to use them.

Second, while virtual cards provide some convenience, physical Mesh cards are not accepted everywhere—especially when traveling. Some hotels, rental agencies, and other vendors may only accept traditional credit cards or alternate payment methods.

There have also been many user reports of merchants rejecting the virtual cards altogether—so it’s wise to carry a backup physical credit card to avoid disruptions. This can obviously defeat the purpose of having a virtual card in the first place.

Another key distinction is that Mesh cards only provide 1% cashback rewards, and this rate is quite low compared to some leading business and corporate credit cards that offer 1.5%, 2%, or even more back.

It’s important to keep these limitations in mind when considering a switch to Mesh cards. The method of maintaining balances, the merchants who accept them, and the rewards rates may all be different for your existing corporate card programs. If you have any high volume vendors connected to your business, it would be wise to check if Mesh cards will be supported to avoid issues.

Restrictions to join: When evaluating Mesh, it’s important to remember that there are restrictions on what businesses can sign up based on size and monthly spending. This may exclude many smaller companies.

Specifically, Mesh requires a minimum of $50,000 in monthly corporate spending to qualify for an account. Thus, if your business has only a handful of employees or limited budgets, you likely won’t meet the threshold for using Mesh.

During the signup process, you need to enter details about your company’s headcount and expenses. If you have fewer than 100 employees, Mesh may not even advance you to a call with a sales rep.

Mesh Payments imposes limits that rule out most small businesses right from the start. That said, it may be worthwhile to contact Mesh directly and inquire about whether exceptions can be made if you believe your company will grow into those targets. Either way, it’s good to know the requirements upfront to avoid any wasted effort.

Limited integrations and questionable performance: When it comes to SaaS integrations, Mesh’s options are currently limited to Slack, Google Workspace, and HubSpot. For accounting software, support includes NetSuite, QuickBooks, Sage Intacct, and Xero. These are clearly some of the most popular enterprise resource planning services out there, but more niche ERPs are not covered.

If you rely on proprietary or less common systems, Mesh may not sync up for you yet. And those needing broader integration capabilities may find the options lacking.

In terms of performance, various Mesh users have aired grievances about the speed of service in areas like card reloading and overall system lag. Some found the UI to be a bit clunky and hard to navigate at first as well.

It’s possible that Mesh is still ironing out performance kinks and smoothing the user experience given its new makeover—these are growing pains you’d expect from a company that’s enhancing its offerings.

Mesh Payments Plans and Pricing

There are no surprise fees hidden anywhere with Mesh. When it says free, it means free.

Of course, its cashback reward system isn’t as prolific as other business cards, but it is truly a hassle-free solution for handling your travel and business expenses—plus you get excellent features (like a unified dashboard, real-time reporting, and virtual payments) that you may not find elsewhere.

Mesh even offers a sign-up bonus and opportunities to benefit from rewards through its partners that you won’t want to miss.

Free

Mesh Payments is a true zero-fee card program, which can be a rare sight to see in business spend management.

You pay absolutely nothing for the platform provided you meet the qualification criteria to sign up. All transactions on Mesh virtual and physical cards earn 1% cashback on qualified purchases.

While Mesh determines expense eligibility for rewards at its discretion, cashback bonuses apply to most general purchases.

New users also get a generous welcome bonus—$200 for spending $3,000, plus another $300 for linking marketing or cloud budgets within the first two months.

Using Mesh Payments also unlocks up to $100,000 in partner perks, including QuickBooks and Amplitude discounts, lounge access, and other valuable deals.

With a hefty welcome offer, access to discounts, cashback on transactions, and no monthly or annual fees, Mesh delivers exceptional value at no additional cost to your normal business spending.

For qualifying businesses, this free program is a win-win.

Final Thoughts

With its recent addition of travel management into its solution, Mesh Payments has created a true all-in-one travel and expense management solution for today’s borderless enterprise.

It provides valuable visibility, controls, and automation to help complex organizations wrangle business spending in multiple regions and currencies, in addition to offering advanced controls over basic SaaS and general expenses.

As an innovative solution with virtual card payments and AI-enabled expense tracking, it’s understandable that Mesh still has some room for improvement and maturation.

Hard to ask for much more from a completely free platform.