Surprising Data Points about the Venture Capital Market

Tom Tunguz

AUGUST 7, 2023

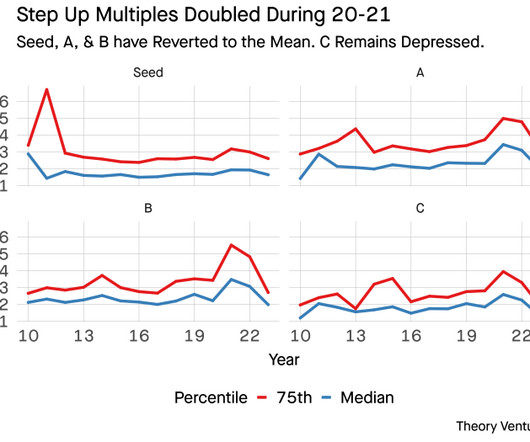

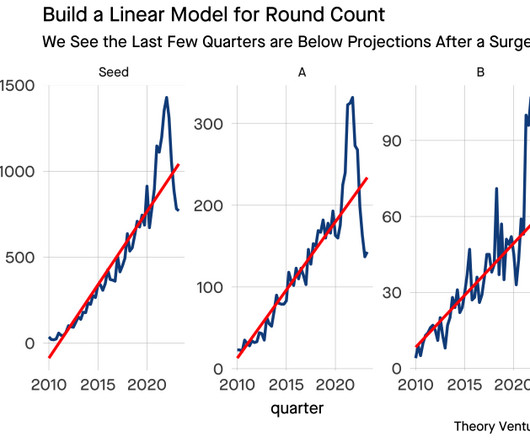

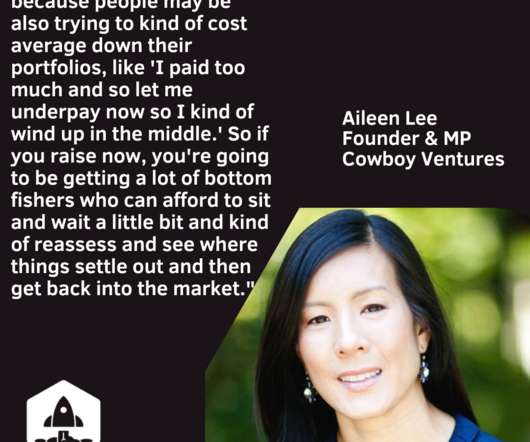

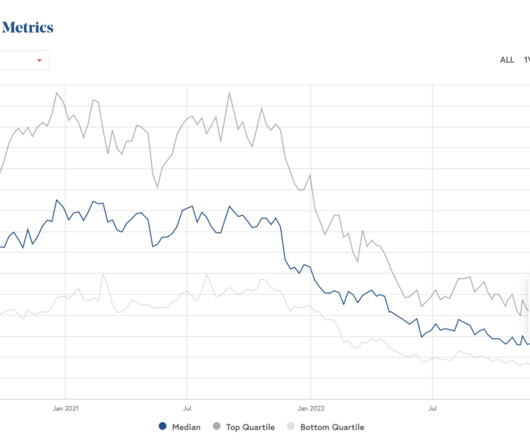

Curiously, this is roughly consistent with the lengthening in sales cycles software companies are enduring with customers. Perhaps there’s a parallel in buyer psychology in software & in venture capital. Time between rounds has jumped about 40%. Seed valuations remained relatively constant.

Let's personalize your content