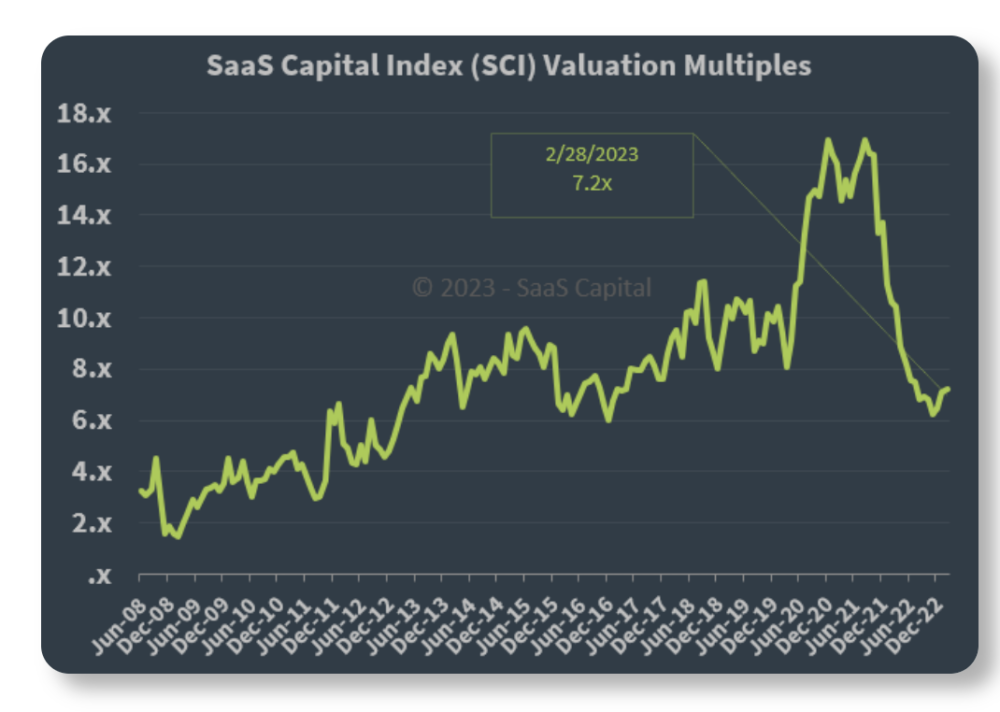

The SaaS Capital Index from SaaS Capital had a nice summary this week of the 3 low points we’ve seen in SaaS multiples, and this chart puts things in great context:

As you can see above, in the early days of SaaS … it was tough to be a public SaaS company. Public multiples often were around 4x-5x in 2008, and then the global meltdown came, and public multiples fell to as less than 2x revenue for a while.

Then, well, right after we sold EchoSign to Adobe way back in 2011, things picked up, with a slow with material and steady increase in public multiples from 2012 to 2015.

At 8x or more ARR in the public markets, SaaS all of a sudden for many people, became interesting for the first time. It was just too hard to make money at 4x ARR.

And then the “Flash Crash” of 2016 came, our first big hit. It seemed really bleak when enterprise SaaS spend stopped growing for the first time — albeit briefly. The markets panicked, and LinkedIn sold itself to Microsoft for what now seems like a bargain.

But buyers came back, and the Flash Crash of ’16 didn’t last. Multiples basically kepy growing until a peak of about 17x in August-November 2021.

And then, the markets began to crater once again, the biggest fall of our SaaS lifetimes, and hit a local low in November 2022. That’s when SaaS revenue multiples fell back to 6x, the lowest rate since 2013.

Since then, as you can see above, the markets have recovered a bit. We’re at about 7x ARR on average now, which is below the average for the past decade but still materially up from the lows of November 2022.

Where will it go from here? We can talk about inflation, and interest rates, and more.

What we do know is that many top SaaS companies are growing at still epic rates even at $1B in ARR. And that while the scale of the upturn and downturn in ARR multiples was unprecedented the past 3 years, fueled by Covid impacts, overall there’s a clear set of trends, and that this is really IMHO just the third SaaS correction over the past 11+ years of a strong run.

My bet is that multiples will at least go back to the prior averages, and have room to grow 20%-30%.

But we’ll see.

I did a deeper dive on SaaS multiples, and what that means for founders and SaaS execs, below at SaaStr APAC: