So one large category of software spend is on Point of Sale systems. The one most of us know best is Toast, because we all use Toast so often when we go out to dinner. And it indeed has strong market share there. And perhaps the one we know second-best is Square. But “POS” systems and software are everywhere, and are a lot more than just Toast and Square.

One leader in SMB commerce is Lightspeed Commerce, founded way back in 2005. They are strongest in retail, but also have a presence in restaurants as well. And their mix of software, payments, and hardware revenue drives up the total deal size — but puts a lot of pressure on margins. They’re at a $750,000,000 run rate, not that much smaller than Toast, and are still growing a very healthy 24% (!). But the margins are tough.

5 Interesting Learnings:

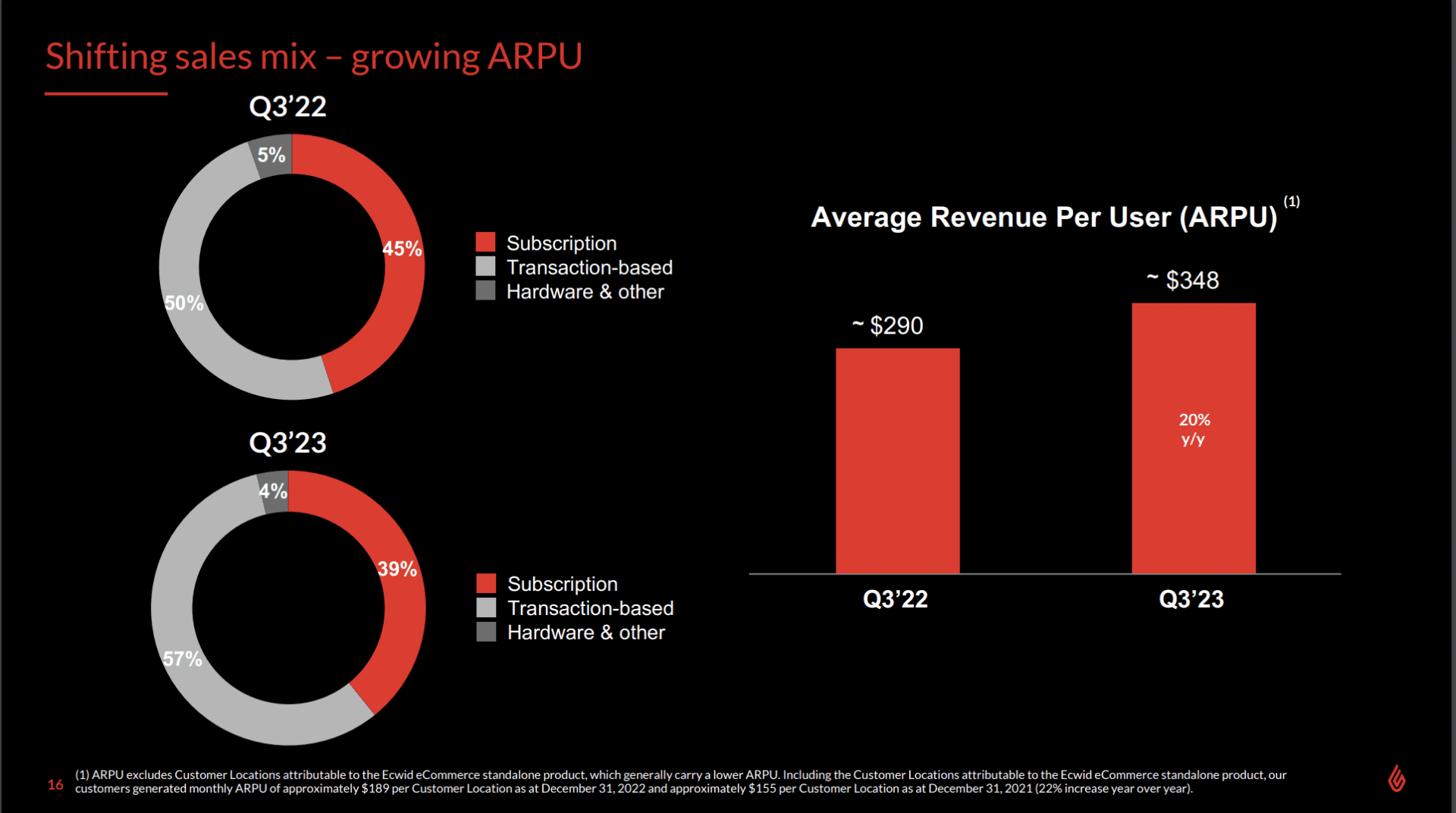

#1. 39% of their revenues from software, and going down. While Lightspeed is at a $750m run-rate, only $300m of that comes from software, and the percent from high-margin software is coming down. Payments are the largest segment (like Toast and Shopify as well), but at least low-margin hardware is a small percent of revenue. Software subscriptions are only growing 9%, vs. 41% for payments / transaction revenue.

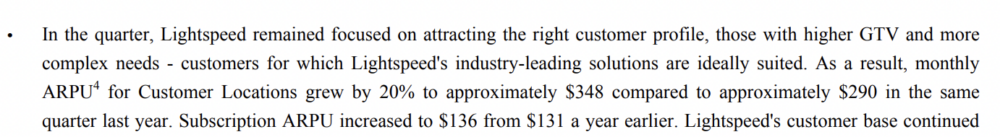

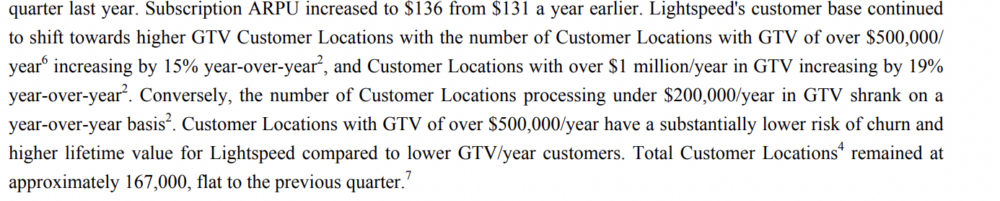

#2. Driving up ARPU at scale key to growth with SMBs. It’s exciting to sell to SMBs, but one of the existential challenges at scale is the low deal sizes. Lightspeed has driven its ARPU up from $348 per location from $290 last year. That’s a material increase in pricing and ARPU. The gains were almost all from transaction fees, though. Subscription fees were essentially flat.

#3. Larger customers growing, smaller customers aren’t. We’ve also seen this with Asana and Zoom, in different categories. Lightspeed’s ARPU at $1m+ GTV customer locations is growing 15% a year — but those at under $200,000 a year GTV are shrinking.

#4. Growth Despite Flat Customer Locations. Lightspeed’s customer count has actually stalled. It ended this past quarter with 167,000 customer locations — flat with the prior quarter. But driving payments processed up 17% on a constant currency basis helped boost revenue growth, for now.

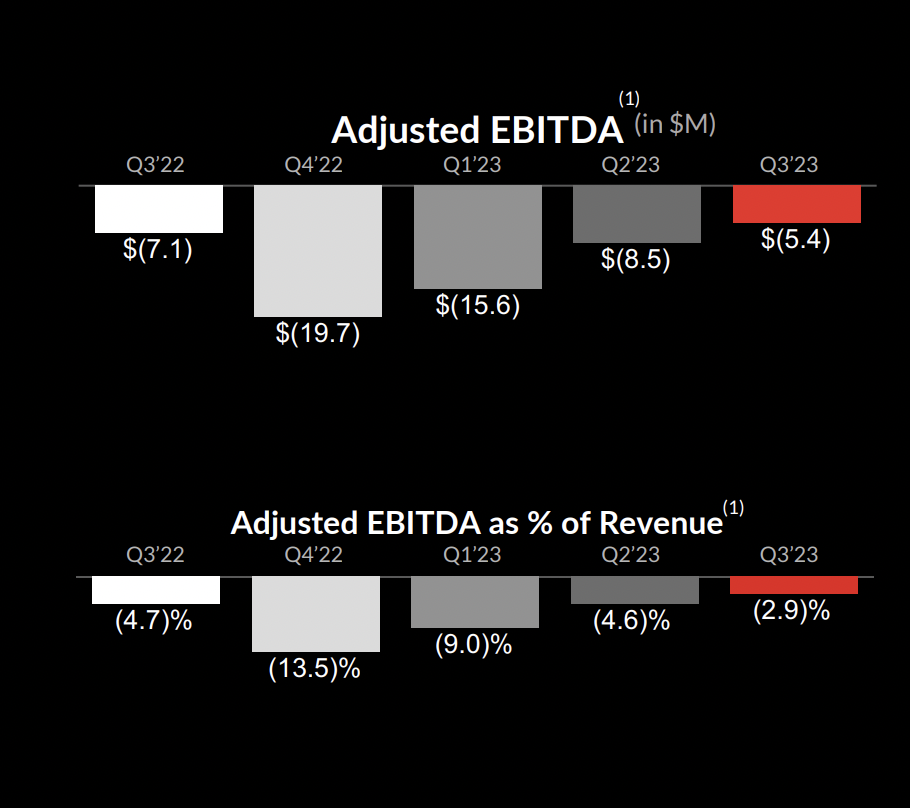

#5. Not EBIDTA positive yet. Selling a hardware + software + payments product to SMBs in a highly competitive space with low ARPUs … is hard. While Lightspeed is approaching EBITDA positive, it hasn’t gotten there yet, even though it’s approaching a $1 Billion run-rate.

And a few other interesting learnings:

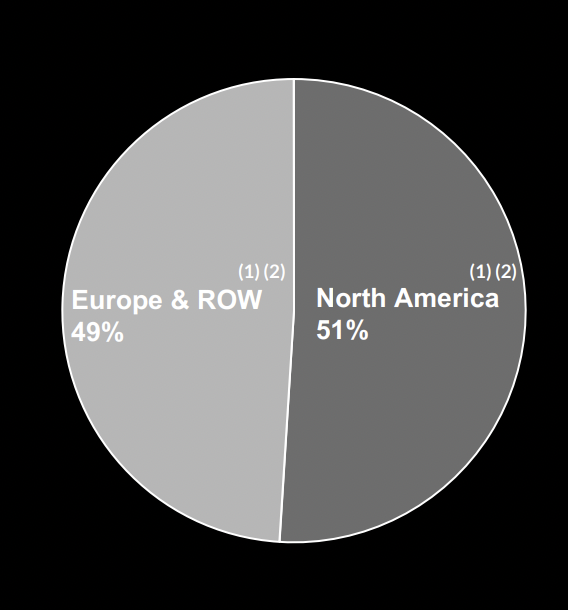

#6. Almost 50%/50% in terms of International:North America revenues. Go global when it works, folks! Some of this is due to a lot of M&A Lightspeed has done, but still interesting to see.

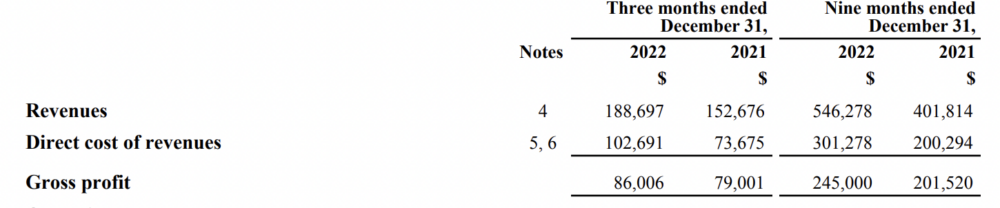

#7. 45% Blended Gross Margins. A struggle Toast also has, and Shopify has to deal with as well Payments are exciting to add to a SaaS business. But the margins usually are much lower. On a blended basis, Lightspeed’s margins are only 45%. Not bad for a payments company, but very low for a software company. If your gross margins are much below 60%-65%, Wall Street won’t really see you as a software company.

Today, Lightspeed is a $2.2 Billion (USD) market cap leader. A nice multiple of its $300m software business. But a pretty low multiple of its overall $750,000,000 business, with payments and hardware added in.

Adding payments and hardware to software can be exciting, and in many categories, is necessary. But know thy margins. Trading for 3x revenues is tough.

And more on Toast which has a similar mix but is growing faster, here: