So is Square a SaaS company? It’s not even Square anymore as a company … it’s now Block. The majority of its revenue is now from Bitcoin transactions, not “traditional” payments and software.

And yet … and yet … its engine is all software and really SaaS. At least still for now. Its software and services business is the one with the real operating margins. It’s core. Square is still a high-margin software company at its core with a large but low-margin payments business on top. And while growth has slowed a bit, its net revenues are still growing an impressive 29% at a $16 Billion run-rate.

Let’s see what we can learn from a SaaS perspective:

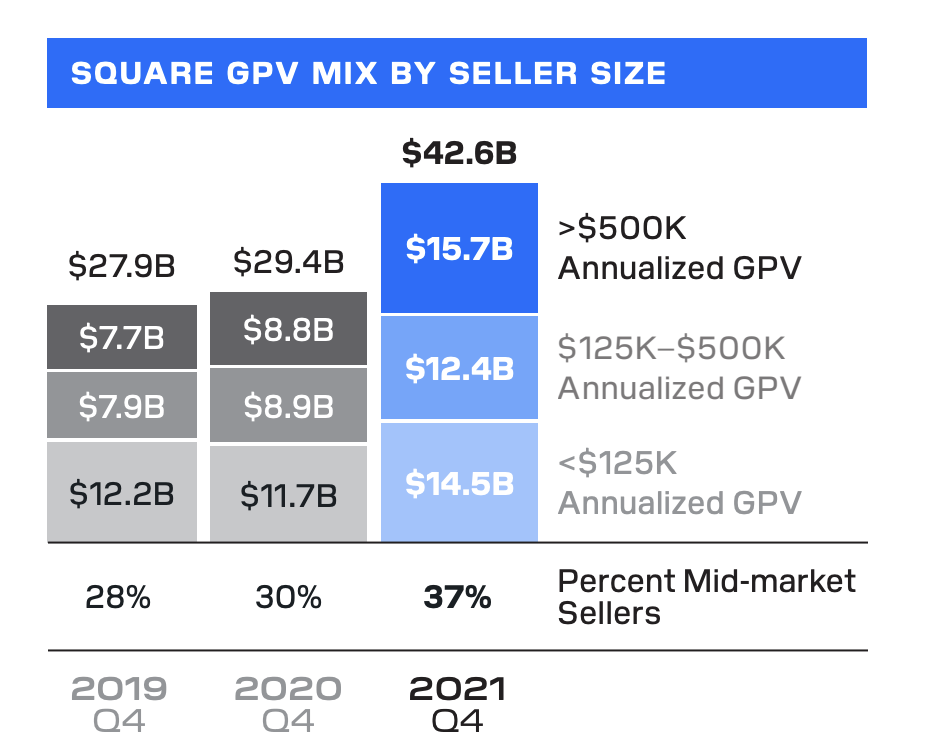

#1. Going upmarket. Square waited to go upmarket, but now like many Cloud leaders, it’s a core engine of growth. Square gross profit from mid-market sellers was up 73% year over year in the fourth quarter and 47% on a two-year CAGR basis.

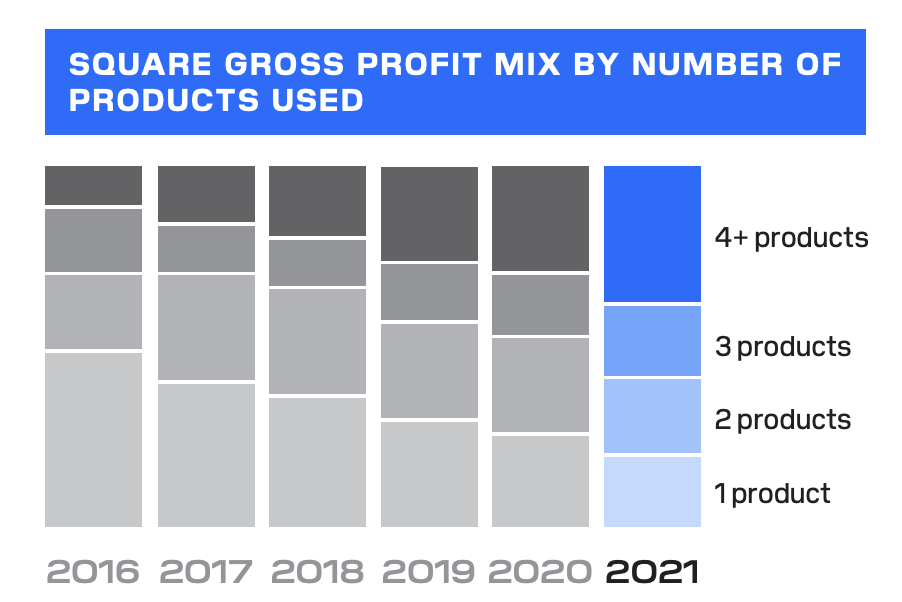

#2. 38% of Square’s gross profit came from sellers using four or more products, up from 10% five years ago. A reminder of the power of going multi-product. Sellers using four or more products generated more than 10x the gross profit on average in 2021, compared to sellers only using one of Square’s products.

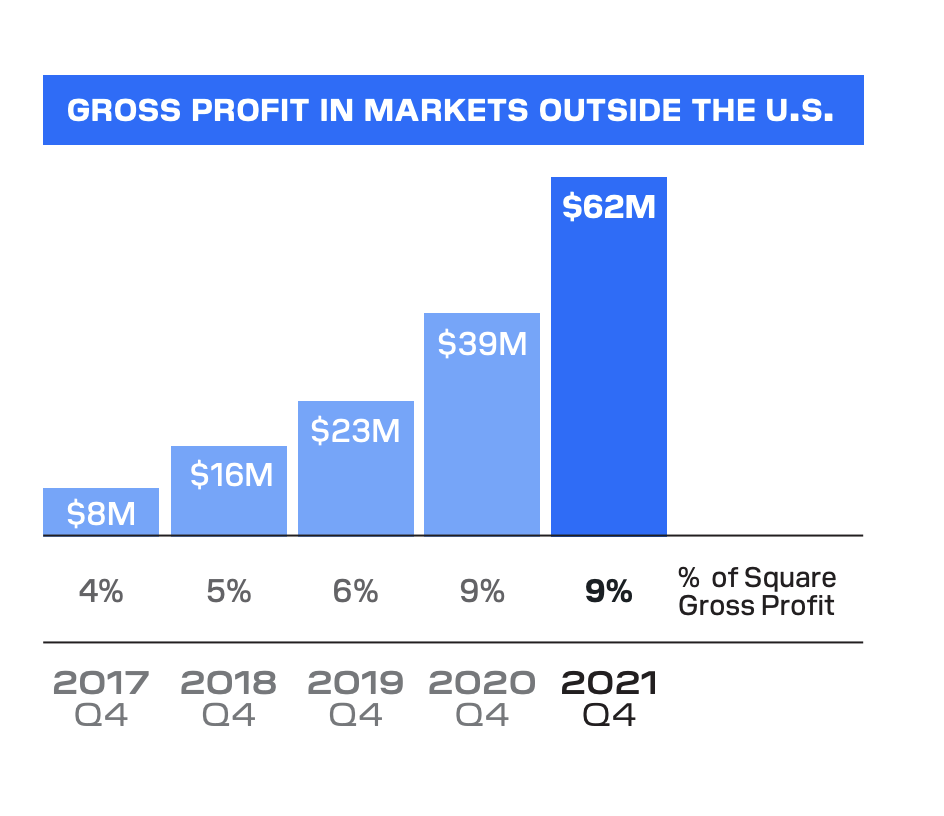

#3. Going global is tougher in payments and fintech. Only 9% of Square’s revenue is international, but going up. This pattern is hardly unique to Square, we’ve seen it with Bill, Toast, Shopify, and more. Going international takes a lot of work in many fintech SaaS businesses.

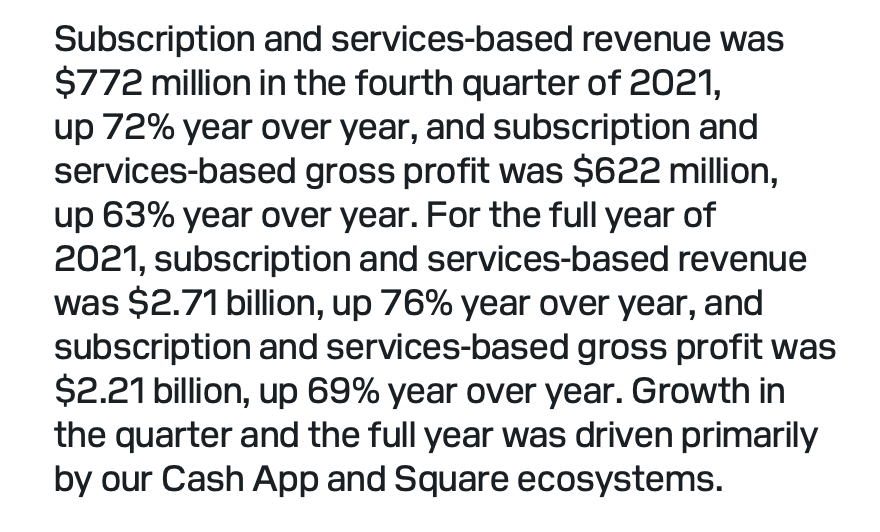

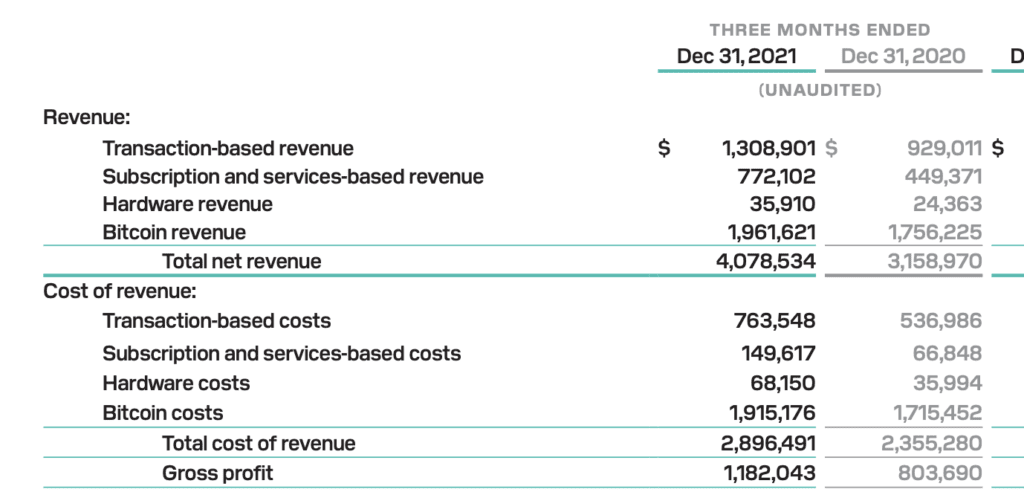

#4. Subscriptions and services are growing 72% at a $3B run-rate. So while just under 20% of Square/Block’s revenue, subscriptions are growing the fastest and with the highest margin. And the core.

#5. 80% Gross Margins in Software and Services, 40% in transactions … and 2% in Bitcoin. Crypto is now their largest revenue stream, but the margins aren’t there — yet. While transactions are 2x the revenue of software and services, each makes about an equal contribution to the bottom line. And they lose money on hardware, but don’t do much of it themselves anymore on a relative basis. This is a good model to think about for roughly similar startups. Try not to spend too much on hardware. And try to get blended software + payments margins still above 60% if you can. Square is at 57% margins blended between transaction revenue and subscription/services:

There’s a lot going on at Square / Block. and a lot of it isn’t SaaS-y. But as so many of us add payments and similar services to our SaaS products, there’s still a lot we can learn here.