Few SaaS leaders have gone through more post-pandemic change than Shopify and Zoom. Zoom came out of 2020-2021 with SMBs no longer growing, but a huge boost in the enterprise. More on that here.

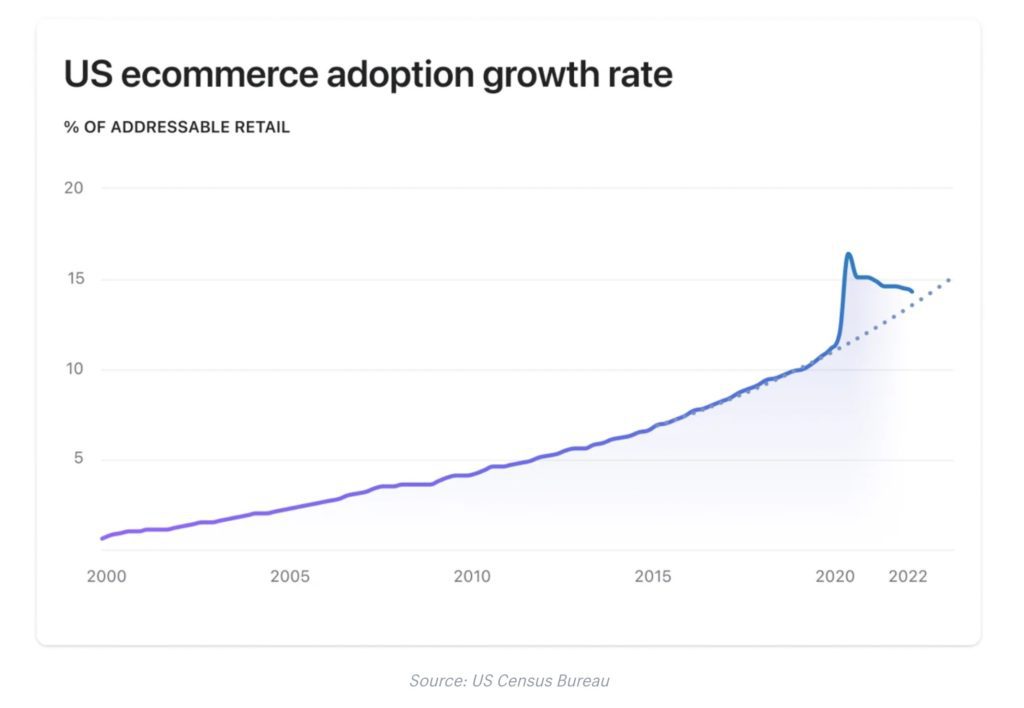

And Shopify came out of all this still growing, but not nearly as much as any of us expected at peak Covid. Not due to lack of execution, but due to a rapid return to on-site and IRL shopping. Folks that wanted to go online, stayed online. But folks that didn’t really want to sell online, sort of stopped when they didn’t have to anymore.

From CEO Tobi Lutke:

And with that, some of the most torrid growth we’ve ever seen … when Shopify went from $1.6B ARR to $3.2B ARR in just one (!) year … returned to a bumpy normal at $5B in ARR.

5 Interesting Learnings:

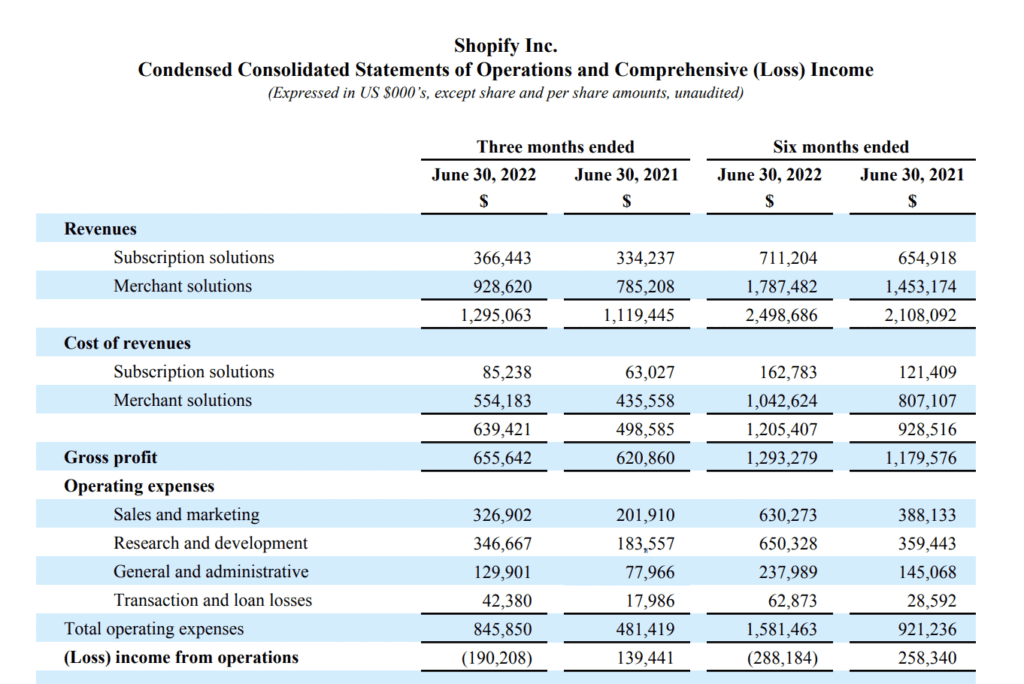

#1. SaaS growth slowed to 10% year-over-year, down from a peak overall growth of almost 100% (!) during peak Covid in Q3 2020.

Shopify returned to earth, and is now growing just at the overall rate of e-commerce.

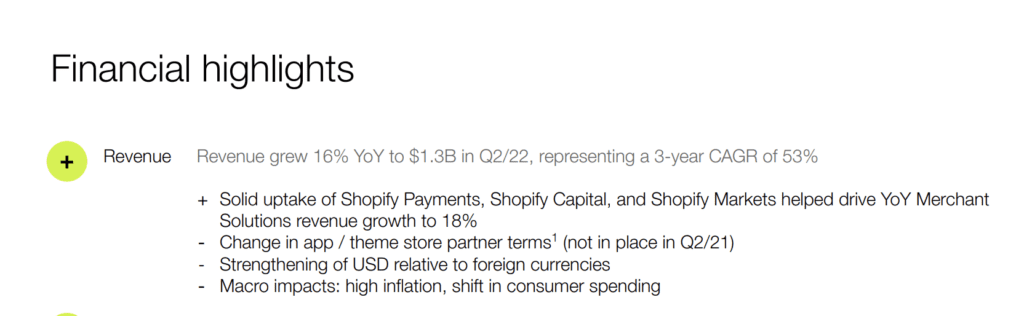

#2. Payments still materially accelerating overall growth to 16%, and predicting revenue growth from payments and merchant solutions to more than double that of subscriptions and SaaS.

A huge chunk of Shopify’s post-IPO growth has been due to payments and merchant services, and even in a time period of slowing growth, that’s still true. But — margins are materially lower.

#3. Expecting a bit of a rebound later in the year, with more merchants joining the platform in 2H’22 than 1H’22.

Part of this may just be the big holiday rush in ecomm, but Shopify is predicting a rebound from these 1H’22 lows.

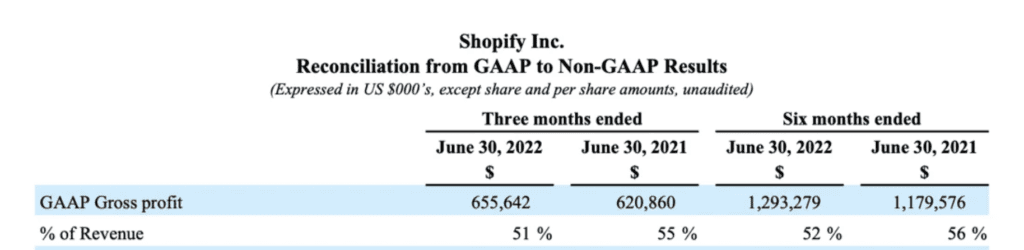

#4. Gross Margins declining toward 50% as payments, merchant services, and more outpace the growth of SaaS subscriptions.

Software is more profitable than payments, usually, and Shopify is no exception. As merchant services continues to outpace software revenues, gross margins are dropping, from 56% to 52% in the trailing six-month period. Payments can scale rapidly, as can more and more fulfillment services coming soon. But Shopify is less and less a SaaS company because of it. Its gross margins from merchant services are only 42%. And once gross margins fall below 50%, a company really isn’t a software company anymore.

#5. Only spending 25% of revenue on sales & marketing.

This is one of the secrets to Shopify’s success. While its gross margins aren’t as high as a pure software company, its self-serve and PLG motions, and strong brand, enable it to spend relatively less on sales and marketing — just 25% of revenues, far less than the 40%-50% that other SaaS leaders spend. And it enables Shopify to spend more on engineering and product than sales and marketing — very rare for a public SaaS company.

So it looked like Shopify in late 2020 and 2021 would dominate a new world. A world where e-commerce was brought forward 5+ years, almost overnight. And they did dominate that world.

But in 2022, we rebounded back to a new version of the old world, instead. Where online e-commerce continues to grow, but folks still want to shop offline as well. A painful rebound, but one no one really could predict. Or quite get right.

And as part of that, Shopify may no longer really be a software company. But more a lower margin payments and fulfillment company with a software layer. One more like Amazon. And less like a website builder for online stores — where it all started.