What Is Merchant of Record (MoR)? How It Can Become the Backbone of Your Online Transactions

Establishing a smooth and streamlined online transaction processing setup is important for every business. When payment processing is smooth, the flow of the recurring revenue stream automatically remains steady. So, many companies have started offering Merchant of Record payment processing services.

Also, businesses that need to hunt investors for their innovative projects must opt for Merchant of Record (MoR) services. Why? MoR service providers take complete responsibility of payment processing for a business. One does not need to worry about tax liabilities, rules, or regulations. MoR providers manage everything so that you will not need to do anything.

What Is MoR?

Today, it has become more and more complex to process payments for any business. There are so many rules regulations and tax liabilities that even financial experts are sometimes perplexed to help businesses streamline their payment processing. Considering these situations, Merchant of record payment processing is introduced.

Merchant of Record (MoR) is a legal organization in charge of overseeing all financial transactions, such as the selling of goods or services. It takes on responsibility for every transaction with the final consumer, managing chargebacks and refunds as well as tax duties, PCI compliance, and payment processing. In essence, a memo of requirements (MoR) simplifies the financial parts of business dealing with the intricacies of payments and guaranteeing legal and regulatory compliance for a smooth client experience.

How to Use MoR for Your Online Transactions?

The Merchant of Record (MoR) is the entity that lies between the retailer and the customer so as to process transactions. The role of the MoR service provider is to process payments from customers’ accounts to the merchants’ accounts. They cut a certain amount as their share. Also, the amount of tax is deducted that one is bound to pay to process payments. All rules and regulations are followed and MoR is liable for that.

However, the retailer receives the amount without getting into this hassle in the end. And that’s how the MoR works.

MoR for Subscription Businesses

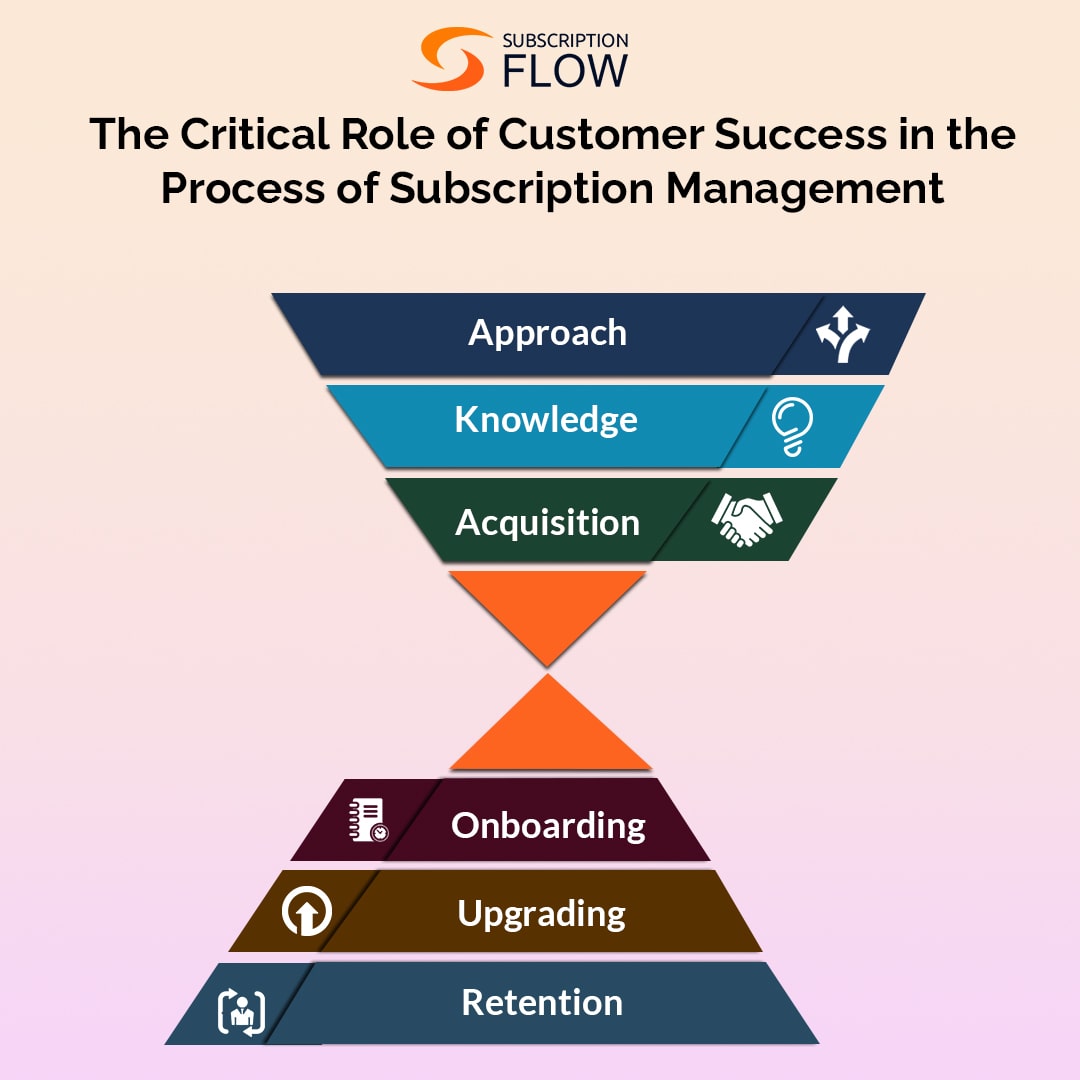

A Merchant of Record (MoR) is essential for subscription businesses to streamline and secure recurring transactions. The MoR, as the legal body in control of payments, handles the complexities of subscription billing, making sure that the services are accurately billed on time. Subscription-based businesses may concentrate on providing value to their clients because the MoR assumes responsibility for handling recurring payments, resolving any difficulties like chargebacks or refunds, and handling subscription modifications. Furthermore, MoR services offer a full solution for the financial side of subscription business operations by facilitating compliance with tax legislation and PCI requirements.

MoR & SubscriptionFlow—Subscription Management System

SubscriptionFlow is a subscription management system that automates billing, recurring revenue management, customer retention, analytics, reporting, and a lot more. There are diverse features that SubscriptionFlow offers. Also, there are many integrations that are offered by our subscription management platform.

However, recently, we have come up with an amazing feature for our users. Now, SubscriptionFlow offers Merchant of Record (MoR) services as well. So, if you want your transactions to be completed seamlessly, then contact team SubscriptionFlow now.

In the subscription business world, the most important thing is customer trust, and payment processing is the point where you win or lose the customer trust. It is very important to make or break businesses to have a robust payment processor. Today, with technological advancement, there are many payment methods and processors that businesses opt for. We are telling you the standard with which you can see whether your payment processor is the right one or not. This is the customer trust. If your customers trust your payment processor, then your payments and transactions are being finalized by the right processor.

SubsciptionFlow has facilitated its users to win customer trust which will result in long-term customer relations as well.

Also Read: Distinguishing Dynamics: Navigating the Realm of Merchant of Record vs Seller of Record

Merchant of Record (MoR) in 2024

Now that the New Year has started, businesses actively plan for the whole year at this time. They go for audits to find out what worked and what not. Merchant of Record will not only help you this time but in the long run as well. It is the future for subscription businesses as it fortifies good-will relations with customers.

Acting as a pivotal point for enterprises, MoR oversees all payment procedures and assumes liability for transaction-related obligations. In the rapidly changing world of digital commerce, MoR plays a critical role in coordinating safe, smooth transactions and guaranteeing adherence to norms and laws. MoR services are anticipated to use cutting-edge technologies, like blockchain and artificial intelligence, to improve efficiency and security in 2024, going beyond its fundamental role in payment processing. This will give businesses a strong platform for their financial operations in the ever-evolving online marketplace.

In 2024, if you want to stay progressive and want to have a tech stack for your subscription business that can help you process payments and maintain the flow of recurring revenue stream, then you need to adopt SubscriptionFlow right away. Its MoR feature will transform your online payment processing in a way that this year, you will surely multiply