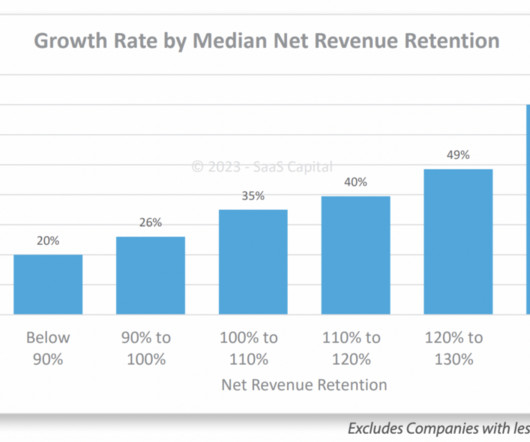

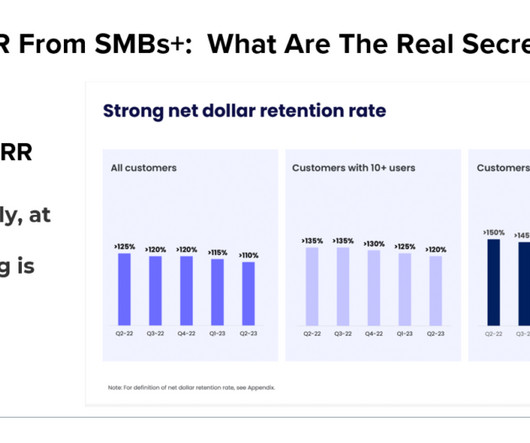

SaaS Capital Survey of 1,500 SaaS Companies: High NRR Startups Grow Twice as Fast

SaaStr

SEPTEMBER 2, 2023

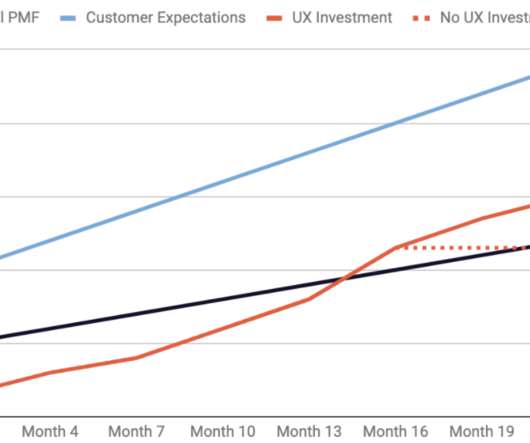

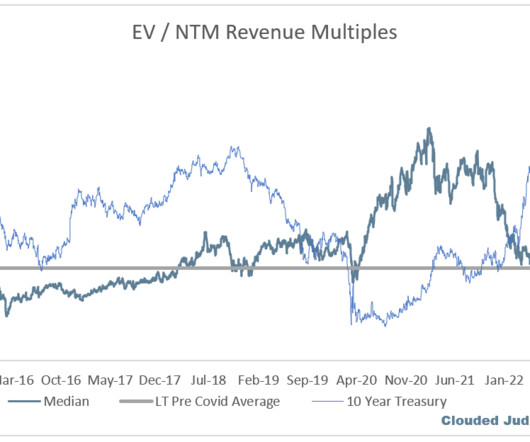

But there are multiple ways to build a leader, and startup don’t always start off with high NRR even if they end up there. This relationship is a rare example of increasing returns from investment in upsells and cross-sells. This is a rare example of increasing returns from investment in upsells and cross-sells.

Let's personalize your content