Product-Market Fit in Different Capital Environments

Tom Tunguz

MAY 2, 2022

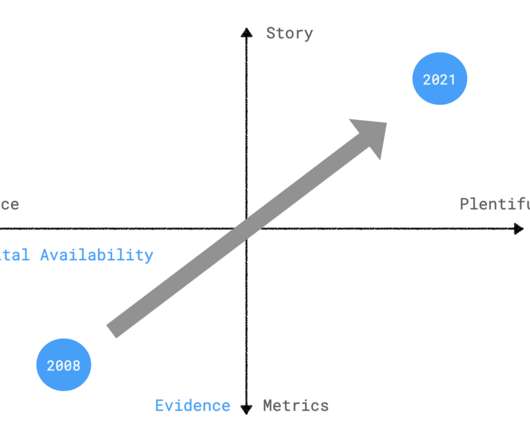

When I asked him what he meant, he replied because capital was so plentiful and accessible today, he hired more expensive people, spent more time developing a product, and invested with a longer time horizon before demonstrating evidence of success. Invest -> Grow -> IPO/M&A -> Re-invest.

Let's personalize your content