Can We Even Afford to Do SMB Sales in the U.S. Anymore?

SaaStr

SEPTEMBER 19, 2023

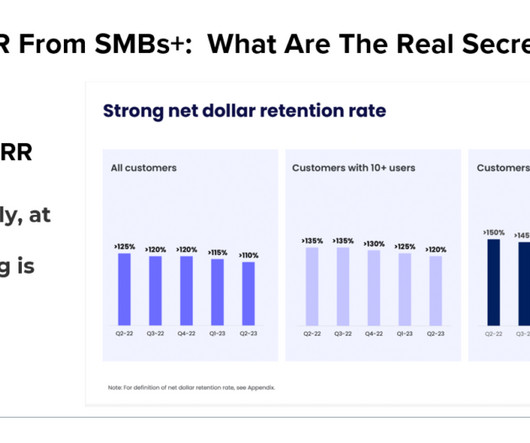

based SMB sales positions. Almost every SMB SaaS company I work with has moved most of its sales team outside the U.S. Almost every SMB SaaS company I work with has moved most of its sales team outside the U.S. These all sprung up as more cost-effective centers of excellence for SMB and even some mid-market sales reps.

Let's personalize your content