Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital?

SaaStr

JULY 5, 2023

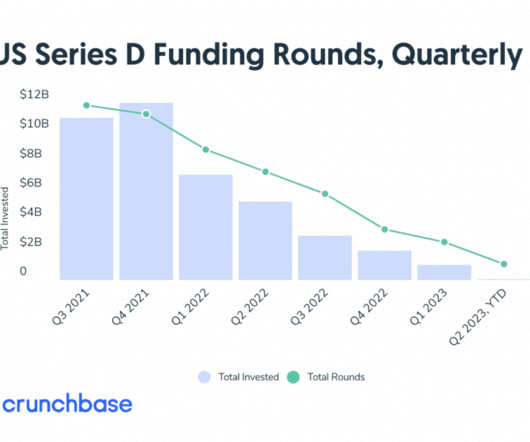

Dear SaaStr: Is Late-Stage Venture Capital More Stressful than Early-Stage Venture Capital? If you do late stage investing … well, every company you invest in is pretty darn good and growing nicely. In SaaS, growth investments generally will all be at at least $20m ARR, or $40m ARR, or more.

Let's personalize your content