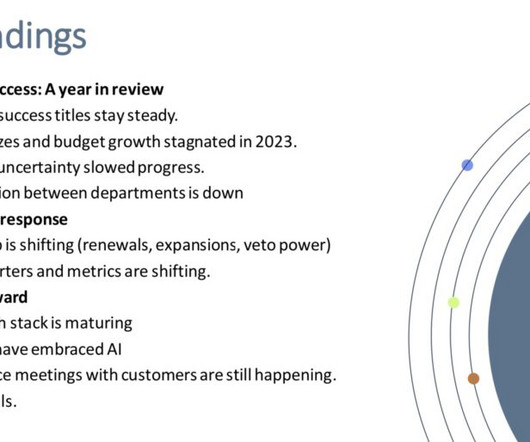

The Typical Startup Saw a 24% Increase in Sales Cycle in 2023

Tom Tunguz

MARCH 27, 2023

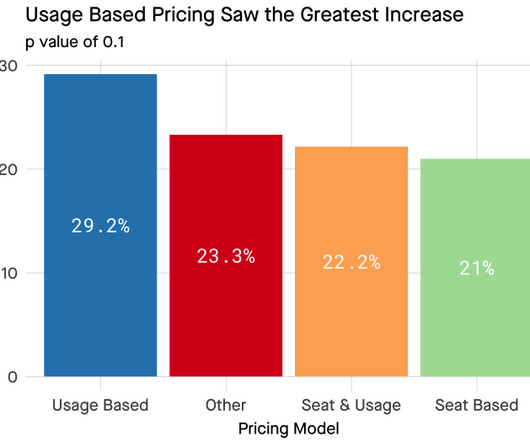

Startups selling to enterprises have increased 36%, twice those of Mid-Market & SMB focused companies. Mid-market & SMB distributions skew left with up to 10% of businesses reporting a decrease in sales cycle during the period. This figure is statistically significant with a p value of 0.0005.

Let's personalize your content