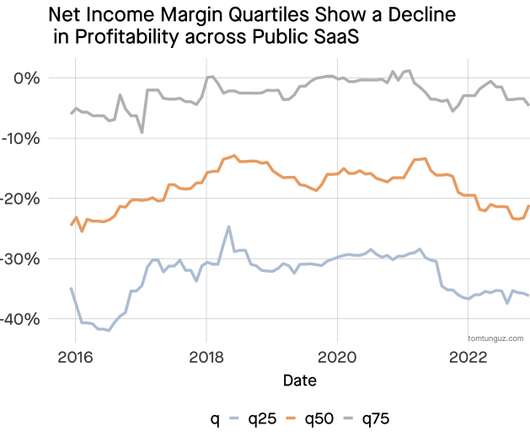

PLG & Profitability : More Product Doesn't Necessarily Mean Greater Profits

Tom Tunguz

DECEMBER 6, 2022

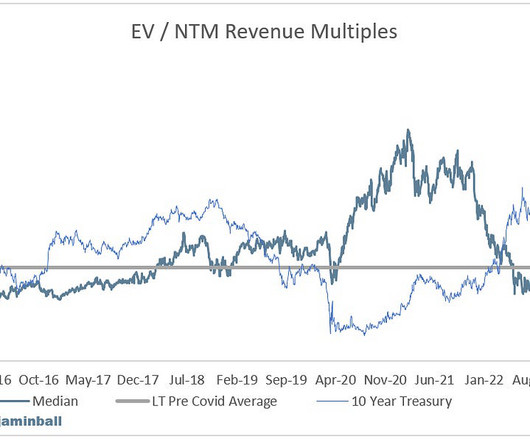

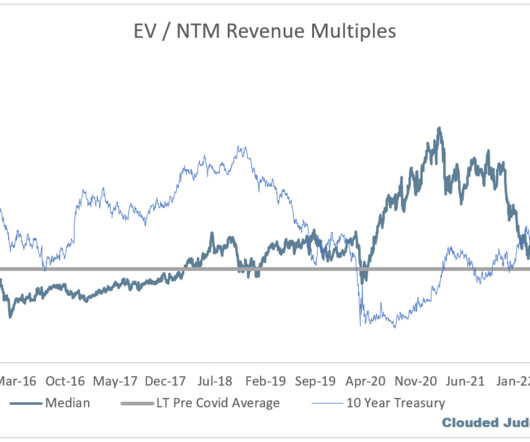

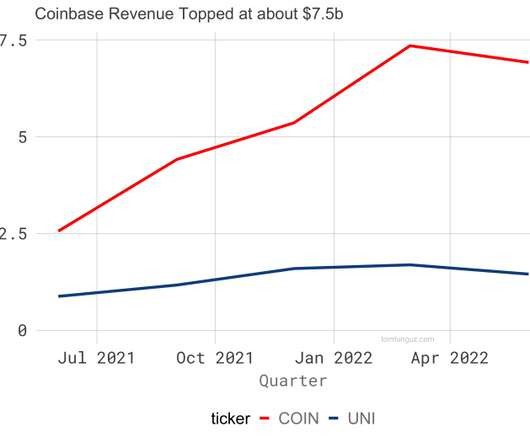

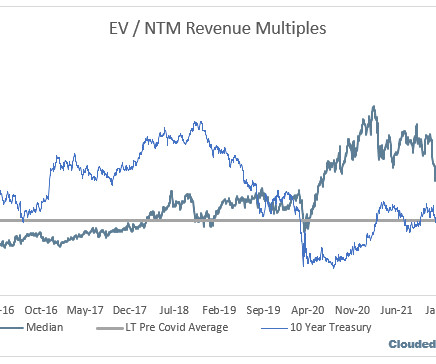

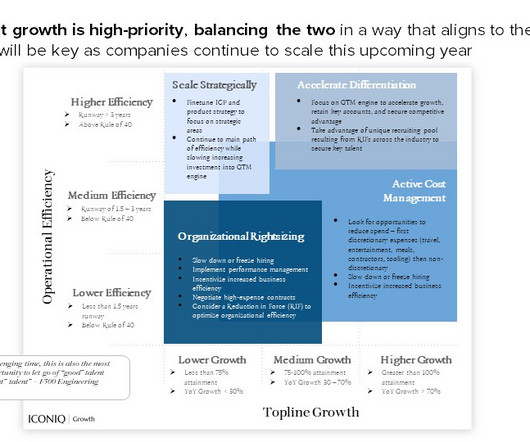

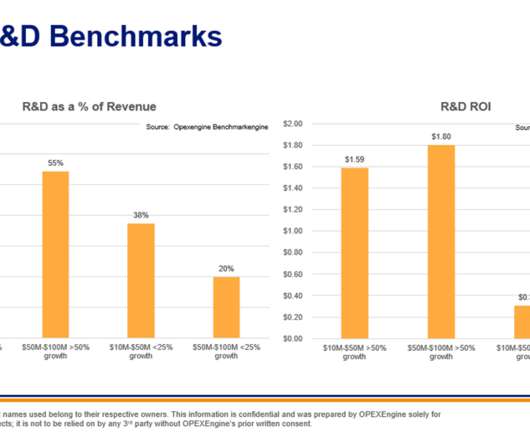

Post-Covid Metrics. PLG companies R&D spend hasn’t produced new business at the same rate as a dollar invested in sales & marketing post-Covid. Some about the data: PLG companies R&D spend hasn’t produced new business at the same rate as a dollar invested in sales & marketing post-Covid. GTM Motion.

Let's personalize your content