So you’ve nailed your pitch for startups and are looking to hook your first mid-market customer. But suddenly, the buyer is a bunch of different people, and they want a bunch of new features. What do you do?

Vanta’s Chief Revenue Officer, Stevie Case, shares lessons learned from leading Twilio’s mid-market team and shepherding Vanta into a mid-market leader as the company’s first CRO.

Case shares the playbook for the “messy middle” to prevent the very predictable problems you run into in the middle ground of the mid-market, that space between SMB and enterprise.

Why The Mid-Market Is So Messy

The mid-market is hard to define. Some define it by headcount, typically around 200-2000 employees, and others by revenue, generally $10M to $1B annual recurring revenue.

Those lines get set on either boundary based on the buying behavior of who you’re selling to. So if you’re selling into companies and their buying behavior changes around 50 employees, you may draw the line there.

These lines will be very specific to your business. Why would you care or want to sell into this middle ground?

Well, it’s particularly relevant right now in our economic climate. The unit economics in the mid-market can be much more attractive than in SMB. These people have money and a budget.

They’re usually more stable than an SMB profile, yet they can move much faster than an enterprise.

Mid-market typically has a single decision-maker, at least to begin with, who will make a buying decision worth millions quickly. It’s worthwhile to chase this segment at a time like this.

So what are the challenges you’ll run into with the messy middle?

Customers Start To Buy Like Enterprises

When customers start to buy like enterprises, this introduces a variety of challenges. Enterprises have all sorts of requirements, like security reviews. As the mid-market company grows, it starts to act more like a bigger company.

They’re starting to build procurement processes and set themselves up to buy like an enterprise, even if they aren’t quite there yet.

You want to be ready for this to ensure you can serve this market and prevent hitting speed bumps, particularly late in the sales cycle.

There’s nothing worse than getting a deal to the finish line, your champion and executive buyer are ready to put signature to paper, and on that last day, you get a call saying they forgot to fill out a security questionnaire or check some boxes that were instituted only last week.

The solution

Get your security certifications in order and make sure all boxes are checked, and offer that information to the buyer before they ask for it.

To keep things moving smoothly, have a mutual close plan in place. The keyword being “mutual.” If you’re a seller, you’ve likely done some form of close plan before. You write the steps on paper and what it looks like to close a deal.

The key in mid-market is to create that close plan in writing and share it with your buyer and your champion to confirm those are the actual steps to close a deal with that company. By taking this step, you force them to figure it out. You’re helping them help you.

Multiple Stakeholders Gets Confusing

Who can make the decision to buy at the company you’re going after? Sometimes your customer won’t know. Sometimes, they’ll say it’s them. They’ll think it’s them. And, in reality, it’s not.

You have to help them discover who the decision-makers are and what their procurement process is.

In rapidly growing companies, the headcount can go from 500-3000 in a matter of months. This means confusing titles might be thrown all over the place, new departments are budding, and the company is in mild disarray as they figure themselves out during these growth spurts.

This can be tough, especially in mid-market with a fast-growing company. The stakeholders, and your buyer, can change from the front of the deal to the back.

The Solution

Your team needs to be multi-threaded, connecting with multiple decision-makers on the purchasing side. The new titles and stakeholders might not make sense initially, but you don’t want to write these people off. They could be your buyer in the future or the now.

Your job is to de-risk this deal, and the earlier you bring people into the mix, the less risk there will be and the less chance for your deal to slip.

You can work around this issue by qualifying buyers early. Talk to your champion, often the founder, and map out who’s new. Ask for conversations with folks even if they aren’t on the current stakeholder list.

The more perspectives in the mix, the less likely the deal gets hung up on the back end. You’ll also educate your champion as you work through this “mapping out” process.

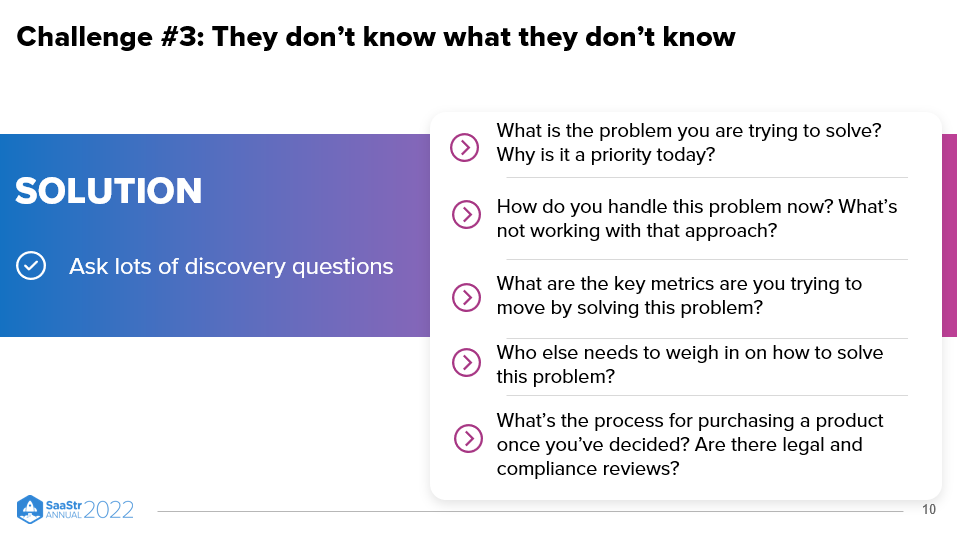

Buyers Don’t Know What They Don’t Know

That’s why you’re here. To show them what they don’t know. Often, your champion might not know how their company buys software. They might think they know, but the reality may be very different once you’re down the path of procurement and trying to close the deal.

SMB companies are usually one decision-maker, and they can move as fast as they want. The enterprise has a more defined process. You’ll likely know who you’re selling to, but it’s a much longer process with a lot of people involved.

And the messy middle?

They usually don’t know their own processes, and once they do, the company is growing so rapidly that those processes might change by the time you start or close the deal.

The Solution

How do you impose order in the chaos and land those big deals in the mid-market? Through a killer discovery process.

You’re dealing with a champion, a buyer, often a founder, looking at a company that will look drastically different 12 months from now. Things move fast. You need to help them map their buying process. To do this, you can do a discovery process in a way that’s respectful and helps your champion understand how their business is changing.

Some of the questions you can ask your buyer are:

- What problem are you trying to solve, and why is it a priority today?

Asking, “why now?” creates urgency. - What metric is this company trying to move by buying your software?

For some, it may be user adoption or reducing churn. - How will you define and measure success, and why does it matter?

- Who needs to weigh in?

You’ll have to ask this question every time you multi-thread and talk to someone new. - What’s your process for purchasing once you’ve decided to buy?

The person you’re talking to probably won’t know even if they tell you they know. Have them write it down and figure it out together.

The Takeaway

You can avoid painful lessons when dealing with the mid-market by understanding the landscape of this unique set of buyers. All three solutions presented by Case will help you get deals over the line more quickly and give you a rock-solid forecast your leaders can trust.

- Get your ducks in a row — security certifications and anything else your buyer needs before they need it.

- Get multi-threaded and qualify buyers early to de-risk the deal.

- Develop a killer discovery process to impose order in the chaos of a fast-growing company.