The Most Popular Financing Round in 2022

Tom Tunguz

JUNE 17, 2022

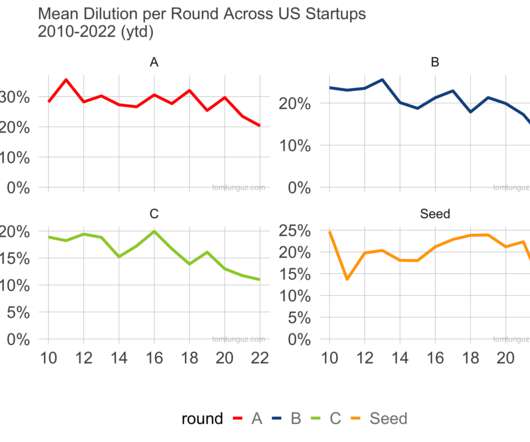

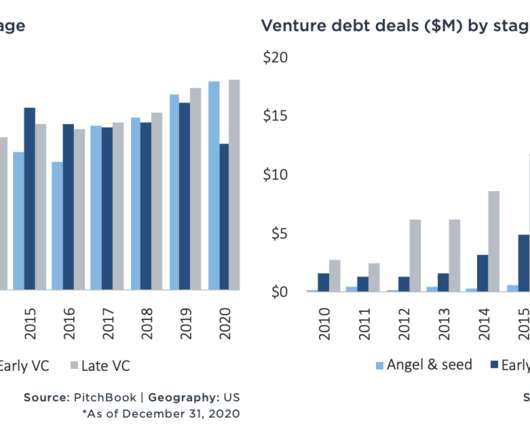

Across financing rounds, dilution from capital has fallen by 30-50% in that decade. Here’s a table of cumulative dilution points for a hypothetical startup raising 4 rounds in one year. Series A has dropped from 30% to 20%; Series B from 22.5% to 12%; and Series C from 18% to 11%. Cumulative Dilution Points.

Let's personalize your content