The Pilgrims Raised 4 Rounds of Financing

Tom Tunguz

JULY 22, 2023

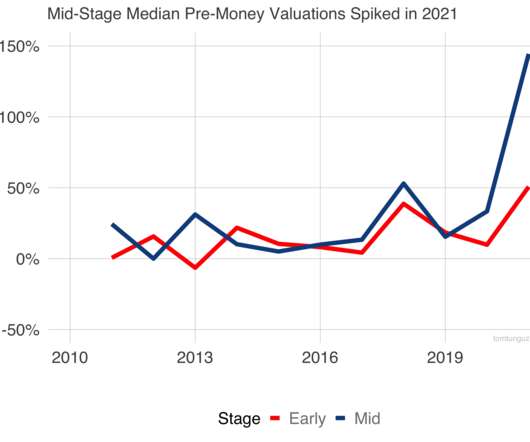

The Pilgrims who journeyed across the Atlantic to colonize America raised four rounds of financing sent via ship each year during the summer. The second round of financing, the Series A, was the hardest to raise because the colonists missed plan : pirates pillaged their beaver pelts. Understanding history is a competitive advantage.

Let's personalize your content