The Top 10 Important Finance Mistakes First Time Founders Make

SaaStr

JANUARY 24, 2022

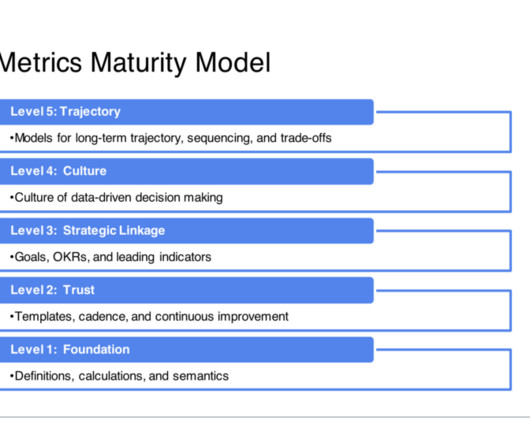

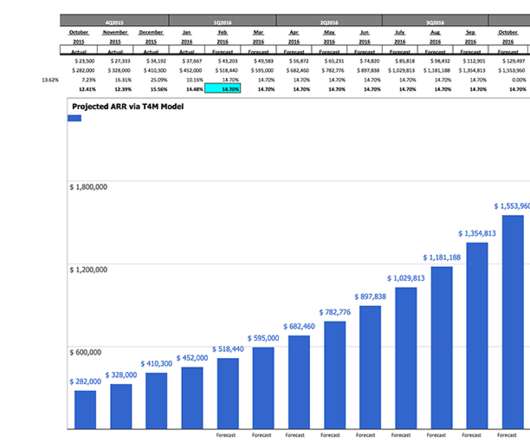

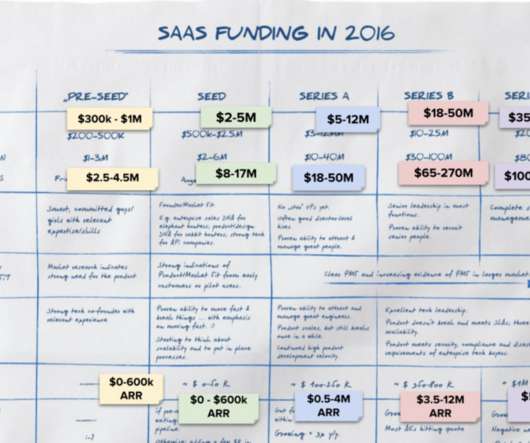

Take a read if you are still running finance yourself, or just have an part-time outsourced resource. In the old days, we didn’t have to worry about finance too much. SaaS accounting and finance has gotten pretty complicated, and the impacts of getting it wrong have gone up substantially. Accounting and Finance.

Let's personalize your content