While Elon Musk is working on taking humans to Mars, the way people and businesses move money internationally has not changed in decades. Whereas we can now tap our credit cards to pay for domestic goods and services, making a cross-border payment remains an inefficient and cumbersome system. This is because at its most basic level, international payments still come down to two things: actually moving the money, and then sending that money through compliance and workflows—both of which have their own complications.

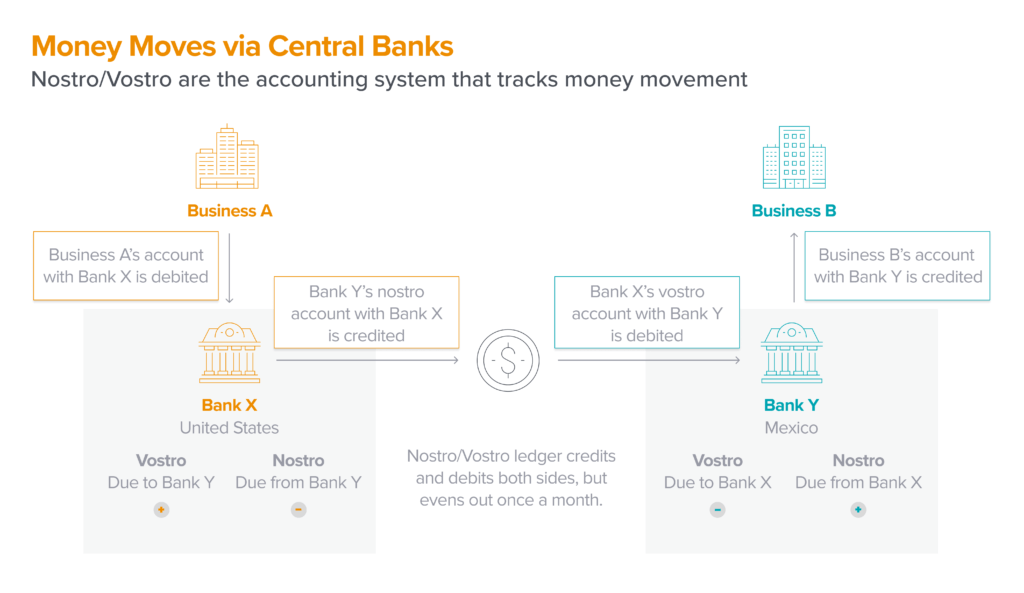

To better understand this, picture a bank in Mexico and a bank in the U.S. that both have customers who want to send payments to each other. Because these banks aren’t leveraging the same local payment networks, these banks can’t directly pay each other. Instead, to complete the transaction, the banks rely on correspondent banking and must stitch together a shared ledger between disparate banking and payment networks.

This shared ledger results in Nostro accounts, the account of Bank A’s money that is being held in Bank B, and Vostro accounts, the amount of Bank B’s money that is being held by Bank A. These accounts tally debits and credits between correspondent banks. Therefore instead of actually “moving” money from country to country, central banks use local payment rails to settle what’s owed between parties. All of this is tied together by SWIFT (Society for Worldwide Interbank Financial Telecommunication), the secure messaging system that helps these stakeholders communicate. These two aspects—money not actually “moving” and SWIFT not actually sending money anywhere—are common misconceptions when it comes to global payments.

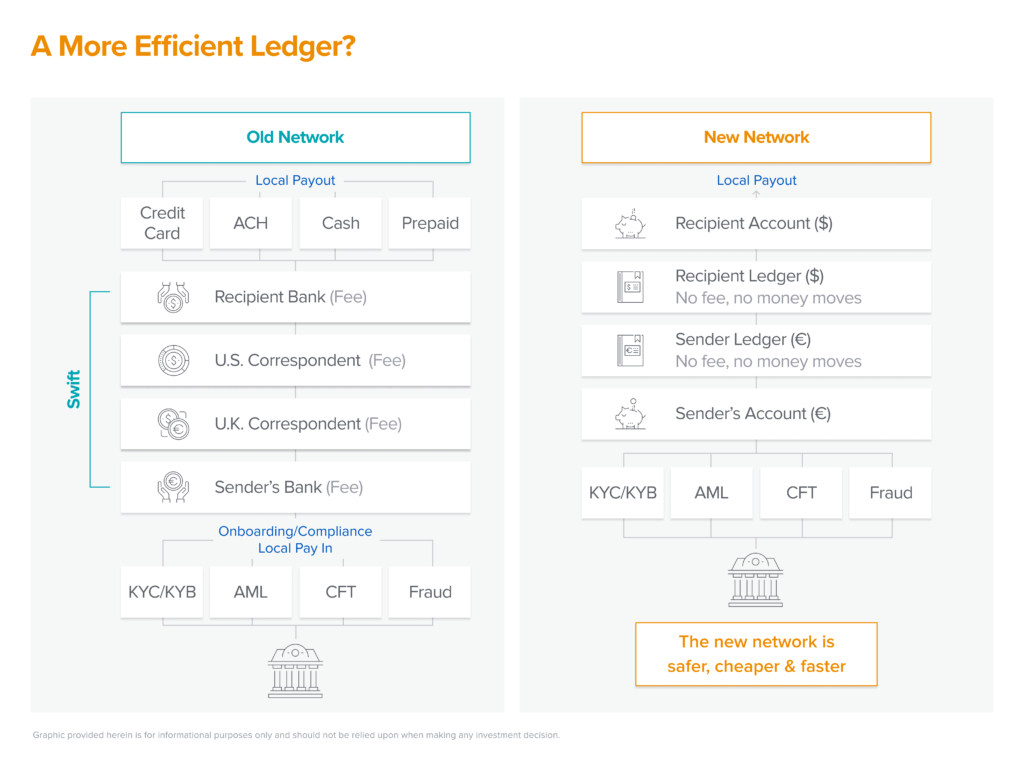

So, if money never moves, why do cross-border transactions take so long and cost so much to complete? As you might guess, the distributed global ledger is to blame.

First, to complete a transaction, originating institutions (“payers”) must manually complete a number of tasks to ensure they are collecting proper documentation and adhering to the compliance methodologies of the receiving bank. As there are few ways to reliably share this collected information (SWIFT’s simple messaging, for example, cannot), receiving banks often have less information on transactions than they want. This exposes them to various regulatory risks and the potential loss of their Nostro Vostro account.

Each transaction also requires payment network interoperability and numerous intermediaries to complete each transaction. This leads to transactions taking 2 to 30+ days to clear, slowing down financial institutions and customers alike. Furthermore, these delays assume the transaction is even possible. As Nostro Vostro requires bank accounts, unbanked individuals often have little recourse when they want to move money across borders.

But what if someone could create a different way of moving money by creating a new network outside of Nostro Vostro?

Let’s break down this idea. Any new network would introduce a classic two-sided marketplace problem that would require significant scale and balance on both origination and receiving. At maturity, a new network business might aggregate sufficient endpoints to recreate an internal version of Nostro Vostro that lives outside of traditional systems. In doing so, it would eliminate certain costs and shorten the time to transfer funds, in the absence of any intermediaries.

While our portfolio company Wise has built this out beautifully for consumer and small business applications, we’ve also seen businesses cluster around three main wedges to create other types of business payments. Most notably, we’re seeing tremendous innovation on the infrastructure side for both incumbent banks and fintechs. For banks, we’ve seen software providers working to directly connect originating institutions (payers) with clearing institutions (receivers) by starting in the onboarding and compliance layers. For fintechs, who are in many ways solving the same problems, we’ve seen companies create new digital on-ramps to existing global correspondent banking networks, which might in turn create their own intra-ledger payments networks. Additionally, we’ve also seen B2B neobanks be built for certain types of international businesses (such as high-volume exporters) where there is a need for industry-specific software and high individual transaction amounts.

Below, we’ll dive a bit deeper into how these three wedges might evolve over the coming years and create great businesses that will improve the existing workflow (regardless the outcome of any new networks).

TABLE OF CONTENTS

While cross-border payments increased substantially from 2011-2019, the number of active correspondents fell dramatically across both developed and developing economies. Since the vast majority of payments volume will continue to come from traditional methods for the foreseeable future, there is an enormous opportunity to help traditional financial institutions (FIs) modernize the way they move money internationally. This is because these FIs are not just losing fees associated with international money movement; they are also losing clients to other FIs that can help businesses move money internationally. Therefore solving this problem is a major priority for FIs, especially in regard to both compliance and revenue.

Namely, these banks need to figure out how they can stay compliant with various regulators, identify and stop financial crime, and identify and stop fraudulent actors. Doing this requires a modern compliance and workflow stack, and we’re seeing companies like Payall solve this problem by increasing KYC/KYB oversight (thus pleasing regulators) while decreasing the friction and costs associated with the transaction (thus pleasing banks).

If a company can create a new way for originators and receivers to communicate downstream, it’s highly plausible a company could also help orchestrate these transactions on both sides of the network and in turn, drive down costs and improve money flows.

TABLE OF CONTENTS

While, for the near future, the majority of cross-border volume may continue to come from existing financial institutions, certain (often underserved or ignored) customers might be better served by an entirely new banking experience. Wise, for example, has been solving this problem horizontally with Wise Business, which enables small international businesses to pay suppliers and employees while managing expenses.

But even as Wise continues to expand its offerings, horizontal solutions often can’t help everyone, and certain international companies may have unique banking and software needs that may be better served by more vertical-specific tools. Take a very high-volume sender, such as an exporter who needs to both manage their business as well as move large amounts of money. This type of company can create unique compliance headaches for traditional banks, so building compliance workflow tools and KYC processes designed specifically for this can help serve more businesses that might traditionally be turned away by banks. Companies like Silverbird and Kapapa are building in this exporter centric market, while others like Levro are working on similar solutions, but for startups.

These types of international businesses often transact with each other—a supplier in Asia might be working with a manufacturer in Europe—and in creating this new verticalized experience a new entrant might create a new network.

TABLE OF CONTENTS

A major reason we’ve seen an increase in B2B neobank activity is because of the rapid advancement of the picks-and-shovels companies that enable these businesses. Whereas in the past, a new neobank might have to build out its own integrated network of financial institutions to power the cross-border experience, companies can now turn to providers like Stripe, Airwallex, and CurrencyCloud for global networks of financial institutions starting on day 0. These providers, combined with banking as a service partners, have dramatically reduced the time to market for new global neobanking solutions, and they have created the financial infrastructure needed to start to aggregate supply and demand.

While these infrastructure providers aren’t necessarily operating at the application level, they are still accumulating customers on both sides of the transaction. Unlike new B2B neobanks that might be focused on a certain type of customer, these providers can be more horizontally focused, which may create opportunities for the scale increases needed to build a new global network.

These three categories constitute a few ways a business might address the complexity associated with cross border payments, notably through addressing compliance and KYC/KYB issues. By solving these hard problems, a business might earn the right to enter into, and monetize off of, the cross border flow of funds, regardless of whether or not it ever creates a new network.

We’ve written about how companies will move money in the 21st century and how those businesses will be default global, and banking and payment solutions need to improve to support that future. We’re excited to back category-defining businesses that enable simpler cross-border money movement.

-

Joe Schmidt is a partner at Andreessen Horowitz, where he focuses on fintech and insurtech.

-

Anish Acharya Anish Acharya is an entrepreneur and general partner at Andreessen Horowitz. At a16z, he focuses on consumer investing, including AI-native products and companies that will help usher in a new era of abundance.