Design partners, or the first few users of a company’s software, are often a key part of the early software development process. By providing valuable feedback on everything from product functionality to user experience, to pricing and packaging, the right design partners can help a company launch and find product-market fit faster. That said, despite their importance, many companies lack a framework for assessing how to find and engage a potential design partner, and end up wasting valuable time with unimpactful partners that are providing misleading feedback or not using the product in the right way.

Having worked with dozens of startups in their zero-to-one journey, we have seen countless companies successfully (and unsuccessfully) work with design partners. To help you find and evaluate these critical collaborators, we have summarized our learnings into a three-part assessment framework based on urgency, capability, and representativeness.

TABLE OF CONTENTS

Before we lay out our framework, let’s first expand on the necessity of using design partners. Design partners are the first few users you enlist to help you define your company’s problem space, and they help you shape your solutions as you gear up your product for market. Not every company needs them, but having a handful of transparent, engaged users or prospective customers can guide you through your first iteration of the product’s functionality, user experience, pricing and packaging, and more.

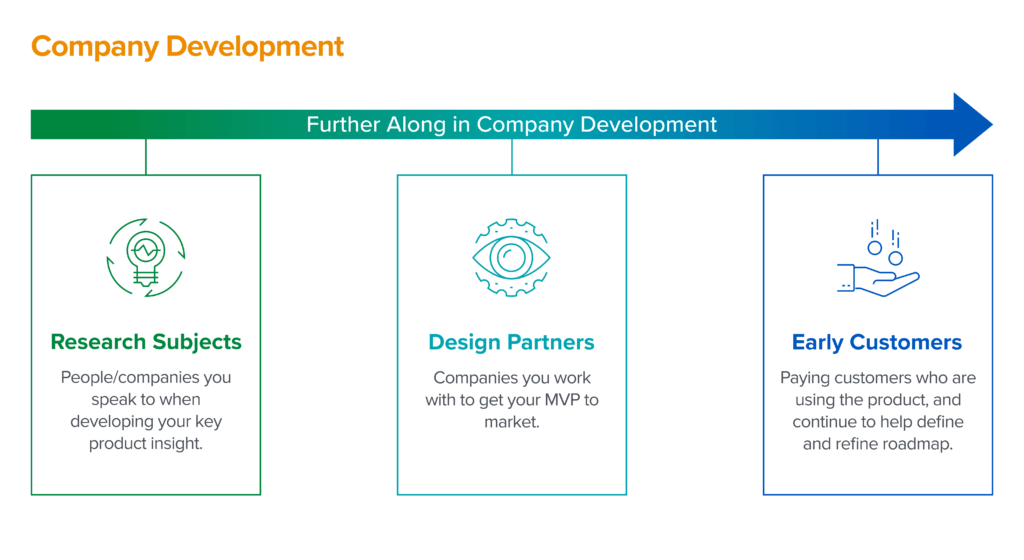

Different companies start engaging with design partners at different stages of their development, as partners can swing between being research subjects and true early customers who will (eventually) pay for your product.  What we’ve observed is that the former is better than the latter. Why is this? It’s because your number one priority is to iterate quickly on the MVP. You want your users to tell you, what is the problem they are facing, what is the solution today, and is your product a better alternative than the status quo—in the most raw and honest form possible. Design partners are not cheerleaders or lighthouse customers, nor do they replace the need for a core product insight or “earned secret” that you gain from having studied the market. Their critiques should help you build something useful and usable for your broader customer base. If they turn into initial paying customers, that’s great! They’ve validated your hypothesis. But to start, you should focus less on whether they are going to pay you and more on if they experience the pain point you want to address or represent the future ideal customer profile. Also, keep in mind that the product you put in front of them can be a mock or prototypes and be manual on the backend, as long as you can effectively communicate the idea and collect feedback.

What we’ve observed is that the former is better than the latter. Why is this? It’s because your number one priority is to iterate quickly on the MVP. You want your users to tell you, what is the problem they are facing, what is the solution today, and is your product a better alternative than the status quo—in the most raw and honest form possible. Design partners are not cheerleaders or lighthouse customers, nor do they replace the need for a core product insight or “earned secret” that you gain from having studied the market. Their critiques should help you build something useful and usable for your broader customer base. If they turn into initial paying customers, that’s great! They’ve validated your hypothesis. But to start, you should focus less on whether they are going to pay you and more on if they experience the pain point you want to address or represent the future ideal customer profile. Also, keep in mind that the product you put in front of them can be a mock or prototypes and be manual on the backend, as long as you can effectively communicate the idea and collect feedback.

TABLE OF CONTENTS

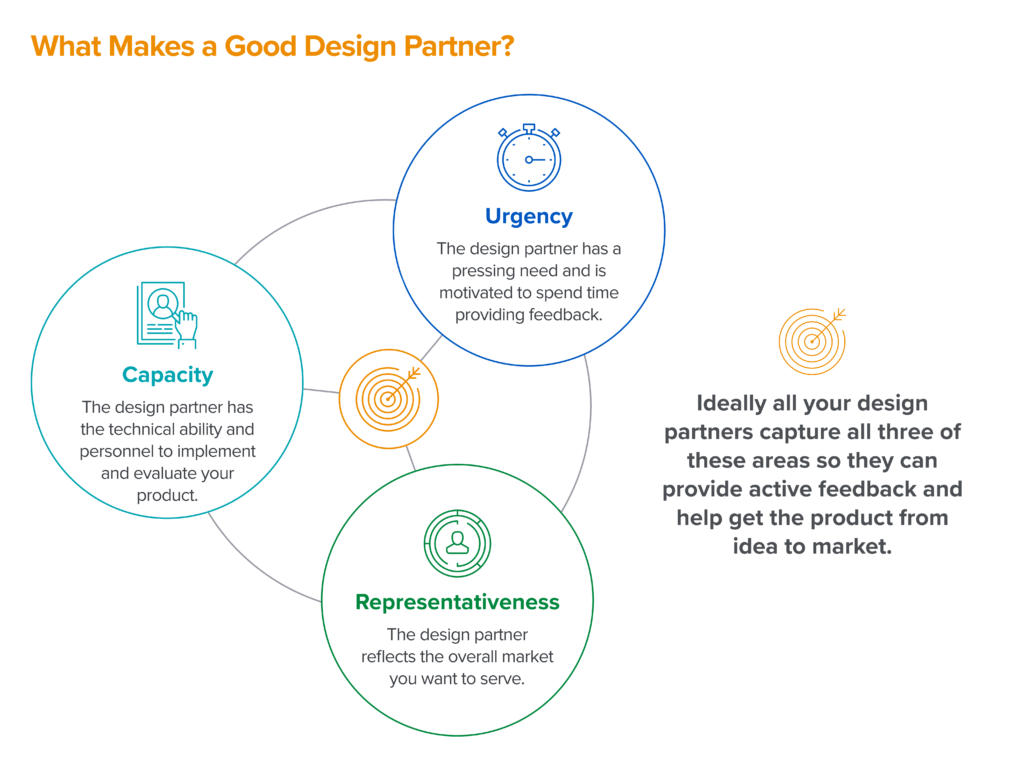

When you are ready to work with design partners, we recommend you assess them using three key criteria:

- Representativeness (of a broader market)

First, the design partner should represent the market you wish to serve. How similar are the needs and systems of the design partner to those of the companies you interviewed as part of your customer research journey and to those of the overall market? You want to avoid overfitting to a particular customer or, worse, building out custom software that only serves one customer.

Representativeness can also refer to the buyer persona of the design partner. Are you working with the right internal stakeholder at your design partner’s company? Are they the one who is going to reflect a similar stakeholder within the organizational structure at other potential customer companies? Your target buyer persona may change over the course of the design partnership too, and you may realize there’s actually a stronger fit for your product with a different buyer—that’s OK!

2. Urgency

The best design partners have a real need for your product. They are excited to work with you and help you shape the product because they are invested in finding a solution. Often, prior to using your product, they’ve evaluated or tried other products or even hacked together a stop-gap measure internally. They want a new product right away!

Urgency is usually higher at scaling companies that value speed and efficiency vs. larger companies, which generally move more slowly, take more time to build trust with, and need to secure more approvals before implementing something new. Early stage startups (Seed, Series A) usually have a lot of urgency, but they may not be the best design partners because their requirements shift often, and they tend not to spend time evaluating alternatives.

One benefit of finding design partners with high urgency is that they can help you spot segments of the market with higher velocity. The same pain point can be shared broadly among an industry or organization, but not all segments are the best first adopters. You want to find the launchpad in a segment with higher urgency—either because they are being hit the hardest by a technology transition or the legacy solution has key limitations. For example, Databricks launched their fast cloud analytics engine as companies struggled with managing large Hadoop clusters on premise. Plaid provided mobile-first onboarding and a faster API-based authentication and account linking process because legacy micro-deposit options were too slow—plus, Venmo was asking for their service. These higher-velocity segments can catapult you into the broader market.

3. Capacity

Finally, the partner needs to have the capacity to actually work with you. This means they can technically implement the product (e.g., they are collecting the right data, have the right software stack, etc.). It also means they have the personnel capacity: the right person with whom to work. Ask yourself, do they have an employee who can be the internal champion of this project? Do they have the ability to actually implement the software? Do they have the time to provide regular feedback? CEOs often get excited about products, but they aren’t the buyer or user and can’t actually force an organization to use a tool, or to use it many times. You want to find a real buyer who can inform you about their implementation details as well as their buying decisions. Obviously, they should also be willing to experiment.

While early stage startups have urgency, they can be harder to work with because they aren’t stable enough internally. A number of things may be changing internally (the organizational structure, the budgets, even the product), and less money is spent on experimenting. On the flip side, they can also be easier organizations to navigate, especially when the product is complex.

TABLE OF CONTENTS

Once you have selected the right design partners, there are a number of tactical considerations you should take into account to make the relationship as productive as possible.

Starting the Conversation

When starting to find design partners, warm connections are best. Just ask around! We’ve also seen companies have a fair amount of luck posting on Twitter or LinkedIn or through targeted cold outreaches. This is because anyone who responds to a post or a DM about being a design partner likely has a burning need for your product and has been seeking a solution; you can evaluate if they have the right user profile you’re looking for after.

Structuring the Relationship

Once a design partner has agreed to work with you, the most important thing to optimize for is having recurring feedback over time as the product iterates. Make sure they answer questions like: How well does the product work? How does it interact with their existing workflow and tools? What are the potential hurdles to get it set up? Does the MVP match your expectations for what was promised?

Sometimes a founder or executive will agree to a design partnership, but the actual person (or team) at the company who must use the product is not on board. Depending on who’ll be the eventual internal champion, getting feedback from only one, but not the other may result in disconnection or mis-identification of persona. You’ll want to have both the potential buyer and the actual user in the design partnership arrangement. The latter could be really beneficial especially in the phase where you’re validating the usability and features sets of the product. Ideally by the end of the period, they are using the product on their own.

To keep everyone on track, we recommend you sign a contact with your design partners, though this is not 100% necessary. A contract is helpful when it comes to defining the amount of time you’ll be collecting feedback from your partner. It also helps you clearly set the expectations around feedback, ensure everyone is in agreement, and define the length of the engagement (e.g., one, three, or six months, with biweekly check-ins via phone calls or meetings). Contract discussions can also help you discern if a design partner won’t have enough time to provide the level of feedback you need—information that’s more helpful before you’re too far down the path with someone.

Selecting An Ideal Number of Design Partners

We recommend starting with five to 10 design partners. Sometimes companies get excited by the amount of inbound interest they’re seeing in the product and will try to sign up more than 20. Having a lot of demand can be a great sign of pull, but the more partners you have, the more conversations and expectations you’ll need to manage, especially if you need to shift direction or try something new. It’s better to have just a few initial design partners to iterate quickly with, and then turn the rest into early customers once the product is ready to go to market. The number of design partners you choose also depends on the type of product you need feedback on. If you’re building for a specific persona and going deep on a particular functionality, say an authentication tool, finding 5 high-quality design partners may be enough. But if you’re building a horizontal product for a sales ops team, you may want to go broader to find companies in different sectors and stages to uncover more market insights.

Converting Partners Into Paying Customers

Notably missing from the framework above is a design partner’s willingness to pay and the proposed size of a potential contract. When you’re initially bringing on design partners, receiving feedback is more important than getting paid and debating contract size. In fact, getting into pricing models and negotiations early on can distract from and slow down the process of getting a product built. That said, if you sense that the design partner is willing to pay, that’s a great sign of market pull and business viability. Just remember to focus less on optimizing the contract value until the product is ready.

Ideally, after your design partner has been using your product and you feel like the product is ready for market, you can begin focusing on your first set of paying customers. If your design partner contract already has a dollar value attached to it, this is the time to upgrade it into a proper sales contract. If your design partner did not agree to pay to use your product, this is the opportunity to explore their willingness to pay based on their experience with the product. You don’t need a perfect pricing strategy when converting design partners. Instead, it’s important to understand the mental model of how your designer partners perceive value, i.e., do they care about saving time, replacing engineering headcount though outsourcing, or displacing an incumbent?

Occasionally there’s a trap that specifically ensnares technical founders: the design partner will value the founder’s technical skill set more than the product itself, and they are willing to pay to retain that expertise. Whether or not you proceed with this engagement depends on the status of your product. We are not against selling consultative expertise before or during the product development phase, since hands-on experience in the early days can provide deeper insights and allow faster, more error-tolerant iterations of the product. However, once the product is ready, continuously doing this can be problematic because 1) it’s hard to scale, 2) the adoption journey and product value is entangled or covered up by the founder’s expertise, and prevents proper discovery of missing features.

Ideally, you can convert some of your design partners into initial customers. That said, it’s perfectly fine to wrap up the design partnership without a signed sales contract. If the partners are not a great fit, thank them for their time and move onto your next sales pitch.

TABLE OF CONTENTS

Finding product-market fit is not a linear journey, but using design partners is one effective way to help you collect high fidelity feedback as you progress on your journey. Keep in mind that as you go through this process, you may need to work with several cohorts of design partners before you finally land in a market that has enough demand to fully jump start your company. So don’t be afraid to churn out several of your early partners, or sacrifice some revenue in the process. At this point of your company’s development, it is more important to learn about the market and your users first, and then closely inspect their behaviors, so you can build the right product to solve the right problem. We’d love to hear about your stories of searching for design partners; please email or DM us @JenniferHli and @Seema_Amble.

-

Seema Amble is a partner at Andreessen Horowitz, where she focuses on SaaS and fintech investments in B2B fintech, payments, CFO tools, and vertical software.

-

Jennifer Li is a partner at Andreessen Horowitz, where she focuses on enterprise investments in data infrastructure and analytics, open source, developer tools, and collaboration applications.