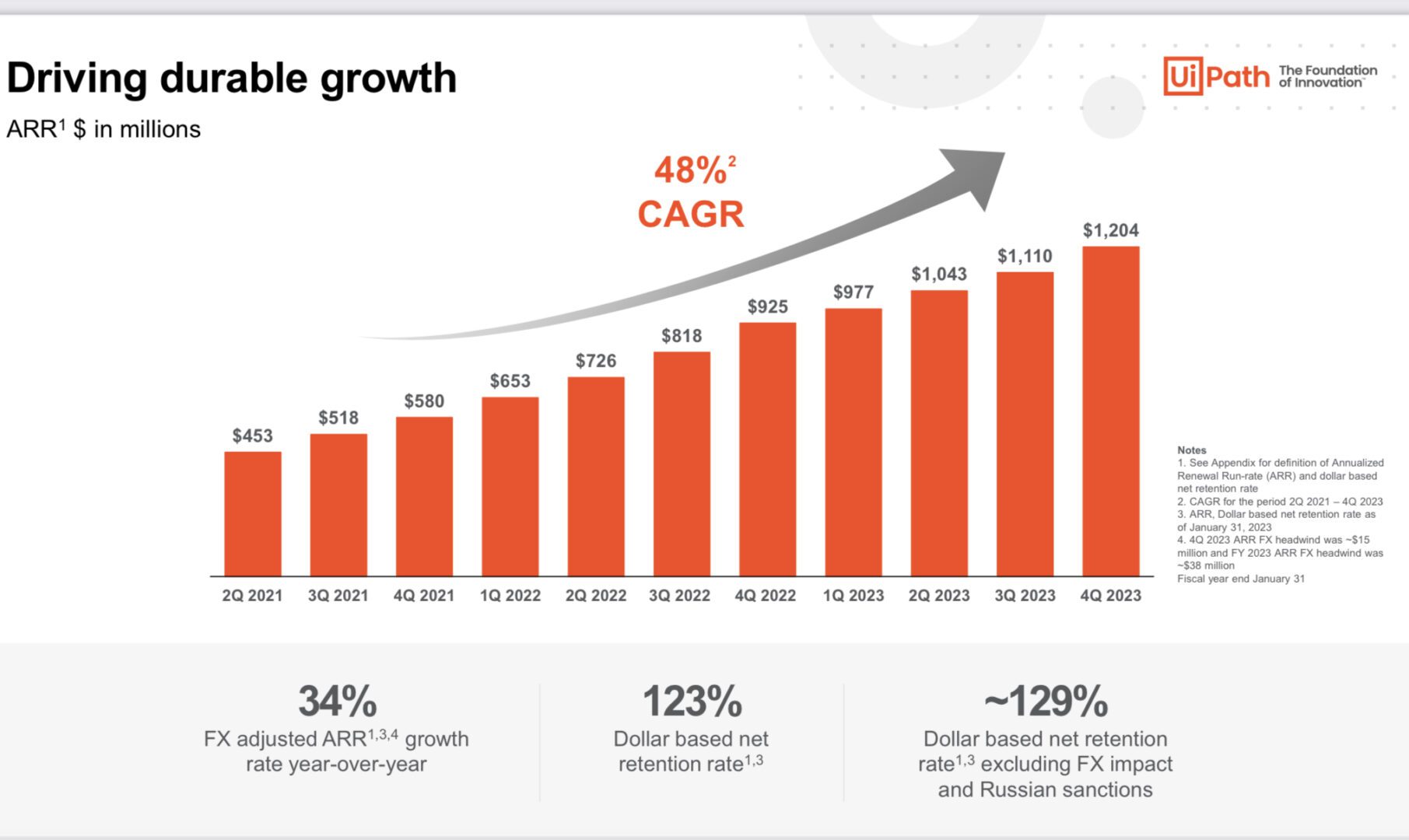

So few Cloud software companies have had a more interesting history than UiPath. It took them a full 10 years to get to $1m in ARR (!). And then after that, explosion. Robotic Process Automation took off, and they rocketed toward $1 Billion in ARR. Growth then slower after a take-off like we’ve almost never seen before.

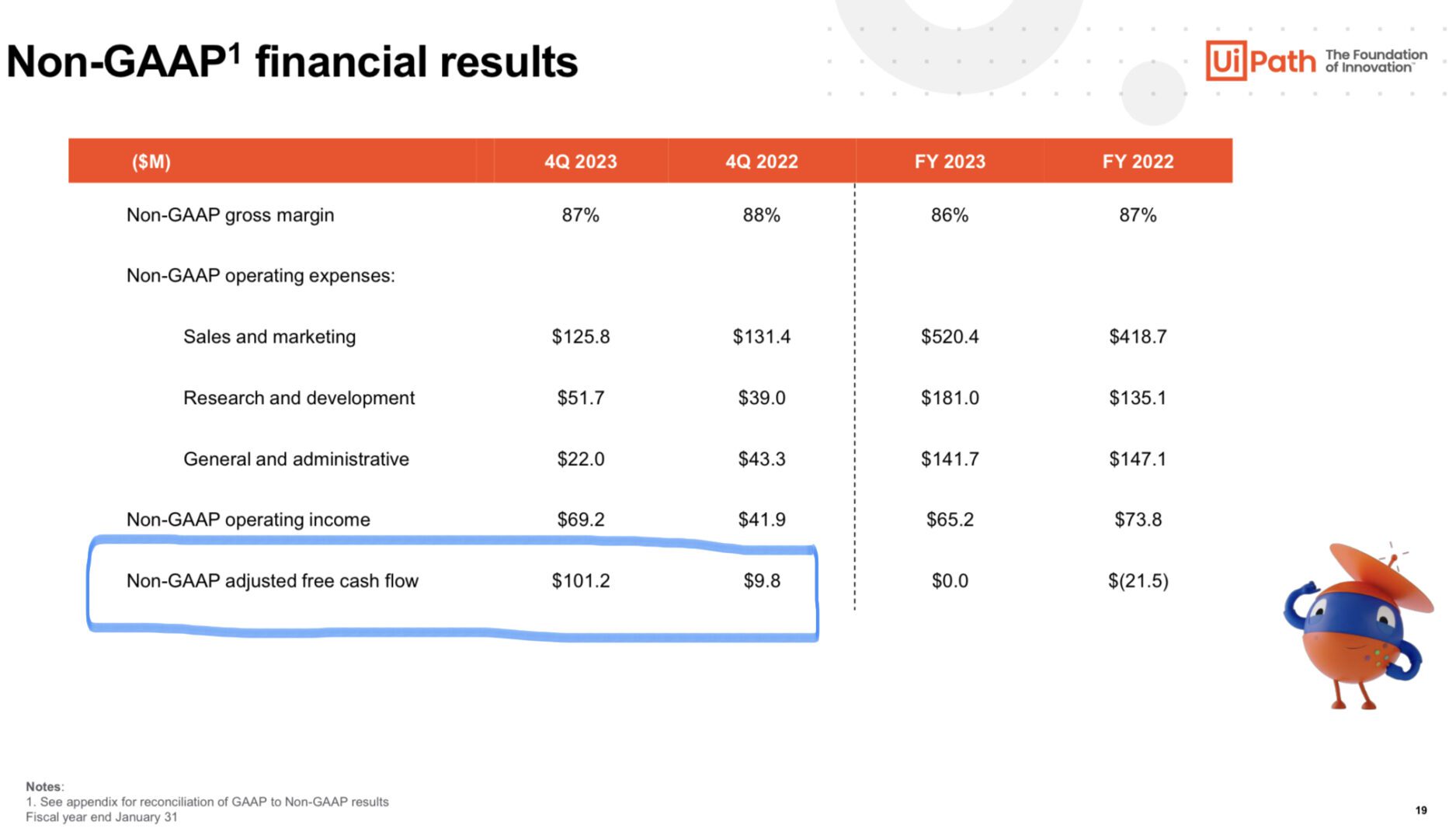

So now it’s a new world, where profitable growth is what’s valued. And UiPath? It’s kept up, and evolved. After its last quarter, it traded up, unlike so many of its peers. Why? Solid 12% currency growth at $1.2 Billion in ARR, and most importantly, 30% growth its recurring revenue business — and now, 22% non-GAAP operating margins.

UiPath is now generated $100 million in free cash flow last quarter. Wall Street is happy to trade somewhat slower growth if it’s paired with even non-GAAP profits and material free cash flow.

5 Interesting Learnings:

#1. NRR is holding up at 123%-129%. A reminder that high NRR really never needs to end, at least in many cases. Yes, NRR was 145% at $600m ARR, but it’s still held up remarkably well at > $1 billion in ARR.

#2. UiPath has cut Sales, Marketing, and G&A expenses at scale — and generated a ton of free cash-flow because of it. While UiPath continues to invest aggressively in product and engineering, it’s cut back on everything else. That’s made the business generate far more cash now.

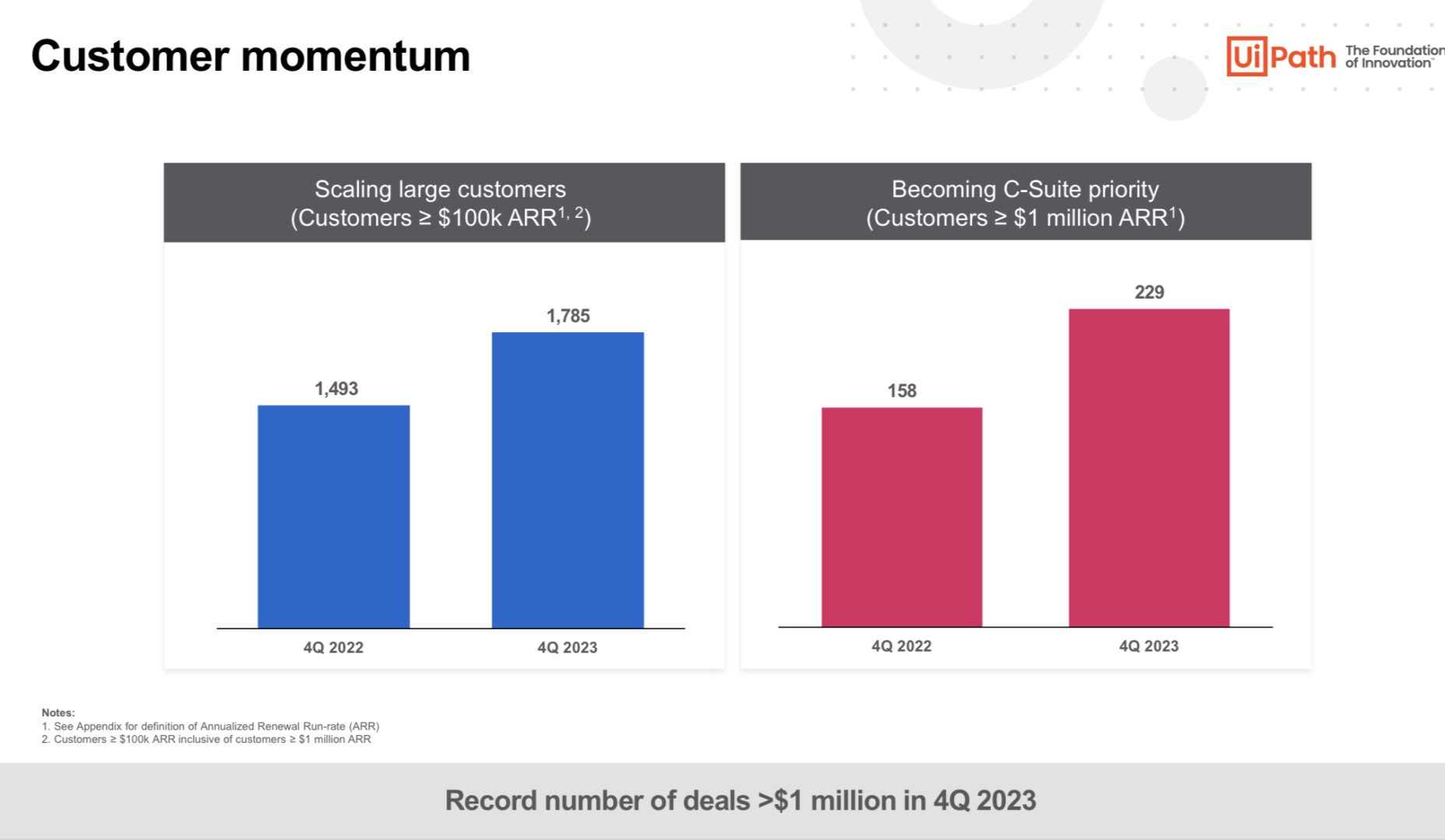

#3. Still closed a record number of $1m+ deals, even in this macro economy. The RPA category promises cost savings, and it seems to be resonating today. UiPath added 70 $1,000,000+ deals in the past 12 ,months alone. Folks tend to get really good at million-dollar deals over time, once they get enough under their belt.

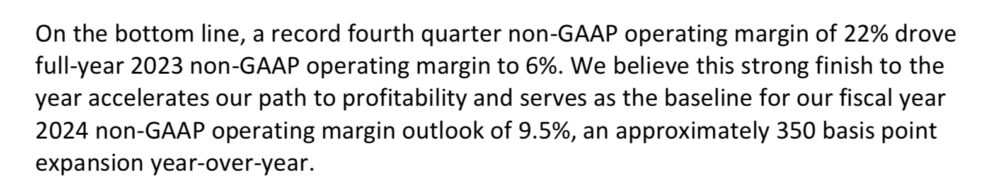

#4. Targeting 9.5% gross operating margins for the year. While UiPath hasn’t yet hit the 20%+ that Wall Street wants for Cloud companies at scale, importantly, it’s on the way. Operating margins are trending up. They were 6% the prior year.

#5. Claim top customers can save 40,000 hours or more of human time using their software. That’s real ROI.

And a few bonus learnings:

#6. Even $1m+ customers often start at $25,000 a year. A real land-and-expand strategy, or at least, increase utilization dramatically over time strategy.

#7. Not seeing any pressure on renewals. While UiPath isn’t immune to macro issues and more CFO scrutiny, one thing they aren’t seeing is higher downgrades, churn, cancellations. They stick with UiPath.

Wow, what a story. A huge congrats to UiPath for cruising past $1.2 Billion in ARR, with acceleration in $1m+ customers — and profits. That’s what the markets want today, more than insane growth paired with high losses.