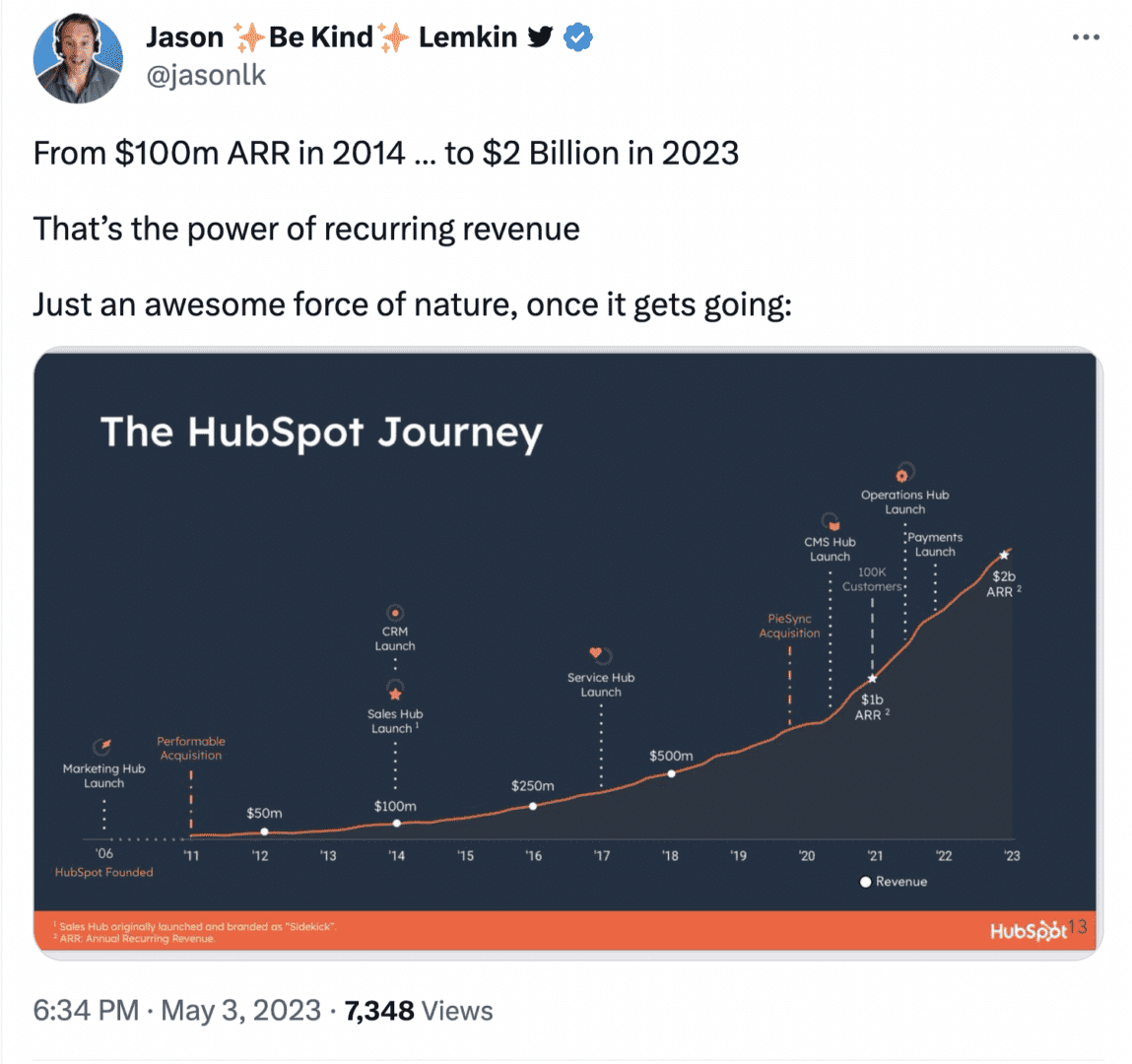

So we’ve covered HubSpot on our 5 Interesting Learning series more than any other SaaS leader, but it’s for a reason. First, so many of us HubSpot itself every day, so it’s … well, tangible. And second, it’s similar to the apps many of us build, sell, and market ourselves. We all at least sort of know HubSpot. If they are doing well, then hey, that’s a challenge to all of us. And if they are seeing headwinds, then many of us will, too. They’re a barometer of sub-enterprise B2B SaaS in many ways.

And what’s the latest? Well, HubSpot has now passed a stunning $2 Billion in ARR, growing 30% in constant currency. And while that growth level is a bit off the crazy pace of 2021, it’s still mighty impressive in the current macro environment. And a good natured-challenge to all of us to keep growing!

Let’s take a look at the latest 5 Interesting Learnings at $2,000,000,000 in ARR:

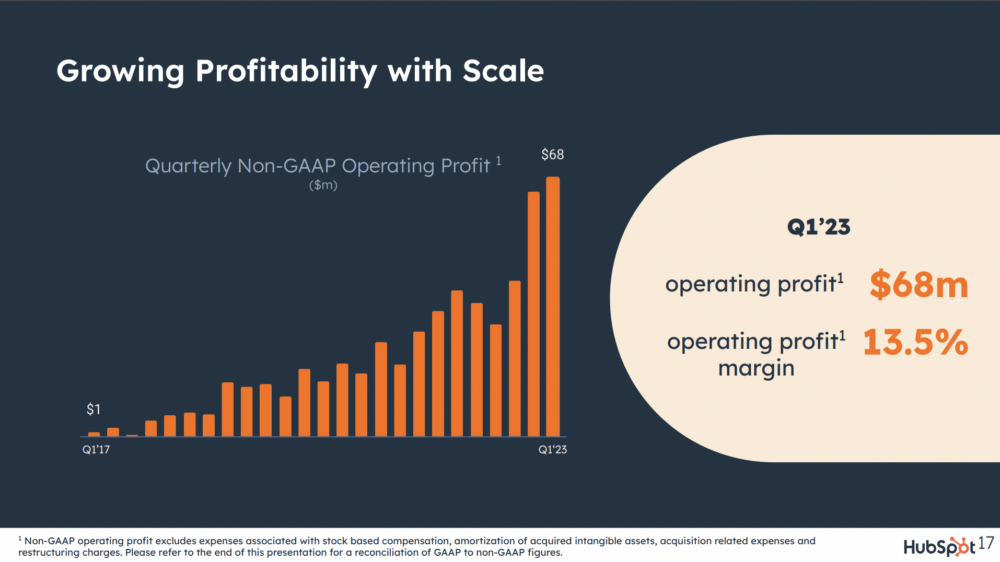

#1. Combining Strong Growth With A New Level of Efficiency.

Like almost everyone in SaaS, HubSpot is getting more profitable and more efficient — quickly. HubSpot’s operating margins have scaled into the double-digits the past two quarters for the first time. HubSpot has managed to continue impressive growth (30% at $2B ARR) while still getting radically more efficient than 12 months ago. They did it. You can, too. Basically, we all have to now.

#2. Slowly increasing ACV, now up to $11,365

HubSpot hasn’t radically driven up its ACV, but it has made slow but steady increases. Pricing is up a modest but material 6% on a constant currency basis, and 3% on an as-reported basis, from a year ago.

#3. Revenue Up 30%, but Employee Count Only up 10%, to 7,055.

At the end of the day, in SaaS, efficiency really comes from growing revenue faster than headcount. Salaries and comp are the vast majority of expenses. Almost everyone is doing more with … yes, more headcount, but only a smidge more. Including HubSpot.

#4. 23% Customer Count Growth Leads to 30% Revenue Growth, but NRR dips to 104%

HubSpot is still very much SMB, especially the “M” of SMB. So NRR is likely never going to be 130%, 140%+. But maintaining 100%+ NRR allows them to grow meaningful faster in revenue than in customer count, even from SMBs. HubSpot’s NRR has dipped to 104%, materially lower than 110% from last year — but consistent with other B2B leaders like Freshworks and others which are seeing similar compression in NRR.

#5. 45% of Customers Now Use 3 or More HubSpot Products.

A reminder of just how important being multi-product is at scale. We did a deep dive here with CTO Dharmesh Shah a little while back:

And a few other interesting learnings:

HubSpot has crossed $2,000,000,000 in ARR growing a stunning 30%

And it's gotten radically more efficient and profitable

Here's how they've done it: pic.twitter.com/tQiyX9HFbm

— Jason ✨Be Kind✨ Lemkin (@jasonlk) May 10, 2023

#6. International Grew Even Faster than North America, and is 46% of Total

That’s different than we’ve seen with FreshWorks and other leaders, who generally are seeing North America being relatively stronger. International grew 33% vs. 26% for North America;

#7. Q1 is Seasonally Strong for HubSpot

While I tend to find founders use “seasonality” as an excuse for a miss, it’s helpful to see HubSpot call it out even at $2B in ARR. Q1 is a strong quarter historically.

#8. 40% of Their Revenues Comes from Partners

This is a similar dynamic to Shopify, but one many SMB leaders have not cracked. But when it works, it’s magical. We had an incredible discussion with founder and chairman Brian Halligan on just how big a moat their partner ecosystem is:

#9. Their focus is customers with 2-2,000 employees, and “up market” is 200-2000.

As chair and co-founder Brian Halligan put it at SaaStr annual, “the M of SMB”.

And a great recent deep-dive with CEO Yamini Rangan here: