One remarkable thing about the invention of generative AI is that it’s one of the first examples of a probabilistic computer that produces outputs that are varied and non-deterministic. Some, who expect these systems to behave like traditional systems, have complained about hallucinations—however, these complaints miss the point. A dispersion of outputs (including hallucinations) is exactly what’s so special here. In fact, they unlock a whole new category of product design: probabilistic products.

By probabilistic products, we mean products with non-deterministic and often emergent attributes. Social networks are an example of probabilistic products. The emergent behaviors that appear on these networks typically cannot be predicted but, instead, can simply be observed. One way to think about this is to organize product categories, or a product’s use cases, into three groups:

- Those that are uniquely enabled by or benefit from the probabilistic nature of the platform

- Those that are tolerant of the probabilistic nature of the platform

- Those that are intolerant of the probabilistic nature of the platform

This first group includes popular image models like Midjourney and Stable Diffusion, whose magic comes from the wide variety of outputs they generate. This entire category of generative media is uniquely enabled and able to produce stunning results because the platforms are non-deterministic. The AI companionship category also fits within this grouping, as the whole value of the product is the very human-like lack of predictability in the interactions; the loss of non-deterministic outputs would cripple the product experience. Another example in this space could include assisted shopping, as an AI’s unexpected and unusual clothing recommendations are exactly what can help shape one’s style and taste.

A second group of products may tolerate probabilistic outputs but don’t necessarily benefit from the non-deterministic nature of the platform. For example, think about products that synthesize existing content, where variability in how the synthesis is presented is generally fine so long as the gist of the synthesis is accurate. Notably, synthesizing numeric content (e.g., your stock portfolio performance) requires a higher degree of accuracy, while the synthesis of written content can have far more variance without sacrificing value. Even code generation is tolerant of variance so long as the code functions as expected.

Finally, there are a large number of use cases that demand deterministic outputs. These examples include everything from financial projections to tax calculations to driving directions—essentially any field that requires a definite answer to set inputs.

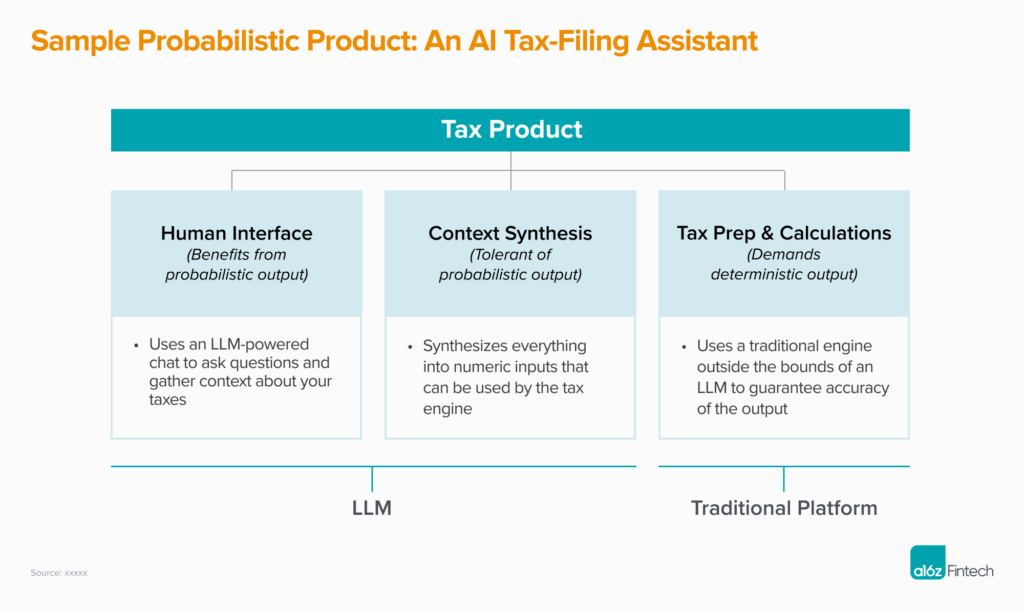

One can also think about individual products as being subdivided into a product architecture that’s organized around tolerance to probabilistic outputs.

For example, picture an AI assistant whose purpose is to help you file your taxes. Such an assistant could be organized into three subsystems that have different expectations of the underlying platform. First would be a human interface that is uniquely powered by a probabilistic LLM. Next, the synthesis of context could be tolerant of probabilistic outputs. Finally, the actual tax calculations could (and should) be done on a traditional engine that’s outside the bounds of an LLM, thus guaranteeing the accuracy of the outputs.

In sum, a new computing architecture demands a new product architecture, and the probabilistic nature of LLMs and GenAI pipelines as a platform creates unique opportunities—and demands—that products and use cases be carefully considered in their tolerance to a dispersion of outputs. Product pickers and designers will do well to consider this carefully in designing experiences that leverage these new capabilities.

For more of my thoughts on why now is the time for product pickers and engineering-oriented founders to succeed in generative AI, read my piece on aligning founder superpowers with product cycles.

* * *

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

- How AI Will Usher in an Era of Abundance

- The Future of Prosumer: The Rise of “AI Native” Workflows

- 2024 Big Ideas: Voice-First Apps, AI Moats, Never-Ending Games, and Anime Takes Off

- The Future of Music: How Generative AI Is Transforming the Music Industry

- Money on Autopilot: The Future of AI x Personal Finance