If you’re in the early stages of fundraising for seed rounds or Series A, the pressure is on to impress a VC firm. An impactful deck that explains your business and the opportunity waiting for investors can often clinch the deal.

Logan Allin, Managing Partner at Fin Venture Capital, has reviewed hundreds of deck submissions and shares the secrets to crafting the perfect presentation to win over investors.

Keep Everything Clear, Simple, and To-the-Point

Allin’s first piece of advice? Leave the jargon at the door. You have one catchphrase to capture an investor’s imagination in your opening, so make it count. As Allin explains, “In telling your story, [communicate] your thesis on why you think your company needs to exist, and why you think there is a huge market opportunity…[be] very clear about what your product currently accomplishes, the product roadmap that’s ahead, and the business model that you’re going to use to monetize that.”

The main sections you want to include in your deck are the business (product and the model), your team (why you?), the market (why is this the right time?), metrics, and what value-add your VC gives the company.

Don’t be afraid to flip the script on the VC, either. Allin points out, “Capital for the best entrepreneurs is a pure commodity. There’s plenty of capital out there. You need to find the right VC partner, and you should be asking your VC upfront the hard questions.”

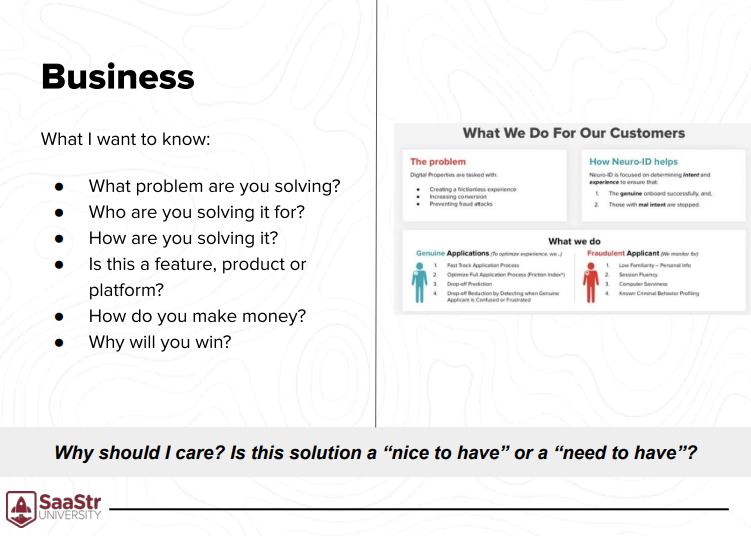

The Business: What Your VC Wants to Know

Firstly, your VC should understand what problem you are solving and who you are solving it for. Come prepared with a deep, detailed knowledge of your customers, segments, and personas that you plan on pursuing.

You should also clarify whether you provide a feature, a product, or a platform. Understand that most investors prefer a platform: “VCs enjoy investing in platforms, and those have longevity and scale, versus a feature or a singular product that might not have that scalability,” says Allin.

Further, you need to showcase your pricing model and the different ways you plan to monetize. And finally, you must be straightforward about your competition in the market and demonstrate why your company will win in the space.

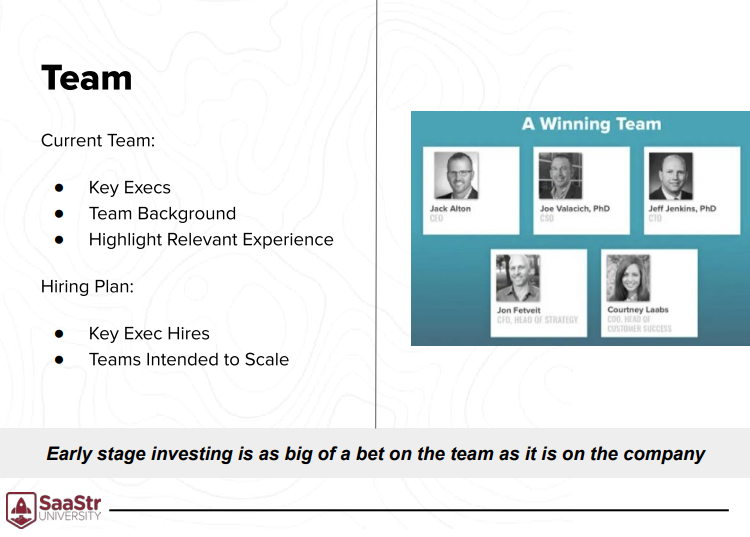

The Team, the Market, and Metrics

Early-stage investing makes as big of a bet on your founding team as it does on the company. In your deck, highlight your key executives, your team’s background, and any relevant experience. Additionally, prepare to discuss what your hiring plan looks like for the future and what teams you intend to scale.

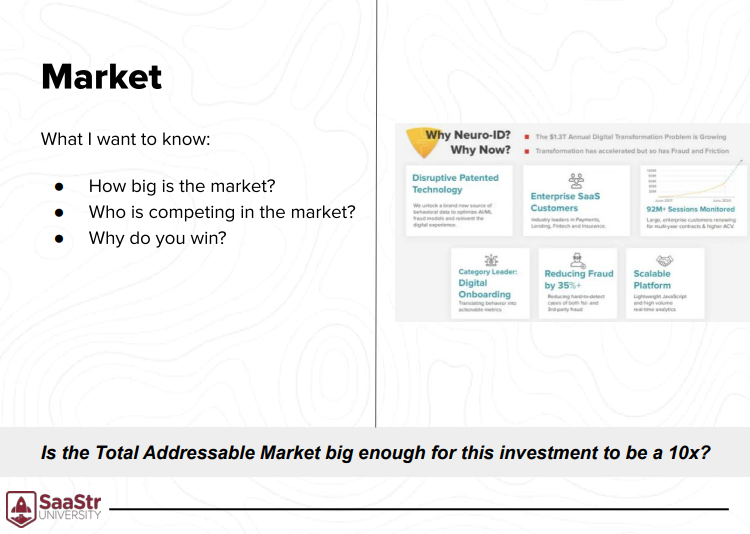

You will also want to zero in on the market size. Investors like a larger target market because it translates into higher business value. Most VCs will be wondering, “Is the TAM big enough for this investment to return 10x?”

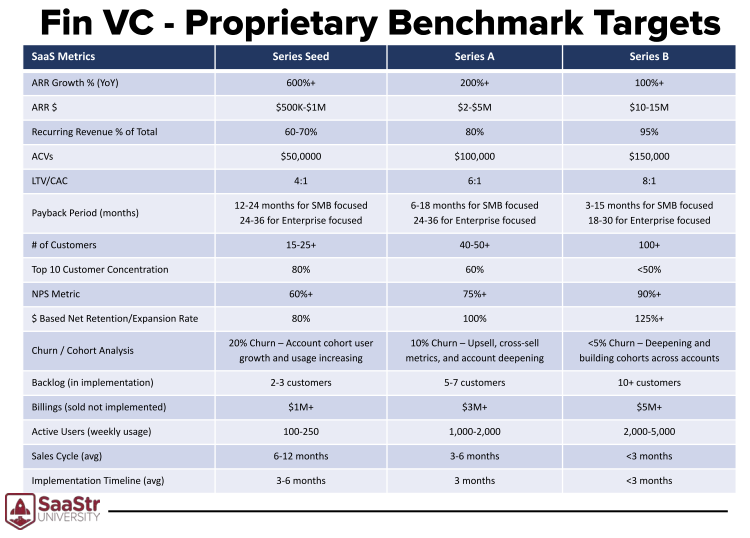

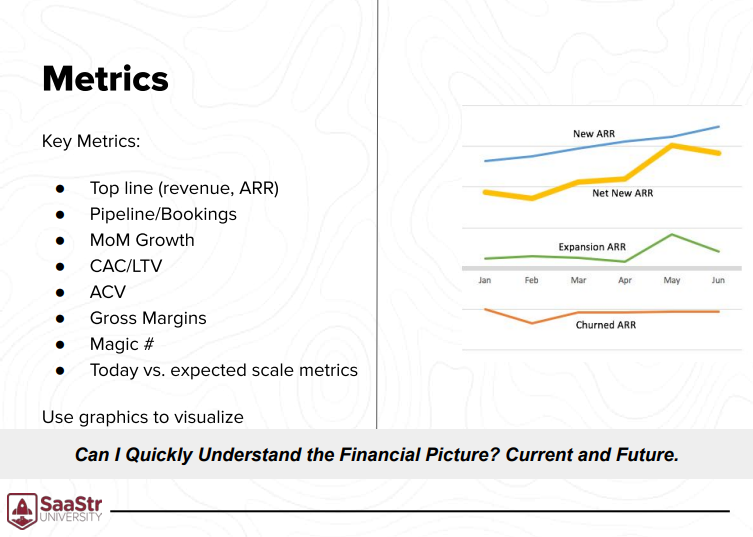

Bring your deck home by showing the proof in numbers. Ensure that your data represents a clear financial picture by including metrics like:

- Top Line (Net Revenue & ARR)

- Pipeline & Bookings

- MoM Growth

- CAC/LTV

- ACV

- Gross Margins.

Key Takeaways:

- Make your introduction count: make it clear what your company does immediately.

- Don’t be afraid to ask your VC whether they would be a good fit for you and your company.

- Demonstrate your company’s traction with thorough data points.