So no source of funding data is perfect. Essentially every source lags, because deals are often reported far after they close. Most unicorn press releases you see were closed months ago.

But AngelList’s data is probably as up-to-date as you can get. The data is more recent than most sources, since it is self-reported by the investors in the round and on the AngelList platform. Carta data may be even more up-to-date (since cap tables are updates as closing), but they are probably close.

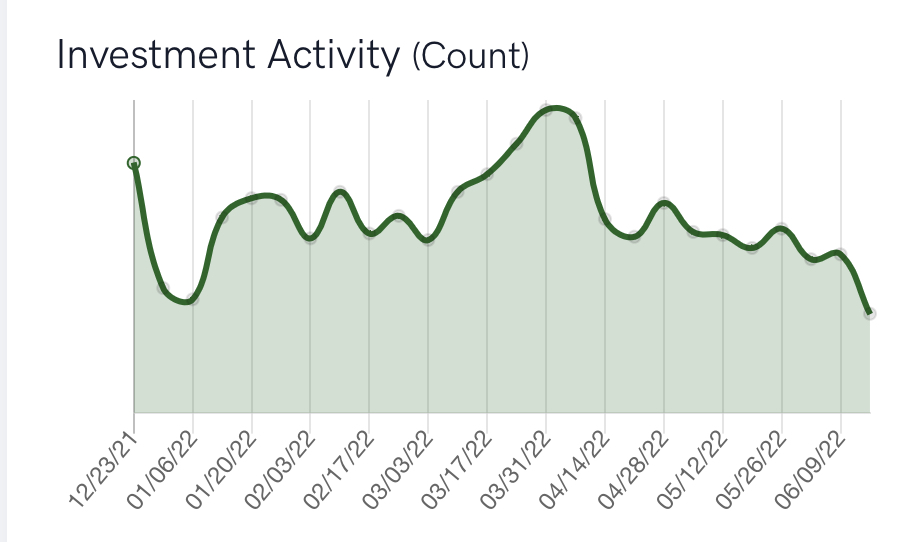

What does the AngelList data show us at 6/16/22?

That seed rounds peaked in March and have been falling even since, and activity is now half of what it was then:

It’s just one data point, but it ties to the generate observation that seed rounds took a little longer to slow down than growth rounds did … but slow down they have.

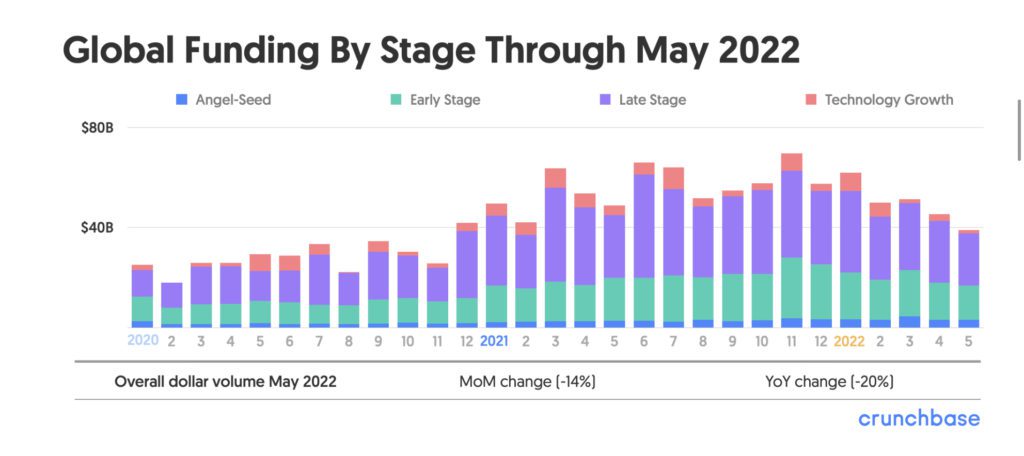

As Crunchbase noted just the other day, growth rounds are down at least 40% as well, and their data likely has more lag than AngelList (and is from a few weeks earlier):

The bottom line is every category of venture investment has gotten harder since the go-go days of 2021. It is what it is. Just be aware of it. As a rough rule, deals are twice as hard to close, and now are at half the valuations, of 2021. And even those prices are often higher than public market comps.

Per AngelList:

About this market data

This data represents aggregated & anonymized data from a subset investments from fund managers on AngelList (as of 06/16/22).

FWIW, I think this understates valuation drops a bit because some “seeds” here are extensions at a price from last year.

Also, you can’t see it in the data, but down rounds haven’t happened yet. You’re only seeing the companies that can raise on “acceptable” terms raising.

— Parker (@pt) June 17, 2022