So another quiet SaaS success story is Jamf after a quiet IPO in 2020. The #1 player for enterprises and businesses managing Apple devices, it’s quietly grown over 20 years into a $500 million ARR machine, growing 27% a year, that’s cash-flow positive. Boom!

They’re doing pretty much everything right, with strong NRR and an efficient engine. But are they worth 10x ARR? 15x ARR? Nope. Everywhere in the public markets are tough today. They’re trading at less than 5x ARR, It’s tough out there.

What if you were a SaaS company and:

– Doing $500,000,000 in ARR

– Highly cash-flow positive (14% revenue)

– Growing 27%

– #1 in your segment

– Expanded into multiple productsWhat would you be worth?

How about just $2.35B in today’s world.

E.g, JAMF: pic.twitter.com/99ZoDn85YO

— Jason ✨Be Kind✨ Lemkin (@jasonlk) January 29, 2023

5 Interesting Learnings:

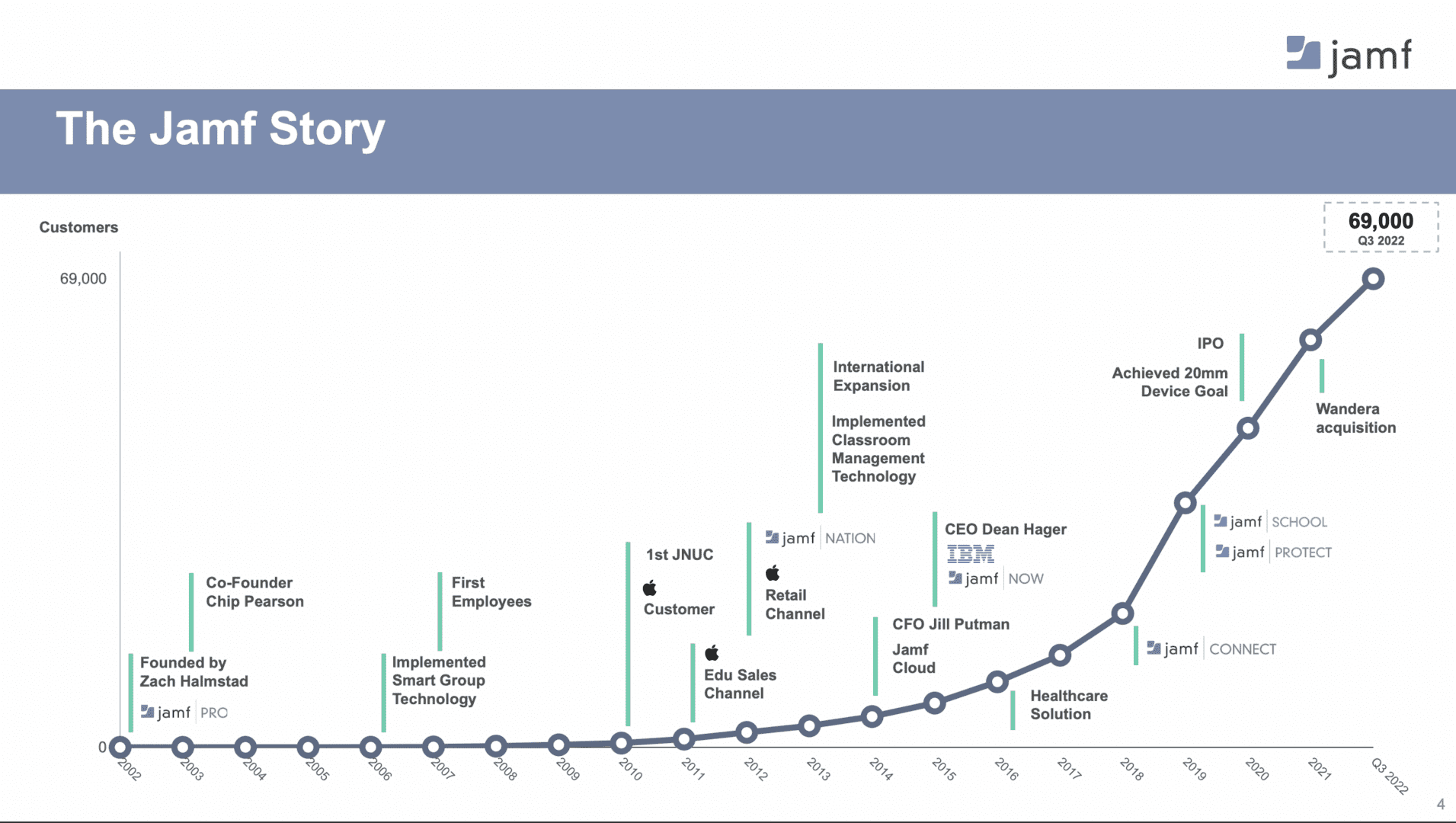

#1. 12+ Years Until Business Really Took Off. The company was founded in 2002, well before Apple’s renaissance, and took a while to take off. It was 8 years until their first Apple customer, and about 12 years until the business started to come together. Sometimes, it just takes a while:

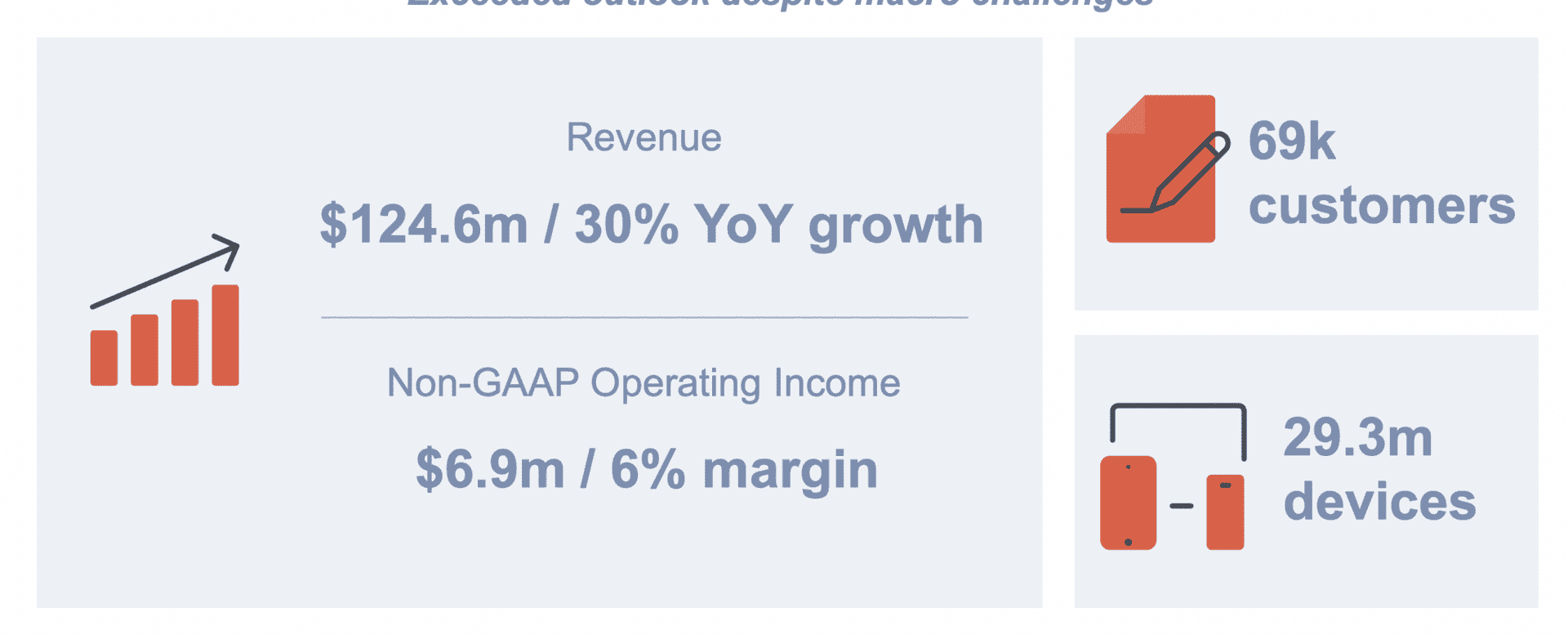

#2. 69,000 Customers, so About $7,500 Per Customer. 114% NRR is pretty solid at this ACV.

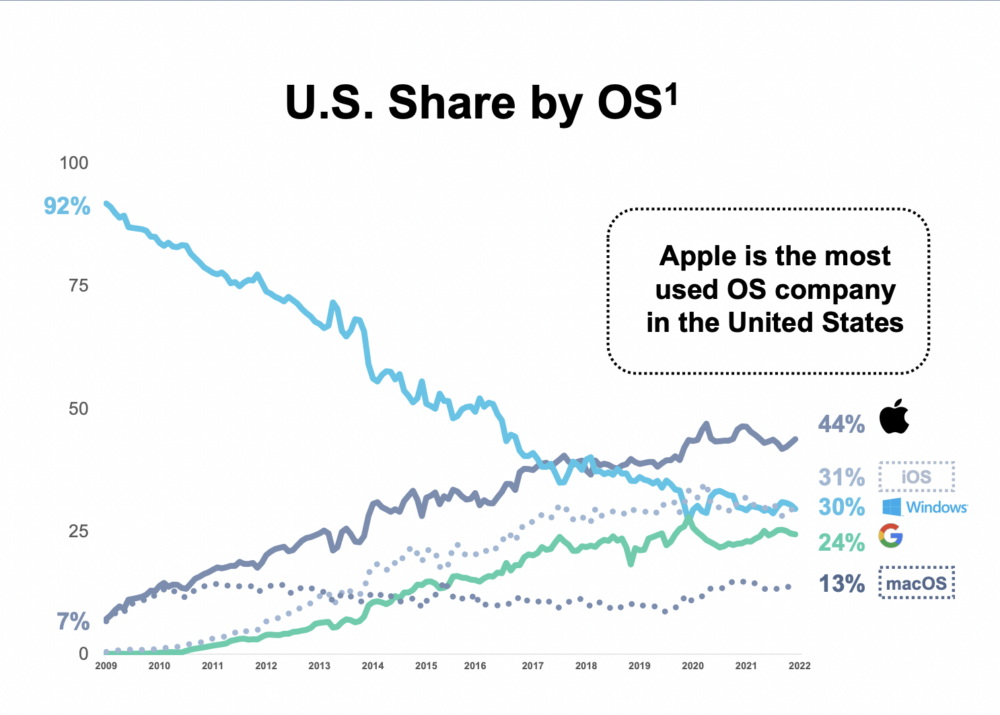

#3. Move to Apple and iOS turbocharges growth. Sometimes, you need a macro trend to really break your way. Jamf again was early here, but as iOS and AppleOS grew and became overall #1 in the U.S., Jamf’s star also rose:

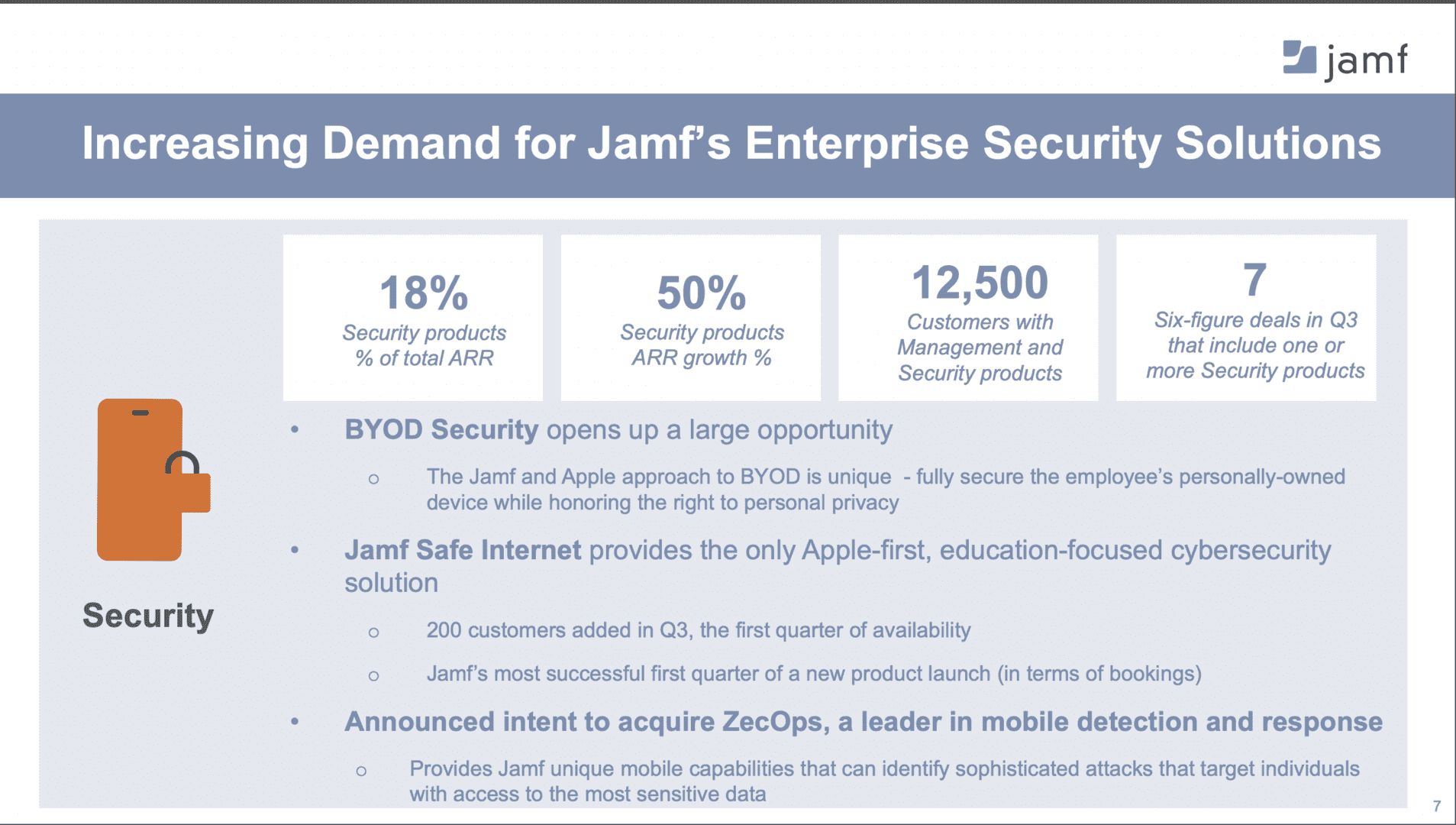

#4. Adding Security Product Key to Six-Figure Deals. Expanding its product offerings into security has been critical to the Jamf growth engine. Security products have grown from 7% of revenue already to 18% today, and fuel the bigger deals.

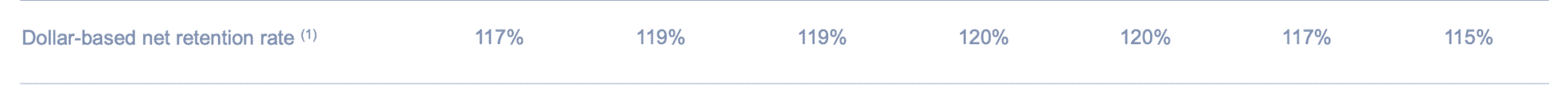

#5. Steady 115%-117% NRR. Fairly impressive, given their relatively low ACV.

Jamf is a great story of going long, nailing a niche, and then thoughtful expanding into a multi-product play. A story for many of us to learn from!