We’ve previously discussed some common issues around pricing and tips for bottom up pricing and packaging, but growth-stage companies often encounter less obvious problems when structuring product packages and pricing models as they scale. Monetization strategies that drove adoption in a company’s early stages won’t necessarily drive growth and a path to profitability in later stages. While every business is different—and pricing and packaging are notoriously difficult to get right—in my experience working on pricing at Freshworks, PagerDuty, and Atlassian, there are three telltale signs that a late-stage company’s pricing and packaging strategy isn’t working—and some approaches to consider to get it back on track.

TABLE OF CONTENTS

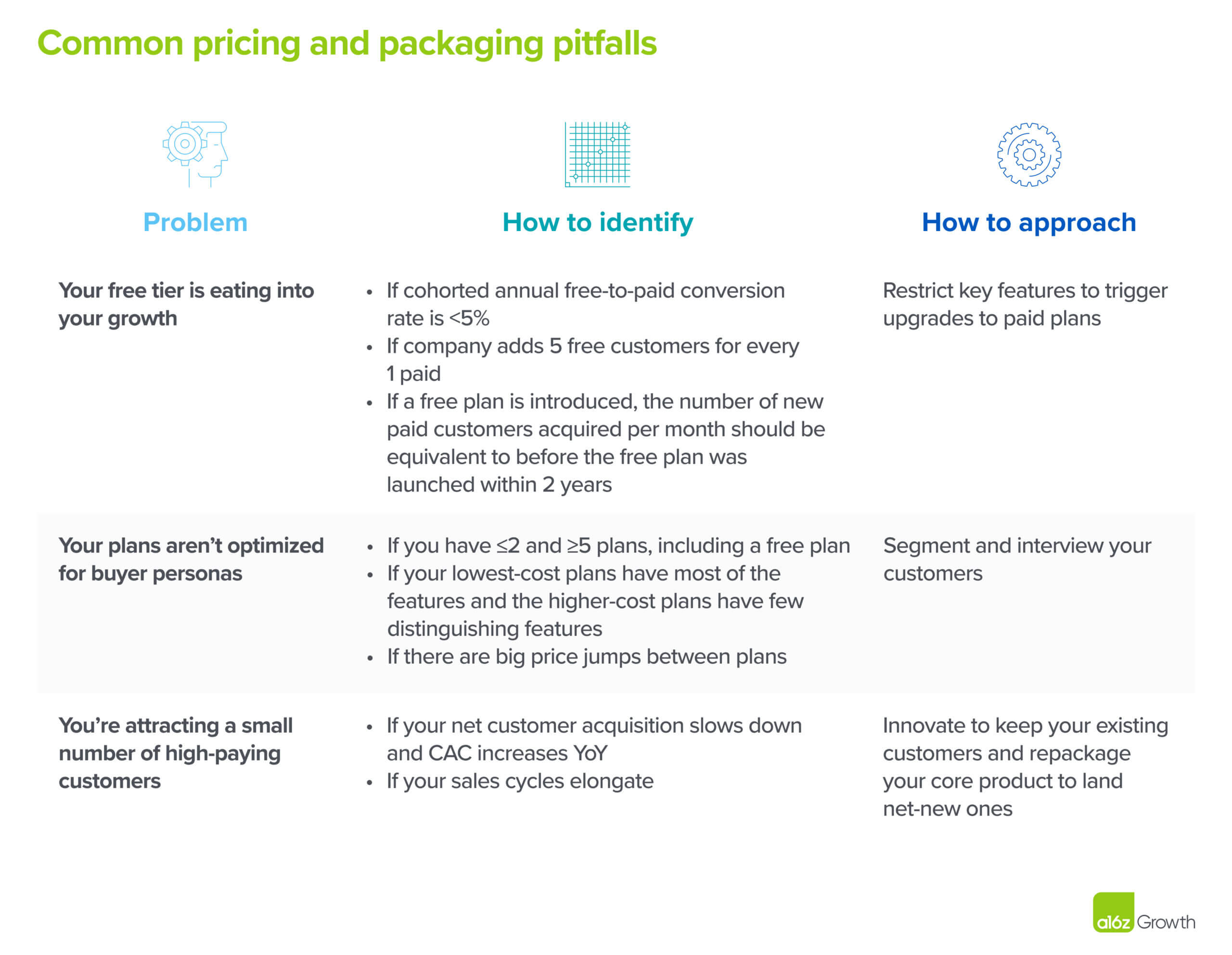

Your free tier is eating into your growth

How to identify

A freemium model is a great strategy for expanding your user base early in your company’s lifecycle, but your growth will stall if you don’t effectively monetize those customers.

Typically, when your free tier is eating into your growth, the proportion of your free-to-paid customers is too high. While there’s no hard-and-fast benchmark to tell you when this is the case, some signs that might indicate your free plan needs an adjustment include:

- If cohorted annual free-to-paid conversion rate is less than 5%

- If company adds 5 free customers for every 1 paid

- Within 2 years of introducing a free plan, the number of new paid customers acquired per month should be equivalent to before the free plan was launched

How to approach

Restrict key features to trigger upgrades to paid plans.

It’s critical to take away the right features in this instance: you want customers to immediately understand the value of the product, but not feel so comfortable that they’ll never upgrade. Product managers tend to know which features unlock this “a-ha!” moment, but if they don’t, look at user activity during trial periods and see what user journeys lead to conversion.

Slack’s message storage limitations are a great example of offering the right level of value to your free customers. With Slack’s free plan, users can access only up to 90 days of message history—they have enough access to the tool to understand the value of the search feature, but a gated level of access creates a pain point for longer-term use.

It’s also costly to serve customers who have a low willingness to pay on your free plan. Sales campaigns that target inactive customers with carrots (i.e., rewards, like discounts) or sticks (i.e. punishment, like termination after 6 months of inactivity) to upgrade can both increase your conversion rate and free up your operating expenses to reinvest into customer acquisition.

Your plans aren’t optimized for buyer personas

How to identify

As your company grows, you’ll likely serve different types of customers with different needs. When any of these customers review your packages, they should be able to quickly identify the plan that best addresses their needs and agree with the price of that plan. If they can’t, your customers might favor a competitor with clearer pricing structures, or you might have customers with a high willingness to pay stuck on cheaper plans.

Here are some signs that might indicate your plans aren’t addressing your buyer personas’ needs:

- You have 2 plans or fewer or 5 plans or more, including a free plan

- Your lowest-cost plans have most of the features and higher tier plans have few distinguishing features

- There are big price jumps (more than 100% in most cases) between plans

How to approach

Segment and interview your customers.

One of the most important pricing principles is communicating a clear value proposition to the buyer persona for each plan.

A great way to figure out what products your customers want and are willing to pay for is to just ask. Survey your customers to figure out what they want from your product and at what price. Match those preferences to the features you’ve built, and package those offerings for that segment. You don’t want to bundle the wrong things together, like security coverage or enterprise features for your SMB segment, or undercharge for segments with a high willingness to pay.

You’re attracting a small number of high-paying customers

How to identify

You’ve addressed an important problem for a small subset of buyers who are willing to pay a premium price for your product—but now you’re reliant on these buyers for a significant part of your revenue. If a competitor comes in and offers what you’re offering at a cheaper price, or if your customers churn for whatever reason (like a bankruptcy), you’re left scrambling for new revenue streams.

Some indicators that this is a problem include:

- Your net customer acquisition slowing down and CAC increasing YoY

- Your sales cycles elongating

Serving a small segment of customers means that you only grow when your customers do. As your customers expand, they’ll likely shop around and encounter competitors who are offering the same products as you, but cheaper. That’s why you’ll see your sales cycles elongating: it’s harder to close deals because you’re stuck in a back-and-forth with your existing customers.

How to approach

Innovate to keep your existing customers and repackage your core product to land net-new ones.

Revisiting your customer segmentation, identifying new opportunities in adjacent markets, and adjusting your packaging can help you keep your existing customers and compete with cheaper competitors. If you’re struggling to identify which elements of your product you should repackage in order to compete in adjacent markets, surveying your competition’s products can help identify offerings that seem sticky or otherwise in high demand.

For example, Tesla launched its Roadster in 2008 for around $100,000—a fully-electric vehicle at a luxury price point that required customers to secure a spot on a very competitive waitlist. After 8 years, other legacy automotive companies released their own fully-electric vehicles at less than half the price of the Roadster, like the Chevrolet Bolt and Nissan Leaf. In order to compete, Tesla quickly followed up with its Model 3 in July 2017, which sold for $35,000 and very quickly became the best-selling electric vehicle on the global market. Tesla also continued to innovate, drawing up plans for an improved Roadster and the Cybertruck—all available at higher price points with newer, cutting-edge features.

Pricing and packaging is an ongoing experiment for most companies. The pricing strategies that get you to product-market fit aren’t likely to be the ones that help you scale. Learning to diagnose these telltale signs that your pricing and packaging needs adjusting can help you better capture the value you offer to your customers and accelerate your growth.

For more on how to effectively segment your customers, read Aligning Product and GTM Teams with Better Segmentation.