Table of Contents

If you remember our discussion on bookkeeping (where you can find useful definitions of many of the terms used here), which discusses the difference between bookkeeping and accounting, accounting is similarly broken down into accrual accounting and cash accounting.

Cash accounting is the simpler of the two. In cash accounting, you record all revenue and expenses when the cash enters and exits your checking account, respectively. This system is often preferred by smaller companies because it requires less expertise to implement. However, many tax authorities require certain kinds of companies, as well as those over a revenue threshold, to switch to the accrual accounting method.

A basic accrual definition is that economic events are recognized when they occur instead of when the monetary transactions are performed. In the accrual accounting method, you record revenue when it is earned and expenses when they are incurred. This adds complexity, but, as we show below, it is well worth the added value of having a clearer image of your company.

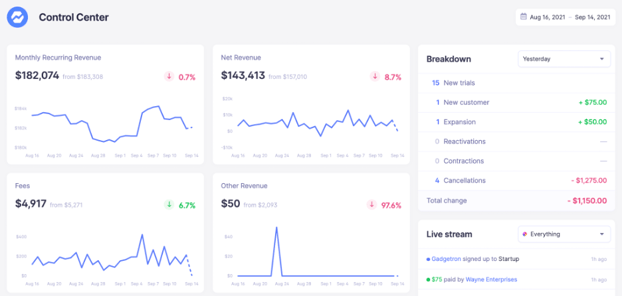

Baremetrics is a business metrics tool that provides 26 metrics about your business: MRR, ARR, LTV, total customers, and more.

Baremetrics can integrate directly with your payment gateways, so information about your customers is automatically piped into the Baremetrics dashboards.

Check out all the information on the dashboards here:

Sign up for the Baremetrics free trial and start monitoring your subscription revenue accurately and easily.

Accrual Accounting vs. Cash Accounting

Accrual Accounting Method

In the accrual accounting method, revenue is accounted for when it is earned. This usually will happen before money changes hands, for example when a service is delivered to a customer with the reasonable expectation that money will be paid in the future.

Similarly for expenses, they are recognized when they are incurred. This is done by following the matching principle.

Accrual accounting entries require the use of accounts payable and accounts receivable journals, as well as a few others for deferred revenue and expenses, depreciation, etc.

- Accrual Accounting Pros

- It makes forecasting easier and more accurate.

- It gives a more accurate representation of the company’s financial health.

- Accrual Accounting Cons

- It is more complex.

- It usually requires professional bookkeeping and accounting services.

- The company might have to pay taxes on revenue earned but not yet received.

Cash Accounting Method

In the cash accounting method, revenues and expenses are recognized when cash is transferred. This is the system used by individuals when budgeting household expenses and by some small businesses.

- Cash Accounting Pros

- It is simple.

- It is easy to know how much cash you have on hand.

- It can be tax advantageous.

- Cash Accounting Cons

- It is difficult to deal with inventory.

- Government tax authorities might not accept it.

- It can make forecasting more difficult.

- It might make the company appear more or less profitable on paper than in reality.

The Two Accrual Accounting Principles

There are two main accrual accounting principles.

- Matching principle: This principle stipulates that accountants should record all revenue and expenses in the same reporting period.

- Revenue recognition principle: This principle refers to the period and manner in which a company realizes its income. A company should recognize revenue in the period in which it was earned, and not necessarily when the cash was received.

For a subscription SaaS provider, this can mean breaking up the money received from an annual subscription into the monthly periods as the services are provided. This provides auditors with an apples-to-apples comparison of a company’s financial picture that is more transparent across industries.

What Are the Benefits of Accrual Accounting?

Accrual accounting provides companies with a more accurate picture of their financial health. Since accrual accounting leads to financial statements with all revenue recorded in the month it was earned (revenue recognition principle) and all expenses lined up with the revenue they generated (matching principles), it provides a far more accurate view of the current health of the company.

Similarly, accrual accounting also allows for better forecasting. Since revenues and expenses are matched to each other and to the correct time period currently and going forward, it is far easier to see how your company’s financial position is changing over time and make strategic decisions based on the information.

Accrual Accounting for a SaaS Business

According to many tax authorities, SaaS companies must use the accrual accounting system, which stipulates that you record revenue when it is earned.

In the case of a subscription revenue stream, this means when you have fulfilled your part of the service agreement. Consider the following two subscription revenue example scenarios to make this point clear.

Scenario 1

Your company offers a discount to clients that pay their bill annually instead of monthly. You have 10 clients that opt for the discount. These invoices total $360,000.

Since you will provide services to these clients for an entire year and your income statements are drafted monthly, U.S. GAAP (Generally Accepted Accounting Principles) standards stipulate that you should move $30,000 at the end of each money into your revenue account and keep the unearned subscription revenue in a deferred revenue account as you have not yet earned the money.

Scenario 2

Your company bills clients at the end of the month for the services you’ve provided during the month. Most of your clients pay within the allowed time period, but some—due to their poor financial health, issues with the payment system, etc.—do not pay on time.

In this case, you might be earning $30,000 at the end of each month, but you may not be receiving all of it until some days, weeks, or months later—or, unfortunately, sometimes not at all.

In the first case, you have more cash on hand than your company has actually earned. In the second case, you have less cash on hand than you have earned, and you might not even receive all the money you have earned.

Connect Baremetrics to your revenue sources

Get deep insights into MRR, churn, LTV and more to grow your business

The same is true for expenses, which must be recognized when they are incurred regardless of when the invoice is paid.

This is done by matching the expenses to the revenue they generate where possible. When this is not easily possible, then either the systemic and rational allocation method or the immediate allocation method can be used.

The former allocations expenses over the useful life of the product, whereas the latter recognizes the entire expense when purchased. Let’s consider a few example scenarios for when expenses should be recognized.

Scenario 1

You decide to advertise your new SaaS product on Facebook. You set a budget of $6000 to hit your targeted market over a 12-week period and pay the invoice. Since you draft monthly income statements, you divide the $6000 into three monthly expenses of $2000 and recognize them over the three consecutive monthly periods.

Scenario 2

You spend $50,000 on new office furniture and laptops. You expect these items to last five years and have no residual value for resale. Instead of recognizing the entire $50,000 in the first year, you should list the asset on your balance sheet and use a depreciation expense to claim $10,000 per year on your income statement.

Scenario 3

You spend $1000 to host a family picnic to celebrate the completion of your SaaS product. This kind gesture cannot be matched to any individual sales and can be recognized under the immediate allocation method as an expense in the period it was paid.

In a related article, we offer a tutorial on managing your total expenses. Click over for some useful help.

Conclusion

The decision to use the accrual accounting method is sometimes made for you by a tax authority. However, the added costs and complexity are more than made up for by the clarity provided on your company’s financial health today and the ability to forecast better into the future. If you are currently using the cash accounting method, consider discussing with your accountants what it would take to move to the accrual accounting method and why that might be better for you.

Baremetrics monitors subscription revenue for businesses that bring in revenue through subscription-based services. Baremetrics can integrate directly with your payment gateway, such as Stripe, and pull information about your customers and their behavior into an easy to understand dashboard.

Baremetrics brings you metrics, dunning, engagement tools, and customer insights. Some of the things Baremetrics monitors are MRR, ARR, LTV, the total number of customers, total expenses, Quick Ratio, and more.