If you follow the public markets, you can see a lot of top SaaS stocks recently have been hit — hard. Zoom has taken a hit as its growth at $4B+ ARR returns to merely high rates, DocuSign took the hardest hit (falling 42%) as growth declined a bit, and more.

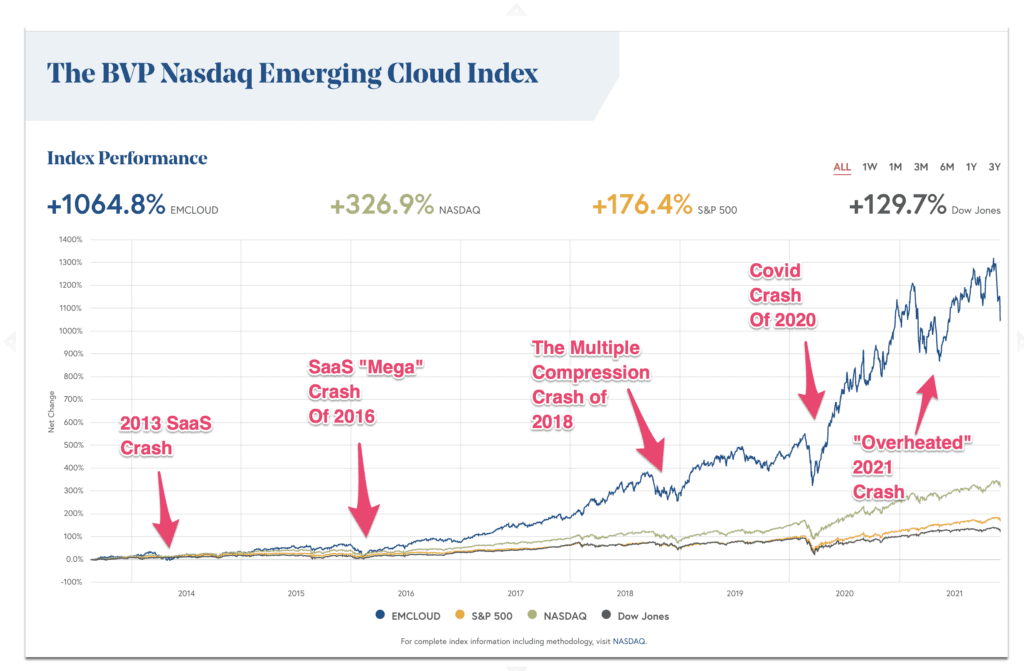

But let me share just a little perspective. SaaS and Cloud have been on an incredible tear the last decade, and especially the last 5 years, like we’ve never seen before. And every 12-18 months, there’s a bump. A mini-crash. You can see them in this chart from the BVP Nasdaq index:

This mini-crash is a big one, but hardly the first. There almost have to be these mini-crashes when we see such explosive growth.

This mini-crash is a big one, but hardly the first. There almost have to be these mini-crashes when we see such explosive growth.

Multiples have fallen in half in many cases, and for now at least, that will have ripple effects across venture and more. When Cloud leaders are valued at 17x revenue instead of say 34x, it’s just harder for your startup to ask for a crazy premium.

But:

- Cloud stocks are still up 1064% over the past 8 years.

- The amount of dollars going into SaaS in the enterprise continues to accelerate faster than ever. More on that here.

- The top cloud leaders from Datadog to Snowflake are growing faster than ever after $1B in ARR. Snowflake accelerated to an incredible 110% growth at $1B ARR.

These are still the best of times in SaaS and Cloud. Just not quite as best as they were a few months back.