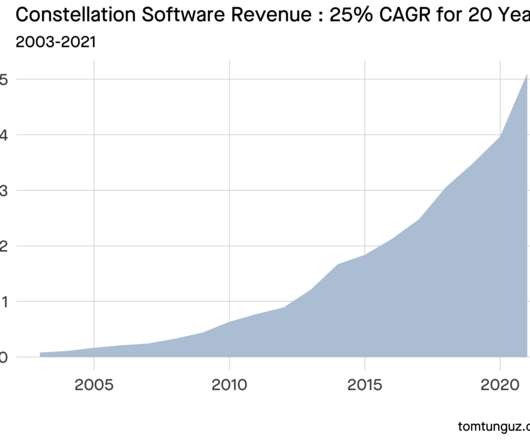

A $30B Software Company from a $15m Investment

Tom Tunguz

DECEMBER 26, 2022

A former venture capitalist, Mark Leonard started Constellation in 1995 with $15m of outside investment & a goal of buying vertical software companies with a moat & good unit economics. Vertical software companies pursue a particular market segment like car dealership management or hotel management software. Acquisition.

Let's personalize your content