SaaS Financial Benchmarks by Baremetrics

Baremetrics

JULY 7, 2021

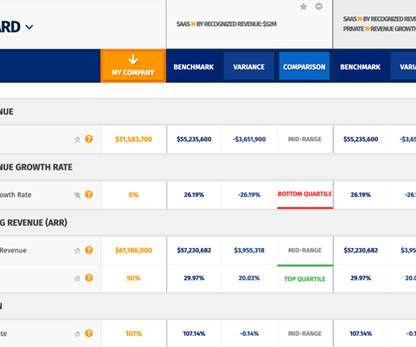

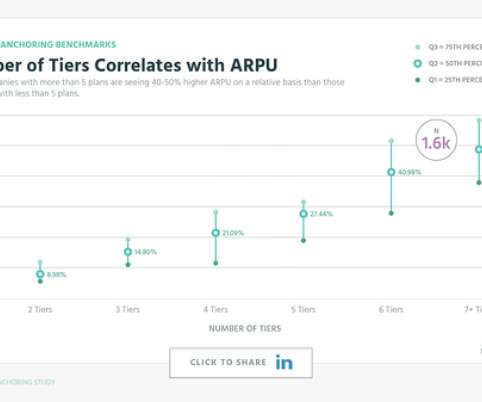

For every decision-maker in a SaaS company, understanding SaaS financial benchmarks makes a proper interpretation your internal performance metrics possible. All the data your startup needs Get deep insights into your company's MRR, churn and other vital metrics for your SaaS business. 2 Why use SaaS Financial Benchmarks?

Let's personalize your content